GLOBAL POULTRY TRENDS - Asia, a Key Chicken Meat Trading Region

Asia is a major poultry meat trading region, as a big importer of some products and an exporter of others, writes industry analyst Terry Evans.Poultry accounts for more than 40 per cent of the world meat trade. Discounting trade between EU states, the FAO’s Food Outlook considers that trade in poultry meat will rise by 2.6 per cent this year to reach 13.1 million tonnes.

On a global basis chicken meat accounts for more than 90 per cent of the poultry meat trade. For all poultry meat, Asian exports are expected to amount to 2.1 million tonnes while imports could exceed 6.9 million tonnes.

Asia plays an important role in the world trade in both fresh/frozen and prepared/processed chicken. On the fresh/frozen side this is the major importing region, while in the prepared/processed sector Asia is the leading exporter (Table 5).

| Table 5. World trade in fresh/frozen chicken meat ('000 tonnes) | |||||||

| Exports | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Africa | 9.5 | 4.8 | 9.5 | 46.3 | 61.5 | 14.4 | 14.3 |

| Americas | 3627.4 | 5517.2 | 7311.6 | 7235.3 | 7260.7 | 7539.5 | 7733.0 |

| Asia | 1432.2 | 420.6 | 765.8 | 876.5 | 1188.0 | 1373.1 | 1287.4 |

| Europe | 1805.1 | 2137.3 | 2344.7 | 2592.1 | 3115.7 | 3477.8 | 3547.9 |

| Oceania | 14.3 | 21.8 | 31.0 | 33.3 | 29.2 | 32.8 | 39.4 |

| WORLD | 6888.4 | 8101.7 | 10462.6 | 10783.5 | 11655.1 | 12437.6 | 12621.9 |

| Imports | |||||||

| Africa | 259.0 | 512.9 | 718.2 | 861.9 | 1069.0 | 1283.4 | 1550.4 |

| Americas | 556 | 912.2 | 1375.6 | 1384.4 | 1493.8 | 1505.2 | 1584.9 |

| Asia | 3276.7 | 2767.2 | 4274.9 | 4650.3 | 5021.5 | 5780.0 | 5328.6 |

| Europe | 1811.2 | 3223.6 | 3374.2 | 3095.0 | 2879.7 | 2790.3 | 3029.9 |

| Oceania | 26.4 | 35.5 | 38.1 | 44.0 | 48.8 | 59.1 | 66.4 |

| WORLD | 5929.3 | 7451.4 | 9781.0 | 10035.5 | 10512.8 | 11418.1 | 11560.1 |

| World trade in prepared/processed chicken meat ('000 tonnes) | |||||||

| Exports | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

| Africa | 1.8 | 2.1 | 1.4 | 1 | 1 | 0.7 | 3 |

| Americas | 92.9 | 270.2 | 427.1 | 418.5 | 427.6 | 424.8 | 430 |

| Asia | 212.4 | 515.8 | 599.3 | 603.4 | 699.5 | 811.7 | 828.4 |

| Europe | 260.8 | 432.7 | 635 | 680.3 | 694.8 | 746.3 | 787.5 |

| Oceania | 2.2 | 1.8 | 1 | 1.8 | 2.9 | 3.4 | 5.2 |

| WORLD | 570.1 | 1222.6 | 1663.8 | 1704.9 | 1825.9 | 1986.9 | 2054 |

| Imports | |||||||

| Africa | 1.9 | 7 | 8.9 | 7.3 | 7.7 | 10.7 | 14.5 |

| Americas | 67.8 | 90.8 | 127.8 | 122.6 | 138.7 | 154.8 | 160.63 |

| Asia | 186.7 | 389.6 | 412.6 | 429.9 | 538.2 | 648.9 | 637.5 |

| Europe | 304.3 | 677.6 | 932.2 | 948 | 1009.2 | 1075 | 1139 |

| Oceania | 1.3 | 2 | 4.2 | 5.5 | 8.9 | 10 | 13.2 |

| WORLD | 561.9 | 1167 | 1485.6 | 1513.2 | 1702.7 | 1893.7 | 1964.6 |

| Source: FAO | |||||||

It is apparent from this table that the world total quantities of fresh/frozen and prepared/processed chicken exported and imported in a year do not balance. There are many reasons for this including:

- Some countries provide data on a general rather than specific product basis.

- Data may be presented on a financial or market year rather than a calendar year.

