Feed Costs Affecting the Poultry Market

This feature is taken from the Avec Annual Report for 2007. A link to the full report is also provided. No poultry producers can say that they are not affected by the growing costs of energy and/or animal feed.

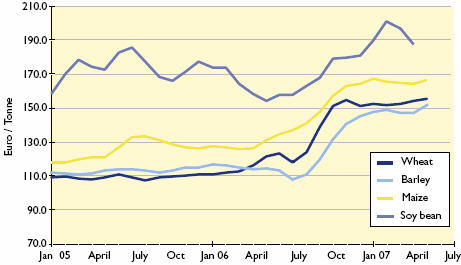

After many years of low prices, cereals price have risen hugely this year and poultry companies are facing much higher production costs.

Maize prices remain at historic high levels meanwhile maize represents about 65 percent of the poultry diet (other ingredients include soybean meal, vitamins and minerals, limestone and amino acid supplements) and it is a principal source of energy (increasing as birds age). Maize price future is about 165€ per ton and it isn’t just high, it is very volatile. In May 2007, prices were about 35€ per ton higher than a year ago. In the same way, soybean prices are, after a huge increase in 2006, a bit decreasing since February 2007 but the difference since last year is still very high.

Source: European Commission

Bio ethanol and GM main causes

The global development of cereal prices depends on the interaction of different factors. Producers have seen high feed prices before, but now they are competing with ethanol producers for available maize. The competition is adding to the feed price uncertainty as the bio-ethanol production is still based at present on cereals (even if there are also facilities using sugar beet).There are two primary public benefits from increased production and consumption of biofuels.The first one is that using biofuels instead of fossil fuels can decrease the rate at which greenhouse gases (primarily carbon dioxide) build up in the atmosphere (atmospheric carbon is used to grow the plant material used to produce biofuels, so net emissions of carbon dioxide are lower for biofuels than for fossil fuels) and the second benefit of biofuels is that it increases energy security. Few would disagree with the idea that reducing greenhouse gas emissions and increasing energy security are goals worth some sacrifice. The fact is that a number of European policies encourage increased production and consumption of biofuels.

But another factor of high feed costs is ongoing bans on genetically modified feeds. Some government of EU member states decided to ban some GMO and this affects very much the supply of raw material for a huge number of producers. As for example, Polish producers might be faced with a problem in the supply of raw material because of possible new national regulation banning all GMO from 2008.

Profit margins are getting smaller daily as feed costs continue to climb. But broiler meat prices have been firmer in most member state and may provide enough incentive to maintain or increase production in spite of the higher costs. Some have changed their market strategies, such as selling birds at different sizes. Commodities or by-product feeds providing a source of protein and energy can also be used to decrease the cost of the grain mix. But all livestock industries are dealing with the extreme volatility in feed prices and companies will not be expanding this year at the rates they normally would. There was a very small carryover in corn supplies, so the price will depend greatly on how the 2007 crop develops. If growing conditions are at least reasonable, 2007 corn production will be sufficient to meet all demands, and corn prices should moderate. Lower corn prices would be good news for livestock feeders and ethanol plants because their profit margins would be greater than either expected. Crop farmers should enjoy income levels for the next few years if the weather cooperates and this boom time for crop farmers will increase land rents and land prices.

In contrast, feed users, and so poultry producers will find persistent high feed costs and tight margins. Eventually, livestock and egg prices will have to rise to cover the higher costs. This price increase might only come about through lower production levels and increased production costs could likely reduce broiler meat production this year. However, as with all policy decisions, it is instructive to pause and consider exactly what we are trying to accomplish with the biofuels policies. Even if some developments, such as the demand from the bio energy sector, could indicate greater need in the long term, it seems to be too early to already talk of a turnaround in the development of cereal prices. As for example, stopping the subsidised set aside in the EU would make more land available for crop farming.

Supply of organic raw material

Organic poultry gains popularity, in particular in the UK. The driving factor behind the rise in sales and the increasing popularity of this sector includes consumer perceptions regarding health issues, the environment and animal welfare.There are several labels that are used to entice consumers.Yet supply still trails demand, resulting in very high price premiums for organic poultry and eggs and a major reason for the high price premiums is the higher production costs in particular related to feed, which can cost 50 – 100% more than conventional feed, and account for up to 70% of the cost of raising organic poultry.

The price of organic grain has lifted so much that organic grain is travelling overland. For example some organic grains are travelling from Kazakhstan to Latvia from where it is shipped to the UK.Yet it should be a price level to attract UK arable farmers to convert more land to organic. But over the last 10 years, the number of organic livestock enterprises in Britain has grown faster than organic arable production. Europe's poor grain harvest last summer, together with stricter EU standards, have raised prices for organic cereals to new levels, with wheat selling at up to €390 per tonne.The biggest demand for organic feed comes from poultry producers responding to the growing popularity of organic chicken and turkey with consumers and despite record high prices, demand for organic feed, especially organic poultry feed, is continuing to grow. Shortages of organic feed ingredients have been predicted for several years and organic livestock producers now have to rely on imports. The immediate challenge to the industry is to ensure that these higher costs are passed to the consumer.

Further Reading

|

|

Take a look at Avec's Annual Report for 2007 by clicking here. |

December 2007