Australian Chicken Meat: Outlook to 2018-19

Chicken meat production is projected to grow over the period to 2018–19, reflecting continued growth in domestic consumer demand, according to Clay Mifsud in the 'Agricultural Commodities' report from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) for the March Quarter 2014.Chicken meat is projected to remain the most consumed meat in Australia over the outlook period, by an increasing margin.

Exports of chicken meat are projected to remain relatively low, with most production consumed domestically.

Chicken Meat Production to Grow

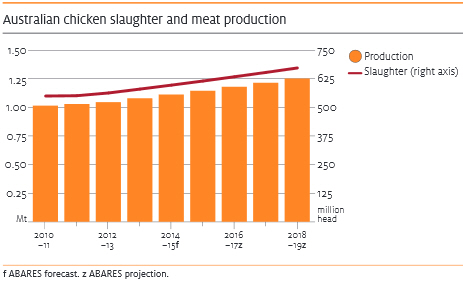

Australian chicken meat production has grown consistently over the past decade to reach 1.05 million tonnes (carcass weight) in 2012–13, averaging four per cent a year. Chicken meat now makes up one-quarter of meat production in Australia, compared with 18 per cent a decade ago.

Growth in chicken meat production is forecast to continue over the short to medium term. In 2013-14, chicken meat production is forecast to increase by three per cent to 1.08 million tonnes and a further three per cent in 2014–15 to 1.1 million tonnes. By 2018-19, Australian chicken meat production is projected to be around 1.25 million tonnes, with its share of total Australian meat production increasing to 28 per cent.

| Table 1. Outlook for chicken meat | ||||||||

| 2011-12 | 2012-13 f | 2013-14 z | 2014-15 z | 2015-16 z | 2016-17 z | 2017-18 z | 2018-19 z | |

|---|---|---|---|---|---|---|---|---|

| Production a, '000 tonnes | 1,030 | 1,046 | 1,080 | 1,110 | 1,140 | 1,170 | 1,200 | 1,250 |

| Consumption, kg/person | 44.0 | 44.1 | 44.7 | 45.2 | 45.7 | 46.1 | 46.6 | 47.7 |

| Export volume b, '000 tonnes | 33.6 | 29.3 | 34.0 | 36.0 | 37.5 | 40.0 | 42.5 | 45.0 |

| Export value, A$ million | 39.7 | 39.5 | 44.9 | 47.2 | 49.1 | 52.4 | 55.7 | 59.0 |

Sources ABARES, Australian Bureau of Statistics

Domestic Demand to Increase

Projected growth in chicken meat production over the next five years is largely in response to an ongoing increase in domestic consumer demand, as retail prices of chicken meat remain well below prices of alternative meats. The domestic market is projected to continue to account for around 95 per cent of chicken meat production. Exports will comprise primarily low value cuts and offal, for which there is little domestic demand.

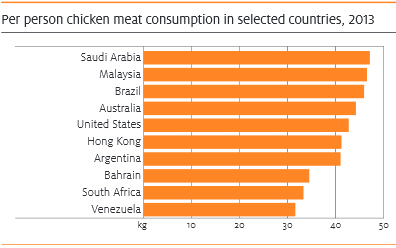

Australia is among the largest consumers of chicken meat, on a per person basis. Over the 10 years to 2012-13, growth in per-person consumption of chicken meat averaged three per cent a year.

Chicken meat is projected to remain Australia’s most consumed meat over the medium term. Australian chicken meat consumption is forecast to rise by one per cent in 2013-14 to 44.7kg per person and a further one per cent in 2014-15 to 45.2kg per person. Over the medium term, consumption is projected to grow to 47.7kg per person by 2018-19.

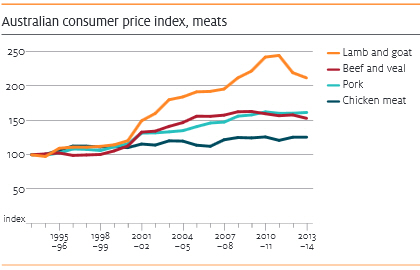

Past and projected future growth in Australian chicken meat consumption reflects the competitive pricing of chicken meat relative to pork, beef and lamb. Over the past two decades, the prices of other meats have risen relative to chicken meat. Over the five years to 2012-13, chicken meat was on average 21 per cent cheaper than pork, and 22 per cent and 45 per cent cheaper than beef and lamb, respectively. Over the medium term, chicken meat is projected to remain substantially cheaper than these competing meats.

The low price of chicken meat relative to other meats is a reflection of strong productivity growth achieved in the Australian chicken meat industry over successive decades. Because of the use of selective breeding techniques, chickens used for meat production reach their ideal slaughter weight in around 35 days, using a total of around 3.4kg of feed. In comparison, 64 days and 4.7kg of feed were required to bring a chicken to market weight in the 1970s.

In contrast with beef and sheep meat production, the chicken meat industry in Australia is highly concentrated and vertically integrated. Around 70 per cent of meat chickens are slaughtered by two privately owned processing companies. Five privately owned medium-sized processors and several smaller processors account for the remaining 30 per cent of chicken slaughter. Chicken meat farmers are generally contracted by processing companies to grow out day-old chicks supplied by the companies.

Exports to Remain Relatively Small

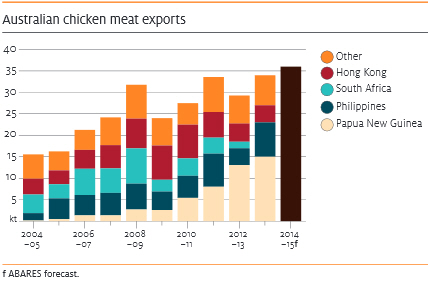

Exports account for less than five per cent of Australian chicken meat production. About 95 per cent of exports comprise frozen cuts and offal, such as feet, kidneys and livers. These attract a higher price in export markets than in Australia. The remaining five per cent of exports largely comprises frozen whole chickens.

Chicken meat exports are forecast to increase by 16 per cent in 2013-14 to 34,000 tonnes (shipped weight) and a further six per cent in 2014-15 to 36,000 tonnes. Forecast growth in domestic production will contribute to an increase in supply of frozen cuts and offal for export. Demand for these products in South-East Asia and the Pacific is expected to rise in the short term.

Over the medium term, Australia’s chicken meat exports are projected to remain at around five per cent of production, increasing to 45,000 tonnes by 2018-19. Frozen cuts and offal are likely to make up most of Australia’s chicken meat exports over the projection period.

March 2014