- There is a time lag between product leaving a country in say December and arriving at its destination in say January of the following year.

- There can be a misclassification of a product between the exporter and importer.

- There can be place-of-origin/final destination inconsistencies. For example country (A) may report that the final destination is country C, but the goods actually reach C via another country (B). As a result country C may report the place of origin of the goods was country B.

In addition, goods can be lost during transport, while occasionally differences can occur due to a typing or calculation error. And, in some instances, exports may not be declared to circumvent an embargo or avoid tax payments.

Between 2000 and 2012 exports of fresh and frozen chicken (including trade between EU member States) increased by 83 per cent to reach 12.6 million tonnes. In broad terms, the volumes shipped from Asia are relatively small showing little change between 2010 and 2012 at around 1.3 million tonnes or around 10 per cent of the global total.

The major exporter in 2012 was Hong Kong selling some 571,000 tonnes, while mainland China shipped 147,000 tonnes (Table 6).

| Table 6. Exports of fresh/frozen chicken meat from Asia (tonnes) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Azerbaijan | 0 | 0 | 28 | 0 | 322 | 121 | 0 |

| Bahrain | 0 | 482 | 282 | 992 | 1037 | 355 | 159 |

| Brunei Darussalam | 17 | 0 | 0 | 0 | 0 | 0 | 0 |

| China, mainland | 372678 | 127630 | 126199 | 131642 | 164698 | 168243 | 147275 |

| China, Hong Kong SAR | 775005 | 167844 | 388993 | 461161 | 695393 | 761453 | 570869 |

| China, Macao SAR | 33 | 15 | 13 | 20 | 0 | 22 | 0 |

| China, Taiwan Prov | 1004 | 880 | 509 | 2447 | 3525 | 3413 | 2989 |

| Cyprus | 283 | 68 | 962 | 958 | 1305 | 1019 | 1167 |

| Georgia | 471 | 795 | 264 | 172 | 712 | 786 | 355 |

| India | 84 | 476 | 1000 | 839 | 2234 | 8767 | 4015 |

| Indonesia | 744 | 0 | 80 | 0 | 78 | 17 | 11 |

| Iran Isl Rep | 7211 | 15150 | 24679 | 399 | 25484 | 27246 | 41917 |

| Israel | 29 | 0 | 1536 | 2316 | 1055 | 367 | 664 |

| Japan | 3339 | 1926 | 6927 | 8699 | 10704 | 4206 | 7048 |

| Jordan | 0 | 1909 | 20000 | 21802 | 19231 | 16472 | 18136 |

| Kazakhstan | 54 | 149 | 2498 | 52 | 430 | 10 | 1409 |

| Korea Rep | 1381 | 2121 | 8056 | 10955 | 20197 | 22779 | 18333 |

| Kuwait | 1178 | 28 | 24 | 765 | 172 | 457 | 801 |

| Lebanon | 201 | 520 | 679 | 937 | 1264 | 1864 | 1981 |

| Malaysia | 3023 | 291 | 2773 | 4333 | 7279 | 7740 | 8211 |

| Occ Pal Ter | 50 | 130 | 350 | 350 | 350 | 350 | 9066 |

| Oman | 100 | 7066 | 9386 | 31262 | 12174 | 11800 | 8740 |

| Pakistan | 0 | 3 | 1 | 0 | 501 | 1718 | 1456 |

| Philippines | 7 | 3861 | 3267 | 4529 | 5505 | 9900 | 5800 |

| Qatar | 12 | 248 | 1060 | 999 | 999 | 999 | 999 |

| Saudi Arabia | 17220 | 17371 | 9875 | 19030 | 8336 | 10972 | 12053 |

| Singapore | 3284 | 11439 | 8846 | 7162 | 8798 | 10267 | 9818 |

| Sri Lanka | 51 | 4 | 206 | 584 | 2259 | 1812 | 970 |

| Syrian Arab Rep | 0 | 1 | 26813 | 8779 | 6673 | 548 | 548 |

| Thailand | 240905 | 4547 | 23323 | 25227 | 33275 | 51245 | 93188 |

| Turkey | 3659 | 44317 | 78519 | 114166 | 138395 | 234148 | 300596 |

| United Arab Emirates | 130 | 11317 | 18567 | 15528 | 15283 | 13883 | 18266 |

| Viet Nam | 0 | 0 | 0 | 246 | 292 | 103 | 476 |

| Yemen | 0 | 1 | 78 | 105 | 105 | 31 | 53 |

| ASIA | 1432154 | 420589 | 765793 | 876456 | 1187960 | 1373113 | 1287407 |

| Source: FAO | |||||||

The most remarkable aspect of this trade is the way in which sales from Turkey have escalated from just 3,700 tonnes in 2000 to more than 300,000 tonnes in 2012. Her biggest customer in that year was Iraq taking 165,200 tonnes or 55 per cent of the total, followed by Hong Kong (24,300 tonnes), Iran (18,300 tonnes), Tajikistan (13,700 tonnes), Libya (12,800 tonnes), the Congo (12,500 tonnes) and Viet Nam (9,500 tonnes).

