Avian Influenza and the Outlook for the Global Animal Protein Industry

The outlook for the global animal protein industry is bright and poultry is going to be the winning protein in the next decade when the world population expands and incomes rise.

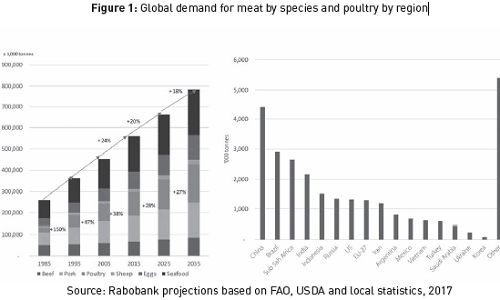

Global animal protein demand is expected to grow by more than 45% whereby poultry (broilers and eggs) are the fastest growing protein markets. These industries will benefit from its very competitive cost of production as well as its health and convenience image. The last several years we’ve seen rising numbers of Influenza outbreaks. A major Question will be: does this influence the outlook for the global industry?

CONSUMER CONCERNS AND AVIAN INFLUENZA WILL PUSH THE INDUSTRY TO CHANGE BUSINESS MODELS

The 45% global market growth is a big long term challenge for the industry and the road to reach these opportunities is often a bumpy road like the industry has experienced in the past decade with lots of volatility in feed grain prices (which is 70% of total costs), rising consumer concerns about production methods with several big system changes like cage free egg production and slow growing birds. Avian Influenza has become a major concern for industries in many parts of the world especially in Asia, Europe, Africa and North America. It has spread in 2015 from Asia where has been for years to the Americas and Europe whereby especially in North America it had and still has a lot of impact on local and indirectly global markets as many importers closed their imports for US products. Europe has been hit this year by again many outbreaks of Avian Influenza but impact so far is relatively limited compared to the 2015 US case.

One of the major challenges for the next decade for the global industry is dealing with a situation in which avian influenza is expected to be endemic in wild birds and it will therefore be an ongoing concern for the global industry. Industries models will be forced to adjust to this new reality.

RISING DEMAND FOR ANIMAL HEALTH PRODUCTS AND SOLUTIONS

The global animal health industry will benefit from this fast growth, but it should adjust their strategy to the big upcoming changes in the global animal protein industry. Many of this changes will support growth for animal health products, whereby the industry should play a responsible role on the edge between human and animal health and supplying the world with a growing demand for production animals as well as for companion animals. Ongoing global animal disease pressure together with a rising awareness of human health (like rising demand for antibiotics free in several markets), food safety, animal welfare and environment will drive industry change, whereby further improvement in efficiency is needed. The importance of the Asian region in global animal protein production, but also in demand for companion animals will rise significantly and this will again especially be true for the Asian animal health industry.

It will be a big challenge for the global industry to keep up with the global 25 percent demand growth in the next decade; this growth which is not evenly spread around the globe. Countries in Asia and large parts of Africa with no natural competitiveness in animal protein production need to reconsider their supply strategy. It will be clear that most of the growth supply will continue to be produced in local areas as fresh product demand remains strong. However, scarcity in global markets will increase the importance of international trade.

INCREASING INTERNATIONALISATION

In the slipstream of a growing trade of meat, companies from developed markets and from exporting countries will come under strong pressure to benefit from global growth. US companies are facing a more challenging local production and trade environment and are also pushed by pressure from shareholders to internationalise their business model. The success of the Brazilian model is going to be a base for further internationalisation of the industry and companies will further move (with support of national investment funds) to multinational structures in which the three directions of internationalisation – access to low cost production, synergy in distribution and access to local market growth – will be all exploited. The Asian region will become much more on their radar screen as this is the area which combine fast local market growth with an increasing need for imports (due limited local resources). Internationalisation will help global poultry traders also to mitigate risks from outbreaks of diseases. Companies could potentially keep supplying key customers in case of outbreaks in one regions. This is a big advantage for international companies compared to local companies.

Having said this, not all companies will make the move to internationalisation; companies in many regions have still plenty of opportunities in their local markets as demand will further might grow with modern distribution is still in an early stage of development, while the level of concentration is low and/or export potential is still not being utilised.

EUROPE: ONGOING EASTERN EXPORT GROWTH

This is why companies in the EU will do well to first utilise the great opportunities in the internal EU market by better integrating the local industry and moving to a regional and later also pan-European business model. Companies in Eastern Europe still have plenty of growth opportunities in their domestic market, although the growth potential in Russia might slow down somewhat after 2015 when Russia will be fully self sufficient. Ukrainian companies still have significant local growth potential, and additional growth could be realised as the industry might become an exporter of poultry products in the medium to long term. A probable opening of the EU market in medium term might present local industries with a great growth opportunity here. Central European countries have already tapped into this opportunity with especially the Polish Poultry sector as leading industry with both strong domestic and export demand. Romania and Hungary are now also tapping into this opportunity.

