Argentina Poultry and Products Annual Overview - September 2005

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Annual 2005 report for Argentina. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Argentine poultry production, consumption, and exports are projected to achieve records in 2006. Production, consumption, and exports are forecast at 1.18 million metric tons (MMT), 1.0 MMT, and 150,000 tons, respectively. This is as a result of good profitability in the sector, very competitive broiler prices in the domestic market, and the opening of many new markets worldwide which look upon Argentina as an alternative supplier.

Situation and Outlook

Argentine poultry exports for 2006 are projected at 150,000 tons, a new record high. This is

the result of a strong world demand (mainly replacing supplier countries with sanitary

problems) and the continued expansion of the local production. Argentine poultry exports

became very competitive after the devaluation in 2002. The serious efforts to maintain an

excellent sanitary status, and the opening of new markets, have helped local exporters to

insert themselves rapidly in the world market. Until 2002, Argentina’s exports ranged

between 10-20,000 tons a year, of which the majority were chicken paws for the Chinese

market. Argentina also imported annually 30-50,000 tons of broilers, primarily from Brazil.

Argentine poultry processors are learning the business and are investing to expand the

number of products and markets. Argentina, due to its capacity and relatively small volume

can produce a wide variety of products, meeting the need of almost any market.

In 2006, local exports of whole frozen broilers and frozen chicken parts are expected to

continue to grow. In both cases, FOB prices are forecast to remain strong. The average

2005 (through June) FOB prices for whole frozen broilers were US$900 per ton, practically 50

percent higher than in 2002. Something similar happened with frozen chicken cutup parts.

Prepared chicken meat prices are also expected to remain strong. Exports of prefried

products will also grow, primarily in high-income markets, with two local companies having

capacity to produce these types of products. Exports of cooked hen to Germany are

expected to grow, with 4 local processors capable of producing this product. Trade sources

indicate that Argentine poultry exports for the rest of 2005 are already committed.

Current Argentine FOB prices are US$1,020 per ton for whole frozen broilers (with giblets) to

Russia, US$2,550 per ton for calibrated frozen breast for the E.U., and $1,050 per ton for

frozen whole broiler (without giblets) for the Chilean market.

The local poultry industry has great expectations of the opening of the U.S. market. After

completing a Newcastle disease risk analysis, APHIS has recently published a rule for public

comments. The local sector hopes to have the final rule and the permission to begin

exporting in late 2005 or early 2006. However, traders believe that the market will move

slowly, with many things to learn and adjust. Frozen breasts seem to have the greatest

market potential.

China, Argentina’s largest poultry market (volume -wise) is expected to continue to grow.

Although most of the exports up to now have been chicken paws and wings, this is expected

to start changing slowly as 12 local plants were recently approved to export poultry meat to

that country. Another factor which will help increase exports is the fact that from now on not

only large importers are eligible to buy Argentine product, but some supermarkets and fast

food chains can also import. Traders believe that the products with best chances are chicken

leg quarters, breasts, and whole birds.

Chile is expected to continue to be one of the best markets for Argentine poultry exporters

during 2006. There is a private agreement between the two countries to limit Argentine

exports to about 1,000 tons a month. In 2005 this goal will be met, and the same is

expected for 2006. Exports to neighboring Chile sometimes diminish somewhat if there are

markets paying better prices such as the Russian Federation, which is currently taking large

volumes at very good values. The typical products exported to Chile are whole broilers, and

some cutup parts. Prefried chicken products are just starting to be exported.

South Africa has become a very important market and it is expected to continue to demand

good volumes of Argentine mechanically deboned meat (MDM), small whole broilers and leg

quarters in 2006. Other African countries have become a very important market for

Argentine exports. While sales in 2001 totaled 450 tons, shipments through June 2005 were

3,400 tons, of which the majority were whole broilers, followed by parts. The main

importing countries were Namibia, Gabon, The Congo, Angola and Liberia.

The Russian Federation has become a very important market, especially for its volume and

value. However, it is an erratic and difficult market. Exports for 2006 are projected at about

10,000 tons, a similar volume to 2005. The products most shipped are whole broilers (with

weight ranging between 1.2 and 1.7 kilos), chicken wings and MDM.

Germany and several other European countries like Netherlands and the United Kingdom are

good markets for higher quality and value products. However, these markets are expected

to remain flat or increase marginally in 2006. The products exported primarily to these

markets are calibrated individually quick frozen (IQF) breasts and cooked hen meat. The

United Kingdom also buys extra large whole broilers. Spain and Italy have great potential

growth for products such as whole broilers, leg quarters, breasts and prefried chicken.

Saudi Arabia has been a good market since 2002. In fact, a leading local processor is

exporting products to this market under an agreement with Tyson Foods. Traders indicate

that although it is a complicated market, because it takes small size broilers (0.8-1.2 kilos),

it could grow marginally in 2006. Most local processors, especially with a strong market

demand, prefer to put weight on their broilers rather than slaughtering them at a lower

weight.