Asia plays a more dominant role regarding imports of fresh/frozen chicken. Here, having reached a new “high” of almost 5.8 million tonnes in 2011, the following year witnessed an 8 per cent cut back to 5.3 million tonnes (Table 7), which represented 42 per cent of total global exports of 12.6 million tonnes.

| Table 7. Imports of fresh/frozen chicken meat into Asia (tonnes) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Afghanistan | 25 | 23192 | 32316 | 23056 | 38591 | 51004 | 21750 |

| Armenia | 13780 | 12878 | 36044 | 27234 | 35475 | 37257 | 32495 |

| Azerbaijan | 13100 | 4268 | 12094 | 11393 | 12776 | 15047 | 10076 |

| Bahrain | 18182 | 28399 | 28351 | 28545 | 36148 | 35307 | 30812 |

| Bangladesh | 0 | 52 | 1 | 0 | 0 | 0 | 0 |

| Bhutan | 20 | 0 | 145 | 163 | 384 | 255 | 598 |

| Brunei Darussalam | 920 | 214 | 175 | 721 | 447 | 877 | 609 |

| Cambodia | 71 | 2 | 228 | 418 | 178 | 332 | 296 |

| China, mainland | 799742 | 370418 | 787196 | 722242 | 515536 | 385498 | 473157 |

| China, Hong Kong SAR | 993778 | 455394 | 653408 | 715341 | 1011178 | 1176978 | 850396 |

| China, Macao SAR | 4883 | 7200 | 11261 | 11023 | 11451 | 12159 | 12502 |

| China, Taiwan Prov | 12250 | 74944 | 182769 | 260077 | 110314 | 108039 | 122933 |