ASIA: BULLISH GROWTH WITH MORE FOCUS ON GLOBAL SOURCING

The position of Asian companies is going to change in the medium term as local market growth with limited resources will be a base for growing awareness among Asian importers about the importance of food supply security. It can be expected that more Asian countries, like China, will follow the Japanese model regarding import security via local joint ventures or via direct investment. The acquisition of Smithfield by WH Group was a landmark investment and is an example which perfectly fits in this direction, but also earlier steps set by for example Saudi Investment Company to acquire a stake in Minerva is in line with this increasing importance of global sourcing.

China’s animal protein import position will be forced to change due to its limited availability of resources for grains and oilseeds. And although most of the chicken supply will continue to be produced in China, import companies will start to acquire companies or set up joint ventures with exporting countries in Asia and Latin America to secure supply. Such a strategy might force also other importers like Middle Eastern countries and the EU to react and follow such a strategy.

GLOBAL INDUSTRY TO OPERATE MORE GLOBAL

One of the consequences of this move is a further globalisation of the global meat industry. The top 3 beef producers produce together already 20% of the world beef supply and this figure is expected to grow further. The importance of vertical integration in industries like poultry, pork and aquaculture is expected to grow further. These factors will mean from an animal health perspective, more consolidation in client portfolio and a growing need of client focussed market approaches.

This whole strategic move in the global animal protein landscape which will occur in the next decade will be beneficial for companies in exporting countries and will stimulate consolidation among companies in these countries. It will also be a great base for newcomers in the global poultry landscape. Countries like Ukraine and Argentina in pork and poultry or Latin America in beef and dairy have here great long-term growth potential to respond to the need of importers to become less dependent on only a few companies from exporting countries. Nevertheless, Brazil will remain the dominant player in the export meat market with its main competitors being United States (in all meat species), Thailand (in processed poultry), EU (in pork) and Australia and New Zealand (in bovine products).

A change will be a focus by internationalising companies on the Asian region where growth in local markets and the early stage of development of modern distribution will present great growth potential for international poultry companies. China, India and South East Asia will be relatively “hot” for foreign investors and may also offer trade synergies with existing business.

INDUSTRY NEED TO ADJUST TO VOLATILE BUSINESS ENVIRONMENT WITH ONGOING DISEASE PRESSURE

This whole process of internationalisation is going to happen in an ongoing volatile business environment especially due to rising disease pressure (with for example avian flu now being a global challenge), economic conditions and exchange rates while feedgrain prices have declined to a somewhat lower level but will still remain volatile. Companies who are not adequately positioned in the market and lack value chain efficiency and flexibility will encounter difficulty in times of volatility.

The new global AI crisis provides another wake-up call and strengthens our view that the virus is endemic in wild birds in many parts of the world. The industry need to adjust to a new reality in which the virus will come back regularly. The EU experience but also the experience in Asia learns that this well possible but requires the industry and government to reply pro-actively to this new reality.

It will force the industry and governments to further modernise business models, as the virus will remain endemic in wild bird populations. Optimal biosecurity, modern value chain and distribution models, and regionalisation will be key themes both in the poultry meat and breeding sectors.

RISING CONSUMER CONCERNS TO CHANGE BUSINESS MODELS

Rising consumer concerns will be a much more important topic in the new market environment of the next decade. Growth in demand with limited resources will require more emphasis on existing resources throughout the value chain. In such a situation a good corporate social responsibility policy should be a key factor among industry players in the animal protein industry. NGOs and clients will be more concerned about the sustainability of poultry production. Companies need to be more pro-active in this sort of issue. At the same time, animal welfare will become more important especially for companies operating in developed markets where suppliers also need to be pro-active in the debate while retailers and QSRs might offer here opportunities to develop further the higher welfare meat product value chains like for example the slow growing chicken concepts in the Netherlands or label rouge in France.

The rising awareness among consumers in Asia regarding food safety has become a licence to operate and will continue to change industries significantly. Recent scandals regarding Melamine in dairy products and antibiotics in chicken has demonstrated again the importance of this trend and have put poultry demand for several years under heavy pressure. New business structures and product solutions are necessary to regain confidence of Chinese consumers in white chicken meat.

Pro-active approaches of animal health companies will be key here. Value chain focussed approaches will be key here and companies who can supply solutions for these long term challenges of the animal protein industry are well positioned to benefit.

WINNERS OF THE FUTURE

The animal protein industry has much going for it here and its efficiency has led to a more sustainable production system than other proteins. Pro-active approaches, marketing of standards and joint approaches between clients and industries will become more important and animal health companies should play as mentioned before a pro-active role here whereby their big footprint and relative low cost (up to 2% of cost) is an important element.

The opportunities for the global industry are considerable, industry players are well positioned to benefit from these challenges but they should take the right strategic direction at the crossroads where the industry is now. If they take the right direction and shape their business model to be ready to deal with the challenges as well as the much greater turbulence in the global market environment, they should be well positioned to become winners in the next decade.

Nan-Dirk MULDER

Senior Global Animal Protein Analyst, Rabobank International, The Netherlands

_________________________________

Information from the Avian Flu Forum hosted by Boehringer on April 2017