Daily US grain report: markets bounce back from Thursday’s pressure

US grain futures prices were higher in overnight trading Friday (24 May) as the bulls made a quick recovery from Thursday’s price pressure.The US government on Thursday unveiled its subsidy plan for farmers hurt by the US-China trade war, and it was not as price-sensitive to soybeans as traders had initially feared. Thus, focus is back on very soggy weather in the US midsection, which remains bullish for the grains due to record slow planting progress for this time of year. As each wet day passes in the Midwest, lower production levels for corn and soybeans are more likely.

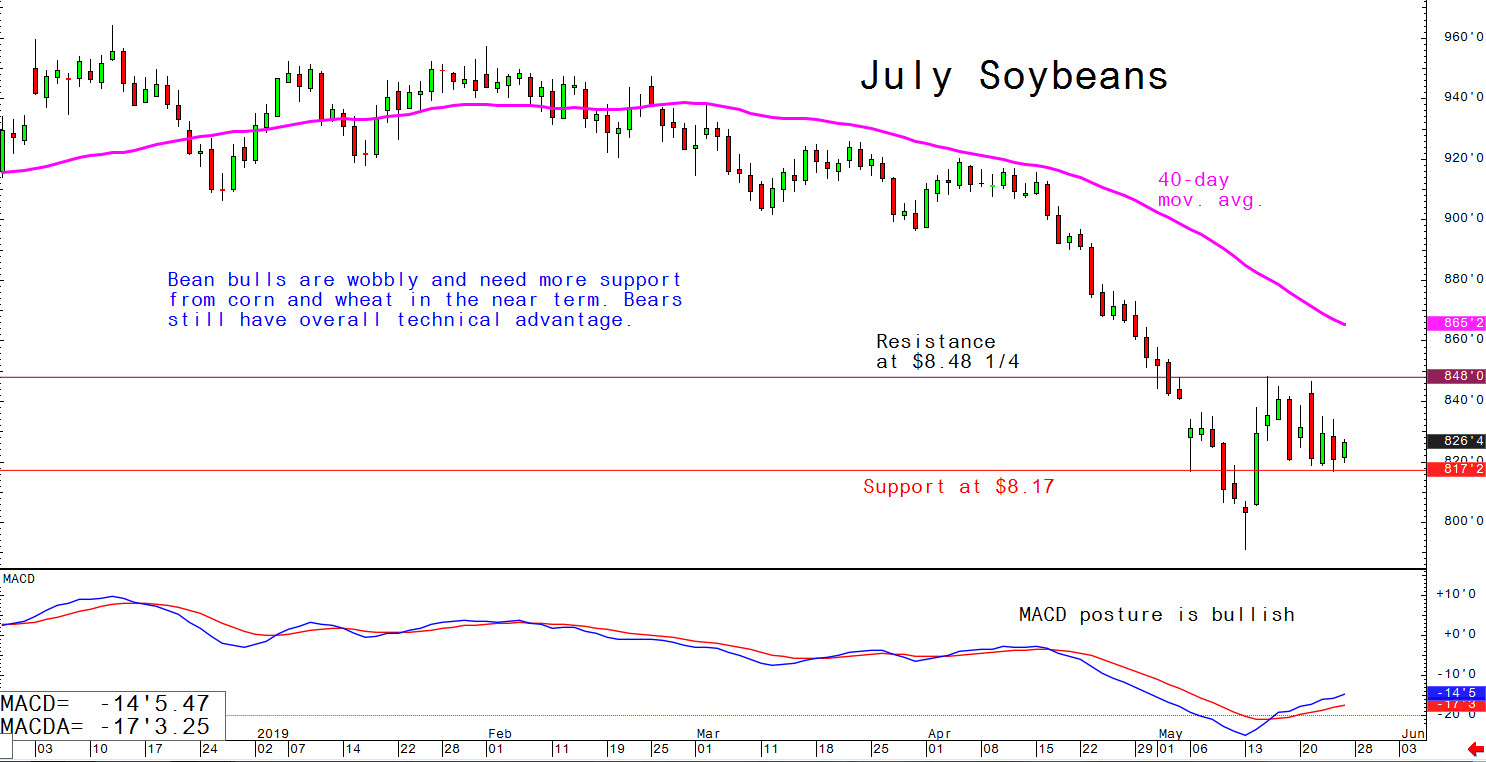

Wheat futures will continue in a follower’s role. If soybeans and corn continue to rally, wheat will, too.

There are two elements now working against the US grain market bulls: a stronger US dollar that makes US agricultural exports more expensive on world markets, and the big drop in crude oil prices this week. The drop in oil is likely to not only spook the commodity market bulls, but also embolden the large speculative “fund” futures traders to re-enter short trades in the US grains.