| Cyprus | 35 | 1796 | 4583 | 4742 | 5743 | 5958 | 6622 |

| Georgia | 16386 | 16218 | 36012 | 38254 | 39558 | 43963 | 43677 |

| Indonesia | 14017 | 3817 | 5294 | 2687 | 125 | 9 | 7 |

| Iran Isl Rep | 22656 | 0 | 25484 | 4831 | 29719 | 64569 | 46806 |

| Iraq | 0 | 30887 | 174435 | 319700 | 262543 | 371978 | 352706 |

| Japan | 568272 | 419119 | 426092 | 331091 | 420253 | 471841 | 425423 |

| Jordan | 363 | 11911 | 41697 | 39363 | 46953 | 47117 | 55621 |

| Kazakhstan | 19885 | 108656 | 131748 | 108120 | 100000 | 156756 | 191131 |

| Korea Rep | 66082 | 46520 | 57881 | 61782 | 92881 | 116849 | 115564 |

| Kuwait | 57972 | 161855 | 191942 | 220729 | 184506 | 159397 | 122395 |

| Kyrgyzstan | 1970 | 11812 | 40325 | 18901 | 86804 | 72825 | 66282 |

| Lao Peo Dem Rep | 8 | 7 | 0 | 0 | 0 | 0 | 0 |

| Lebanon | 3 | 380 | 2016 | 6392 | 8829 | 3719 | 10496 |

| Malaysia | 29876 | 17133 | 31705 | 27783 | 36097 | 39822 | 44845 |

| Maldives | 1200 | 3866 | 4073 | 4565 | 6175 | 6847 | 6677 |

| Mongolia | 18 | 438 | 1817 | 1498 | 4479 | 5210 | 4999 |

| Myanmar | 5 | 0 | 33 | 2259 | 3279 | 558 | 97 |

| Nepal | 0 | 50 | 1 | 0 | 196 | 313 | 311 |

| Occ Pal Ter | 3958 | 9000 | 8200 | 9400 | 11000 | 8400 | 7350 |

| Oman | 24566 | 51927 | 75500 | 134911 | 74126 | 90060 | 176469 |

| Pakistan | 0 | 0 | 6 | 0 | 5 | 6 | 90 |

| Philippines | 17519 | 26288 | 43758 | 61463 | 98005 | 111855 | 107208 |

| Qatar | 23905 | 25534 | 44423 | 67881 | 51992 | 74720 | 82364 |

| Saudi Arabia | 276467 | 450842 | 454234 | 554709 | 645012 | 737263 | 743338 |

| Singapore | 83887 | 91228 | 104089 | 99029 | 104665 | 111714 | 118846 |

| Sri Lanka | 1321 | 1580 | 1940 | 844 | 841 | 1891 | 800 |

| Syrian Arab Rep | 0 | 127 | 1079 | 20 | 2845 | 8581 | 9855 |

| Tajikstan | 415 | 9616 | 24585 | 24066 | 235568 | 23773 | 19286 |

| Thailand | 22 | 11 | 23 | 24 | 310 | 1162 | 990 |

| Timor - Leste | 4100 | 4500 | 4500 | 4500 | 4500 | 4617 | 4531 |

| Turkey | 0 | 143 | 637 | 1142 | 446 | 539 | 385 |

| Turkmenistan | 4700 | 1317 | 6683 | 5650 | 2000 | 588 | 7997 |

| United Arab Emirates | 110900 | 170336 | 274446 | 311669 | 285569 | 319366 | 355847 |

| Uzbekistan | 9167 | 6475 | 3638 | 3222 | 4758 | 11089 | 15013 |

| Viet Nam | 50 | 5373 | 235209 | 269783 | 506971 | 802233 | 515697 |

| Yemen | 60196 | 101441 | 72862 | 109059 | 104280 | 81683 | 113215 |

| ASIA | 3276674 | 2767164 | 4274938 | 4650282 | 5021511 | 5780024 | 5328564 |

| Source: FAO | |||||||

In 2012 Hong Kong was the biggest buyer of fresh/frozen product taking 850,000 tonnes, of which more than 300,000 tonnes came from the USA, almost 290,000 tonnes from Brazil and 122,000 tonnes from mainland China.

The second key buyer was Saudi Arabia with 743,000 tonnes of which nearly 573,000 tonnes were purchased from Brazil and 147,000 tonnes from France. Other leading Asian buyers were, Viet Nam (516,000 tonnes), the United Arab Emirates (356,000 tonnes), Iraq (353,000 tonnes) and Oman (176,000 tonnes).

More recent figures on exports and imports of broiler meat to and from Asia are provided by the USDA (Tables 8 and 9). World broiler exports are assessed at around 10.4 million tonnes, though the trade between European Union member states is excluded from this figure, though the data does include prepared chicken along with fresh/frozen sales.

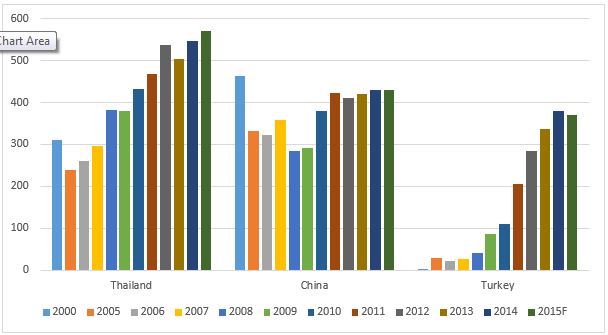

In Asia the key exporting countries identified are Thailand, China and Turkey (Table 8 and figure 8), their combined sales rising from 776,000 tonnes in 2000 to 1.36 million tonnes in 2014, while the forecast for 2015 shows a small increase to 1.37 million tonnes.

The breakdown of the total reveals Thailand and Turkey have expanded this business during the review period while exports from China have shown little change since 2011 and are well below what was achieved back in 2000.

| Table 8. Leading exporters of broiler meat in Asia ('000 tonnes) | ||||||||||||

| 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015F | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Thailand | 310 | 240 | 261 | 296 | 383 | 379 | 432 | 467 | 538 | 504 | 546 | 570 |

| China | 464 | 332 | 322 | 358 | 285 | 291 | 379 | 422 | 411 | 420 | 430 | 430 |

| Turkey | 2 | 30 | 23 | 26 | 42 | 86 | 110 | 206 | 284 | 337 | 379 | 370 |

| Total of above | 776 | 602 | 606 | 680 | 710 | 756 | 921 | 1095 | 1233 | 1261 | 1355 | 1370 |

| F = forecast, prepared products are included but chicken paws are not. | ||||||||||||

| Source: USDA | ||||||||||||

Figure 8. Turkey is rapidly becoming a key broiler meat exporter in Asia ('000 tonnes).

