Mexico Poultry and Products Semi-Annual Overview - March 2007

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Annual 2007 report for Mexico. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Mexico’s 2007 chicken meat production forecast has been revised lower, although it is still expected to exceed the 2006 level. Higher feed costs are expected to dampen production in 2007. Consumption for 2007 is still expected to slightly surpass 2006 at around 3.1 MMT, and imports are also forecast higher. The growing trend towards vertical integration and consolidation in Mexico’s poultry industry is expected to slow due to new Federal regulations.

Section I. Situation and Outlook

Production

Mexico’s chicken meat production forecast for MY 2007 (Jan-Dec) is revised downward by 3.1 percent from the previous forecast to 2.6 MMT due in part to higher input costs. However, this figure is still slightly higher than the revised MY 2006 production estimate of about 2.5 MMT. Although Mexican producers enjoy favorable demand for their products, industry sources report a slow down in production compared to previous years due to a combination of factors, including higher feed and production costs and competition from imports.

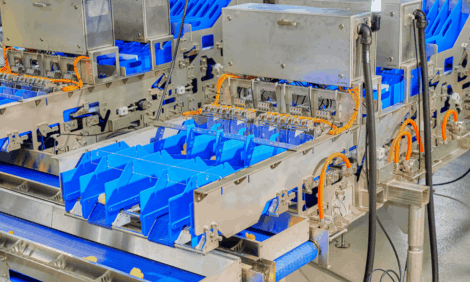

Mexico’s poultry industry has invested in modern technologies to enhance its competitive position. Nevertheless, some producers remain concerned about their competitive position when the market fully opens in 2008. Mexico’s poultry sector has focused on consolidation and improved positioning in the domestic market through increased distribution and marketing of value-added poultry products. Poultry will continue to cost less relative to other meats in Mexico, which should give the sector advantages over other animal protein sources. The estimate for MY 2005 production has been adjusted slightly lower based on final industry data.

Concerns over increased feed costs have become a key issue for Mexico’s poultry industry. Feed costs represent 55 to 60 percent of the total cost of production for Mexican producers, which are major users of imported feedstuffs from the United States. Industry sources report that 60 percent of the feedstuff usage is comprised of sorghum and yellow corn, 23 percent from oilseeds and protein meals, and 17 percent from other products such as safflower, orthophosphate, calcium, and methionine. About 40 percent of the sector’s consumption of yellow corn and sorghum is imported from the United States. Mexico’s poultry producers prefer yellow corn to sorghum because of its better nutritional value and the color it gives to the birds’ skins.

Historically, Mexico has been a white corn producer and only a sma ll percentage of its corn production has been utilized as animal feed, which has compelled the poultry industry to import the grain from the United States. The recent surge in corn prices led to turmoil in retail poultry and egg prices (but not producer prices) throughout the country. In November 2006, the Poultry Producers Association (UNA) estimated that for every $1,000 pesos per ton increase in coarse grains, poultry prices would increase by about $2 pesos/kg. Industry sources report that a price hike in January 2007 was due more to speculation rather than a lack of supply or higher production costs. Industry research showed that prices in some retail chains jumped from $26.90 pesos (USD $2.48) per kilogram in November, to $32.00 pesos (USD $2.80) per kilogram in December. In fact, it was reported that there was an oversupply of poultry meat in December due to slack demand. Further price escalations that started in mid-February appear to reflect higher international corn prices. Producers also note that production costs have also increased due to higher costs for electricity, packing materials and transportation.

According to Mexico’s poultry organization (UNA), feed consumption for MY 2005 was 13.2 MMT, (8.3 MMT of feed grains, 2.6 MMT of oilseeds and protein meals, and 2.3 MMT of other raw materials). Unofficially, for MY 2006, UNA estimates feed consumption 2.4 MMT higher. Projections for MY 2007 indicate that feed consumption could fall by 1 - 2 percent, due to higher feed costs, mainly for yellow corn.