Venezuela, which had never purchased poultry products in Argentina, signed an agreement

last year to import 5,000 tons from eight different local firms. However, logistical problems

delayed the operation and in the meantime, world prices increased significantly. Therefore,

only 700 tons from one company were shipped. So far, the government has handled

imports, but some private companies are now eligible to import directly. Some business has

already occurred with supermarkets. Products most demanded are whole broilers and parts.

Poultry imports for 2006 are projected to remain negligible. After Argentina’s devaluation in

2002, inexpensive Brazilian poultry imports stopped. Imported products are still quite

expensive for Argentine consumers and local processors meet, in volume and quality, the

domestic market needs.

The following table shows Argentina’s current import duties, export rebates and export

taxes:

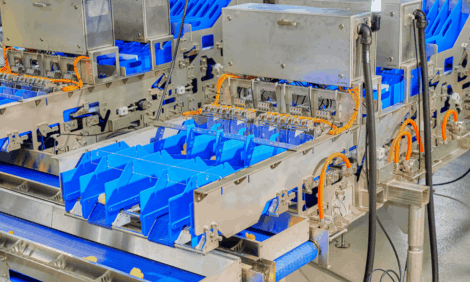

Local broiler production in 2006 is forecast to reach 1.18 million tons, the highest ever. Good

profitability in the domestic and export markets, which is expected to continue in the near

future, should encourage local poultry processors to invest strongly to accompany this

growth in demand. Over US$60 million were invested in the local poultry sector during the

last 12 months. Investment was focused on almost all sectors of the industry: housing

facilities, grain storage capacity, feed mills, processing capacity (several started to operate a

second shift), ovens, freezing tunnels, IQF freezing facilities, cutup rooms, etc. However, the

key bottleneck is the number of growout houses, which they are working at full capacity.

Although credit availability is very limited, some processors and a few provincial banks are

facilitating credit lines to contract growers and processors to expand their capacity.

There are about 43 officially inspected poultry plants operating in Argentina. There are a few

smaller ones which are not inspected by the Federal Government. Approximately 11 plants

account for almost 60 percent of the total output of which most have implemented HACCP

and ISO programs.

The local poultry sector benefits from the excellent land, climate and environment. Also

costs are very competitive as a result of the availability of large volumes of good quality feed

produced at low cost in the same poultry areas and with practically no freight expenses. The

cost of hand labor and energy in dollar terms is also low. The fact that the local industry is

strongly vertically integrated allows for production efficiency, excellent product quality,

product standardization, and tight traceability. The average cost of production is about

US$0.75 per kilo and it is expected to increase 5-10 percent in 2006 as labor and energy

costs are expected to increase.

Approximately 90 percent of broiler output comes from the provinces of Entre Rios and

Buenos Aires. Other minor producers are in Cordoba and Rio Negro. Practically all local

companies are owned by local families. There are a few announcements of large

investments in this sector, but no foreign capital has entered the sector so far.

The very good sanitary status, without avian influenza or Newcastle Disease, permits the

opening of most foreign markets. There are currently over 50 markets open on 5 continents.

The U.S. and Canadian markets are expected to open soon.

Domestic demand for 2006 is forecast at slightly over one million tons. This record high

represents approximately 27 kilos per capita. Most contacts indicate that there is still room

for growth as per capita consumption in neighboring countries is higher. Domestic demand is

very strong, primarily because of high beef prices (Argentines are the largest beef consumers

in the world), diet concerns and growing purchasing power. The current retail price for a kilo

of broiler is US$1.33 (including 21 percent VAT), while a kilo of beef short ribs (the

competing beef cut) is retailing at US$2.45 per kilo. In the past two and a half years, retail

prices for broilers increased 5 percent, beef prices 21 percent, while inflation in the same

period was 13 percent.

Inflation in the last several months has been higher than what the government was

expecting, especially in an election year. Therefore, in the last few months it has put

pressure on processors and sectors to limit price increases, especially basic food products.

This has been the case of the dairy, beef and poultry industries. The local poultry association

signed an agreement by which the wholesale price will not exceed $2.7 pesos (US$0.93) per

kilo in the next few months. Wholesale prices are expected to increase slightly during 2006

as result of higher costs of production and a firm demand.

The government has indicated that in 2006 it will try to maintain the exchange rate at about

the current level of $2.90 pesos to a dollar to continue to support exports and thus

employment. Several economists believe that if the government did not intervene in the

financial market, the value of the dollar would be significantly lower.

The government does not have a specific policy for the poultry sector. However, maintaining

a weak local currency helps exports, which are very profitable. Grain and oilseed exports are

taxed 20 percent, and therefore, local poultry processors have an advantage while buying

their feed. The government is also working very hard in controlling diseases and opening

new markets. Also through some official programs, poultry exporters are assisted and

encouraged to participate actively in international food shows and trade missions. The

private sector does not have an entity or program to coordinate and finance such efforts.

Further Information

To read the full report please click here

Source: USDA Foreign Agricultural Service - September 2005