Bear market in grain continues

Aviagen Broiler Economics seriesGrain prices continue to fall. A large harvest this year in the US of corn and soybeans combined with continued growth in production in South America means that poultry producers worldwide are likely to continue enjoying low grain prices. Low grain prices may well last for another year. However, it is important to remember that bear markets eventually end so enjoy this one while it lasts.

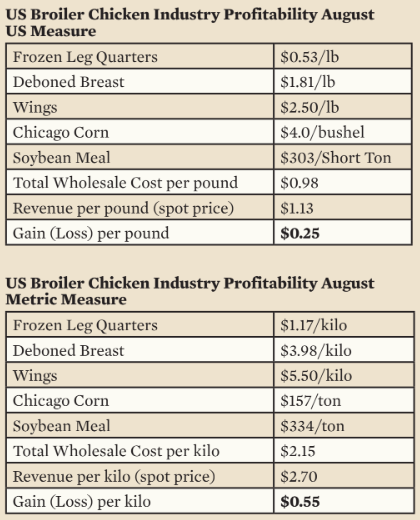

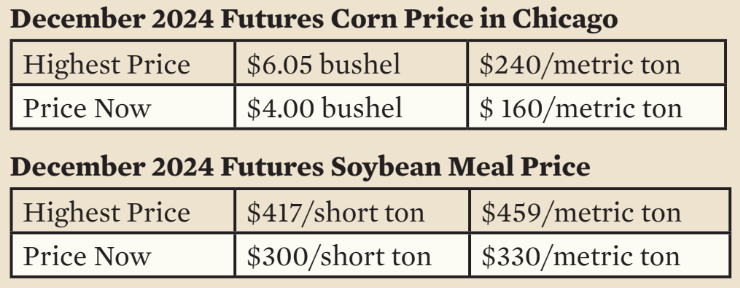

The benchmark price of corn in Chicago is now $4 per bushel ($160 per metric ton) and is likely to stay low for the rest of the year because huge stocks of unpriced old crop corn on US farms must be sold in the next two months to make room for the coming ample harvest. Soybean meal is also a bargain due to the return of production in Argentina this year and the continued growth of total production in South America.

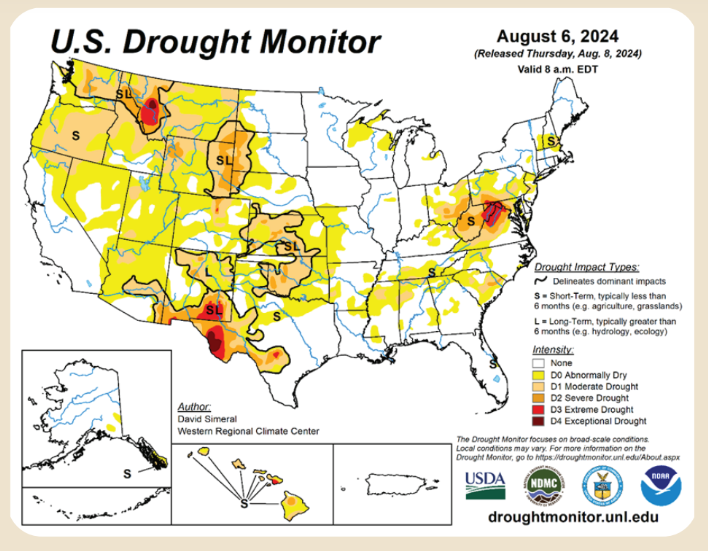

Prices are unlikely to reverse direction in the short term. As the US drought monitor below shows, the Corn Belt is in excellent shape apart from a small area on the extreme eastern edge. Overall, in South America and the rest of the world, conditions are also favorable.

