Canada - Poultry and Products Annual Report 2010

Under Canada's strict supply management system broiler meat production is forecast to increase by two per cent in 2011, up to 1.04 million metric tonnes, as the sector takes advantage of improved market demand, according to the latest GAIN report from the USDA Foreign Agricultural Service.Production

Broiler meat production

For 2011, Post forecasts an increase of two per cent in broiler meat production over the 2010 level, up to 1.04 million metric tons (MMT). Improving economic and market conditions, combined with a projected decline in red meat production and with the broiler sector's ability to adjust more quickly to market needs are the major factors underlying this evolution.

Post estimates broiler meat production for 2010 at 1.02MMT, up a moderate 0.9 per cent from 2009, reflecting a slow recovery out of the recession year.

Canadian broiler meat production had seen a period of rapid growth during the 1990s, with an average annual growth rate of 5.8 per cent for the entire decade, reflecting a strong domestic market demand both from the retail and food-service sectors and a change in consumer preferences away from red meat and towards a perceived healthier chicken diet.

With the decade starting in 2000, broiler production expansion slowed down, achieving a much more modest average annual growth rate of 1.6 per cent, reflecting a matured market that seems to have maximised its potential. For the time being, future growth will be mainly supported by the annual increase in Canadian population, and by the ethnic composition of Canada's immigration, where many newcomers of Asian or African origin have a stronger preference for chicken meat over red meat.

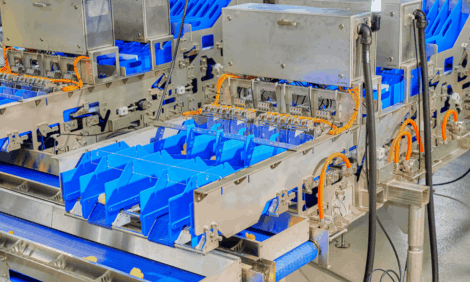

Canada operates a supply management system in the broiler sector. Unlike in the United States, the industry is not vertically integrated, with a multitude of independent chicken farmers, often operating family businesses, supplying live birds to processing companies. Production is tightly controlled through a quota system. Decisions on production volume are taken before every eight-week cycle, with the national volume being allocated to each of the ten producing provinces, and subsequently further allocated to individual producers based on the total production quota.

Consumption

Reflecting production trends, a stronger demand and continued consumer preference, per-capita broiler meat consumption is forecast to increase in 2011 to 31.8kg, up from an estimated 31.5kg in 2010.

Total domestic chicken consumption in Canada has almost doubled in the past 30 years. The increase was partly due to the country’s population growth, which increased almost 39 per cent from 24.5 million in 1980 to about 34 million in 2010. At the same time, the increase in consumption is also attributable to chicken’s increasing popularity among Canadians during the period. Overall, Canadian preferences have shifted towards chicken primarily due to an increase in health awareness and the perception that chicken is leaner and therefore healthier than other meats. Price is not a major factor since poultry prices, due to the supply management system, are consistently higher than beef or pork, which are not under supply management schemes.

In recent years, the pattern of Canada’s immigrant population is one that is more likely to have dietary preferences for chicken rather than beef or pork. In addition, Canada’s food service providers are continually introducing chicken menu items in creative ways or as an ingredient in ethnic-style food offerings that are becoming increasingly popular. Chicken Farmers of Canada's Strategic Plan for 2009-2013 lists as an industry objective to increase annual per-capita consumption of chicken to 33kg.

Prices

With the supply management system, chicken producers receive a fixed price for their live birds, which is determined every eight-week cycle based on production costs. Ontario is the largest chicken-producing province in Canada, capturing about one-third of the market, and therefore Ontario live bird prices are the basis for the calculation of prices in other provinces. Due to the supply management system, producer prices have remained remarkably stable over time, and only showed a more substantial increase in the past few years due to the dramatic increase in grain and feed prices.

Like with most agriculture products, broiler meat retail prices are minimally impacted by farm gate prices. The Canadian supply management system only guarantees certain price levels for producers and not downstream for the other participants in the supply chain. Wholesale and retail broiler meat prices are usually reflective or market conditions in terms of supply and demand. They are also reflective of consumer preferences for various chicken cuts, and of their quality and degree of transformation.

Similarly to consumers in United States, Canadian consumers tend to prefer white meat (breasts and wings) rather than dark meat (legs). The most expensive chicken cut is the fresh boneless skinless breast, widely used in restaurants and a preferred barbecue item for Canadians. Wings are seen as a good complement to beer and are very popular during the winter hockey season. Leg quarters are usually the least expensive chicken cut in groceries, cheaper even than the whole birds.

Further Reading

| - | You can view the full report by clicking here. |

September 2010