|

Industry sources report that consolidation and investment in infrastructure continues to grow in Mexico’s poultry industry, but the expected expansion of large, vertically integrated companies is slowing due to the implementation of provisions contained in Mexico’s Federal Economic Competition Law (Ley Federal de Competencia Economica). The objective of this law is to restrict monopoly practices. Trade sources report that some vertically-integrated operations could be considered as monopolies under the provisions in the law. In 2005, three leading companies accounted for 52 percent of total domestic production of chicken meat. Medium-size companies are expected to merge into cooperatives and associations, while smaller producers look to becoming contract producers.

|

Consumption

Consumption figures for MY 2007 were revised downward by 1.7 percent to 3,095 MT due to a slowdown in production and expected higher prices. However, the new forecast is still higher than the 2006 estimate. In addition to higher production costs, Mexico’s producers could also be hurt by reduced purchasing power among some consumers who are facing higher prices for staple products such as tortillas. Nonetheless, poultry will continue to remain cheaper than other animal protein products such as beef and pork, which should give it a competitive advantage. UNA estimates that average per capita consumption for chicken increased from 53.28 pounds in 2005 to 55.06 pounds for 2006.

Trade

Chicken and turkey meat continue to be the primary poultry products imported by Mexico. The processing industry imports me chanically separated chicken and turkey (MSC & MST) and poultry cuts as inputs for the domestic sausage and cold-cut industries. Import estimates of chicken cuts, mainly leg quarters, and mechanically separated chicken (MSC) for MY 2007 were revised upward by 7 percent compared to the previous forecast due to rising demand from the processing industry. According to industry sources, some retail store chains began to import whole U.S. chickens in 2006, which were cut up for retail sale. It is uncertain whether this trend will continue in 2007. Import data for MY 2005 was revised upward based on recent Mexican trade data. The United States continues to be the main supplier of chicken meat to Mexico. However, Chile’s presence in Mexico’s poultry market is expected to continue, mainly in the provision of frozen chicken cuts.

Official figures indicate that 2006 imports of U.S. chicken leg quarters (CLQs) (HTS 0207.13.03 & 0207.14.04) under the poultry safeguard filled the established tariff-rate-quota as of November. According to official data, the CLQ TRQ 2005 was also filled. (see table below for TRQ levels)

Imports of CLQs beyond Mexico’s border areas are subject to an over quota tariff of 19.8 percent for 2007. The safeguard will end in January 2008, when the TRQ is phased out and the high-tier tariff drops to zero, as the following table shows:

|

Concerns over the presence of Low Pathogenic Avian Influenza (LPAI) and Highly Pathogenic Avian Influenza (HPAI) in the United States in 2003 and 2004 resulted in the imposition of import restrictions for poultry and poultry products from several U.S. states. The restrictions on LAPI were lifted in October 2005, but the HPAI restrictions remain on the following counties in Texas: Gonzales, Guadalupe, Galdwell, Bastrop, Fayette, La Vaca, De Witt, Karnes, Wilson, Comal and Hays. USDA/APHIS is continuing to work with SAGARPA to remove these restrictions.

As a result of the Japan-Mexico Free Trade Agreement, a Tariff Rate Quota (TRQ) was established for Mexican poultry exports to Japan, as the following table shows. The in-quota rate under this TRQ is zero. Industry sources report that to date, no trade has occurred.

|

Policy

No further changes from MX 6071. In January 2006, Mexico published a modification of its Avian Influenza regulations; NOM-044-ZOO-1995 “National Campaign against Avian Influenza” (See report MX6013). The new requirements were implemented in April 2006. Imports of U.S. poultry must comp ly with one of two options regarding AI testing: a) a negative result on 59 samples to AGID or ELISA tests or; b) that the flock/farm of origin is recorded in the National Poultry Improvement Plan (NPIP).

Marketing

Generic advertising campaigns continue to be a valuable tool for the sector in increasing domestic consumption of poultry products in Mexico. Currently, most poultry meat in Mexico is sold as whole birds. However, the share of poultry sold via supermarkets is expected to grow as consumers become more accepting of poultry cuts and other poultry products. USAPEEC continues to support marketing strategies within the NEPP (NAFTA Egg and Poultry Partnership), which promotes the exchange of information and technical expertise between both the U.S. and Mexican poultry industries.

Further Information

To view the full report, including tables, click here (PDF Format)To view our complete list of 2007 Poultry and Products Semi-Annual reports, please click here

March 2007