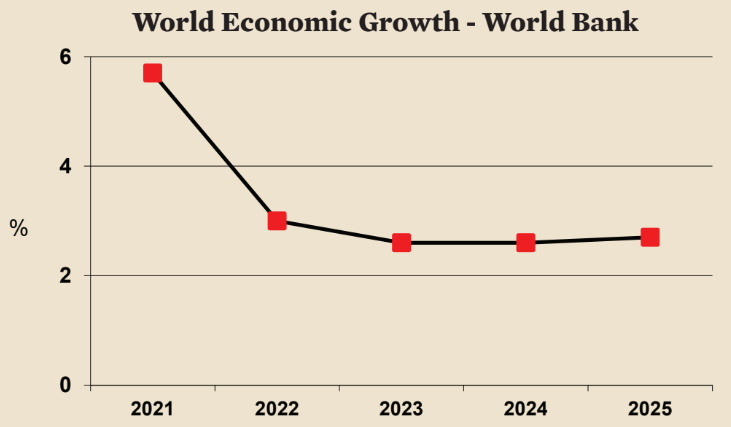

How long will the bear market in grain bottom last? It could last through crop year 2025-2026 as the world economy continues to be sluggish and supplies remain ample. The World

Bank expects that the half decade of 2020 to 2025 will have the slowest world economic growth in 30 years. However, with prices now below the cost of production in many cases, higher prices are inevitable in the not too distant future.

Corn

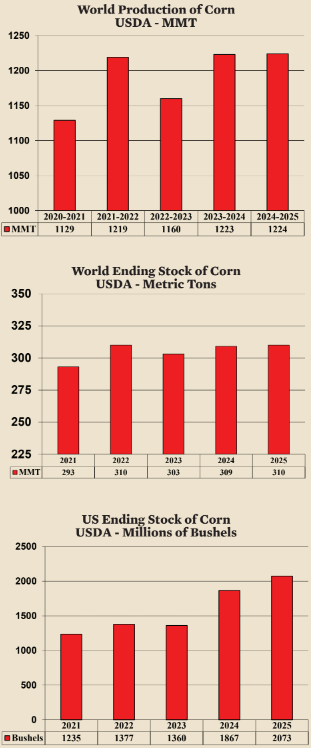

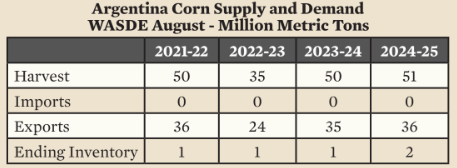

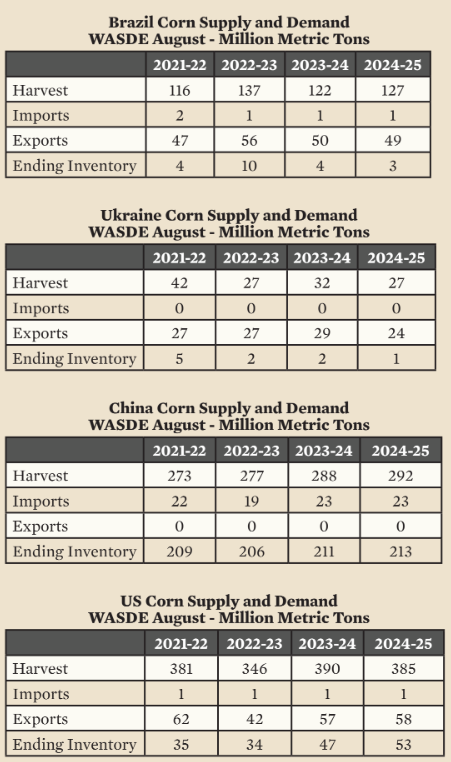

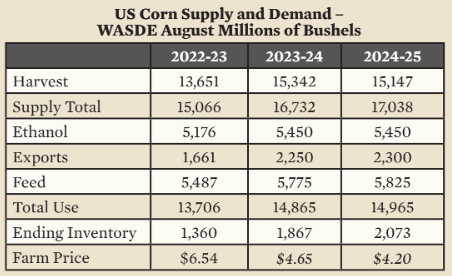

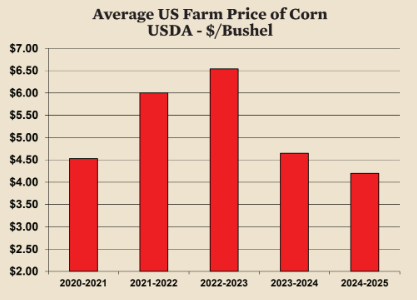

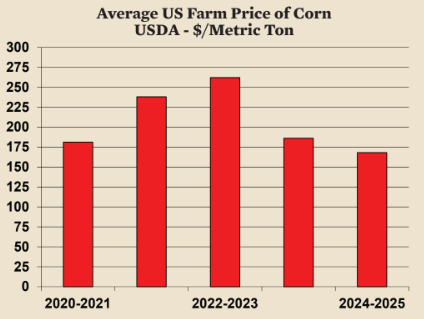

The latest WASDE report projects that world corn production will continue to be ample in crop year 2024-2025. Two crop years of higher production and higher ending inventory resulted in lower prices. The average farm price in the US last crop year was $6.54 per bushel ($262 per metric ton). The average this crop year will end up less than $5.00 ($200 per metric ton) and is likely to be even lower next crop year. An average price of $4.20 ($166 per metric ton) is projected by the USDA for crop year 2024-2025 which starts at the end of this month.