Thailand’s exports look to be well on their way to hitting 600,000 tonnes soon, while the USDA considers that Turkey’s broiler meat shipments which reached 379,000 tonnes in 2014, could decline slightly this year to 370,000 tonnes.

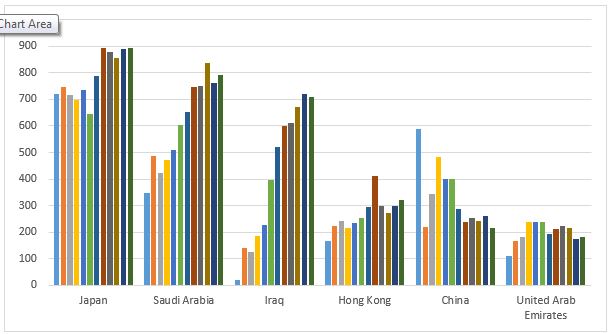

Purchases by the major broiler meat importers in Asia (Table 9 and figure 9), have increased by a little over a million tonnes a year since 2000, though the total has hardly changed since 2011 around an average of 3.1 million tonnes.

| Table 9. Leading broiler meat importers in Asia ('000 tonnes) | ||||||||||||

| 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015F | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Japan | 721 | 748 | 716 | 696 | 737 | 645 | 789 | 895 | 877 | 854 | 888 | 895 |

| Saudi Arabia | 347 | 485 | 423 | 470 | 510 | 605 | 652 | 745 | 750 | 838 | 761 | 790 |

| Iraq | 21 | 139 | 124 | 186 | 227 | 397 | 522 | 598 | 610 | 673 | 722 | 710 |

| Hong Kong | 168 | 222 | 243 | 215 | 236 | 253 | 295 | 410 | 300 | 272 | 299 | 320 |

| China | 588 | 219 | 343 | 482 | 399 | 401 | 286 | 238 | 254 | 244 | 260 | 215 |

| United Arab Emirates | 112 | 167 | 182 | 238 | 240 | 240 | 195 | 213 | 223 | 217 | 175 | 181 |

| Total of above | 1957 | 1980 | 2031 | 2287 | 2349 | 2541 | 2739 | 3099 | 3016 | 3081 | 3159 | 3111 |

| F = forecast, prepared products are included but chicken paws are not. | ||||||||||||

| Source: USDA | ||||||||||||

Figure 9. Rapid increase in chicken meat purchases by Saudi Arabia and Iraq ('000 tonnes).

Since 2011 the quantities of broiler meat bought by Japan have shown little movement since 2010 at just under 900,000 tonnes a year.

While imports by Saudi Arabia declined in 2014, a recovery is anticipated in 2015 which will bring the total close to 800,000 tonnes.

Iraq’s imports climbed annually to reach 722,000 tonnes in 2014 though some reduction is forecast for this year.

Although imports by mainland China have tended to decline long-term forecasts point to a marked expansion in this trade.

Because Hong Kong re-exports much of its imports, the USDA considers Hong Kong’s imports to be the quantities imported less the quantities exported. This explains the large difference between the FAO’s 850,000 tonnes in 2012 and USDA figures for Hong Kong’s imports of 300,000 tonnes in that year.

World trade in prepared/processed chicken meat reached a record almost 2.1 million tonnes in 2012, equivalent to around 3.1 million tonnes of fresh product (Table 5).

Asia is the leading exporting region in this field selling some 830,000 tonnes or 40 per cent of the world total in 2012. Two countries dominate this scene accounting for 91 per cent of the business – Thailand with 464,000 tonnes and mainland China with 287,000 tonnes.

Thailand’s main customers in 2012 were Japan (221,000 tonnes) and the United Kingdom (133,000 tonnes). Japan was also China’s biggest buyer purchasing 232,000 tonnes.

Asia’s imports of these products have accelerated from less than 200,000 tonnes back in 2000 to 650,000 tonnes and 640,000 tonnes in 2011 and 2012 respectively. In the latter year Japan was the top buyer taking almost 460,000 tonnes or 72 per cent of the regional total. Hong Kong came next with purchases of just under 100,000 tonnes.

October 2015