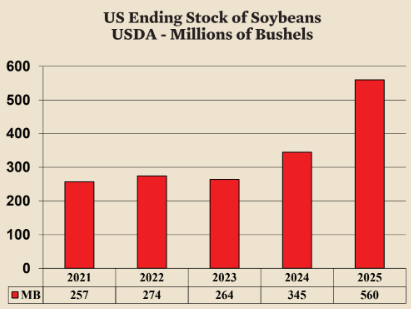

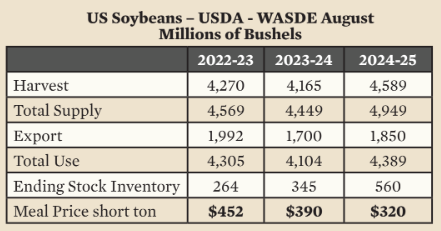

Soybeans

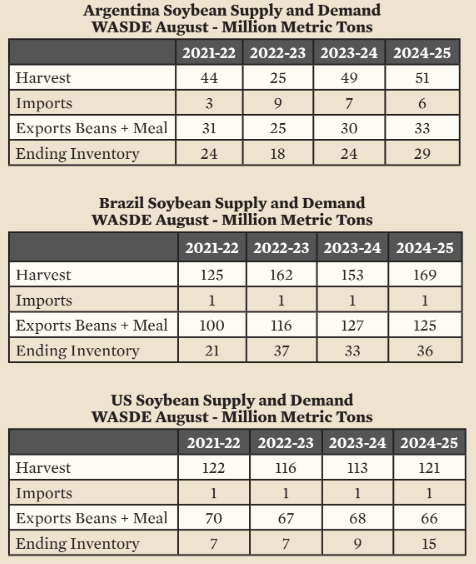

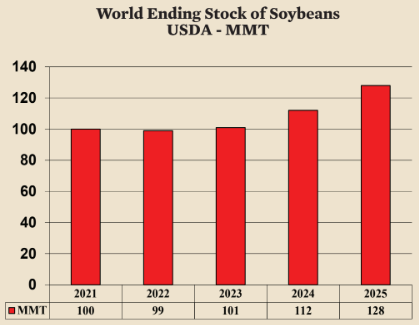

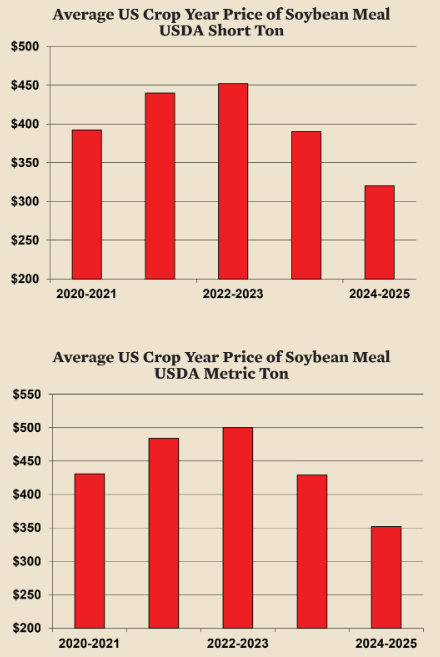

Production continues to increase rapidly in South America. The enormous ability of Brazil to increase soybean production combined with the production of Argentina and Paraguay results in South America now representing 55% of world production. Continued rising production in South America and a good harvest in the US means that the US benchmark price of soybean meal is projected to average only $320 ($352 per metric ton) in the next crop year which starts at the end of this month.

World and US ending stocks will be higher at the end of this crop year and possibly next crop year as well. Higher ending inventories, of course, are likely to lead to lower prices.

Chicken industry

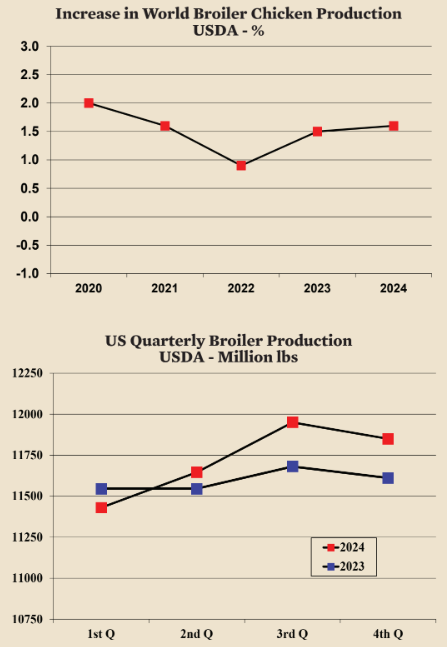

Slow growth in the world economy recently is reflected in the slow growth of world chicken production. World chicken production growth averaged just 1.5% recently. It is likely that growth will accelerate starting in 2025 and rise to an average of 2% for the last half of the decade.

Low prices in the US in 2023 led to an increase in production of only 0.4% last year. For 2024, the USDA predicts growth will increase to 1.1% with most of the growth in the second half of the year.

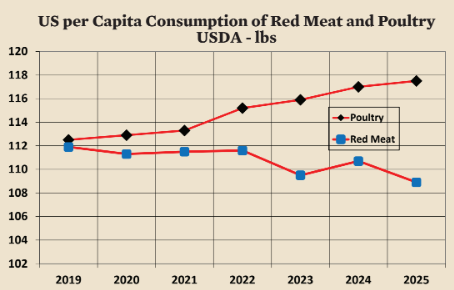

Poultry per capita consumption in the US continues to take market share from red meat. Between 2021 and 2025, red meat per capita consumption fell by 3 pounds (1.4 kilos) while poultry consumption rose by 5 pounds (2.3 kilos). Total meat consumption is relatively stable.

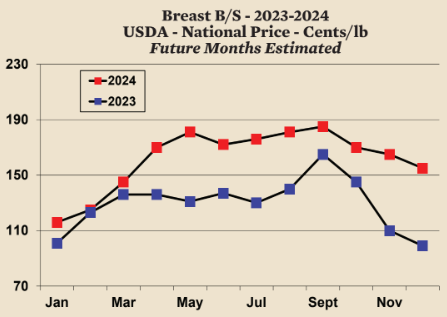

Deboned Breast

The spot prices of deboned breast in the US rose surprisingly fast in the first five months of 2024, helped by high prices for competing meats. In addition, a relatively robust US economy with low unemployment helped support the price. For the entire year the average price of deboned breast is likely to be significantly higher than last year.

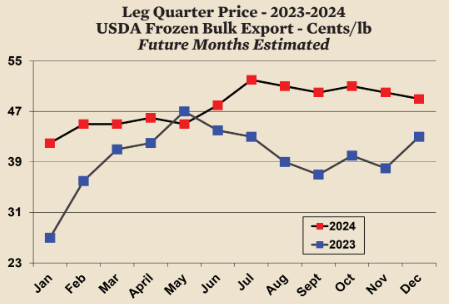

Frozen Leg Quarters for Export

Spot prices for frozen leg quarters are slightly higher than last year despite a reduction in the volume of exports. Trade issues and a relatively strong dollar are reducing the potential volume of exports.

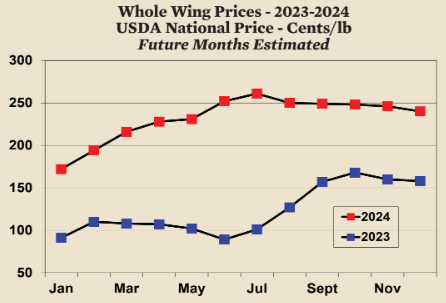

Wings

Wing prices are remarkably high. The price is now double the price last year at this time. Wing prices can be expected to remain high as demand appears to be insatiable.

Due to the firm demand for chicken and low price of grain, chicken production in the US is currently profitable when calculated using spot prices, and is likely to continue to be profitable throughout the year.