Farmer sentiment declines sharply as commodity prices weaken

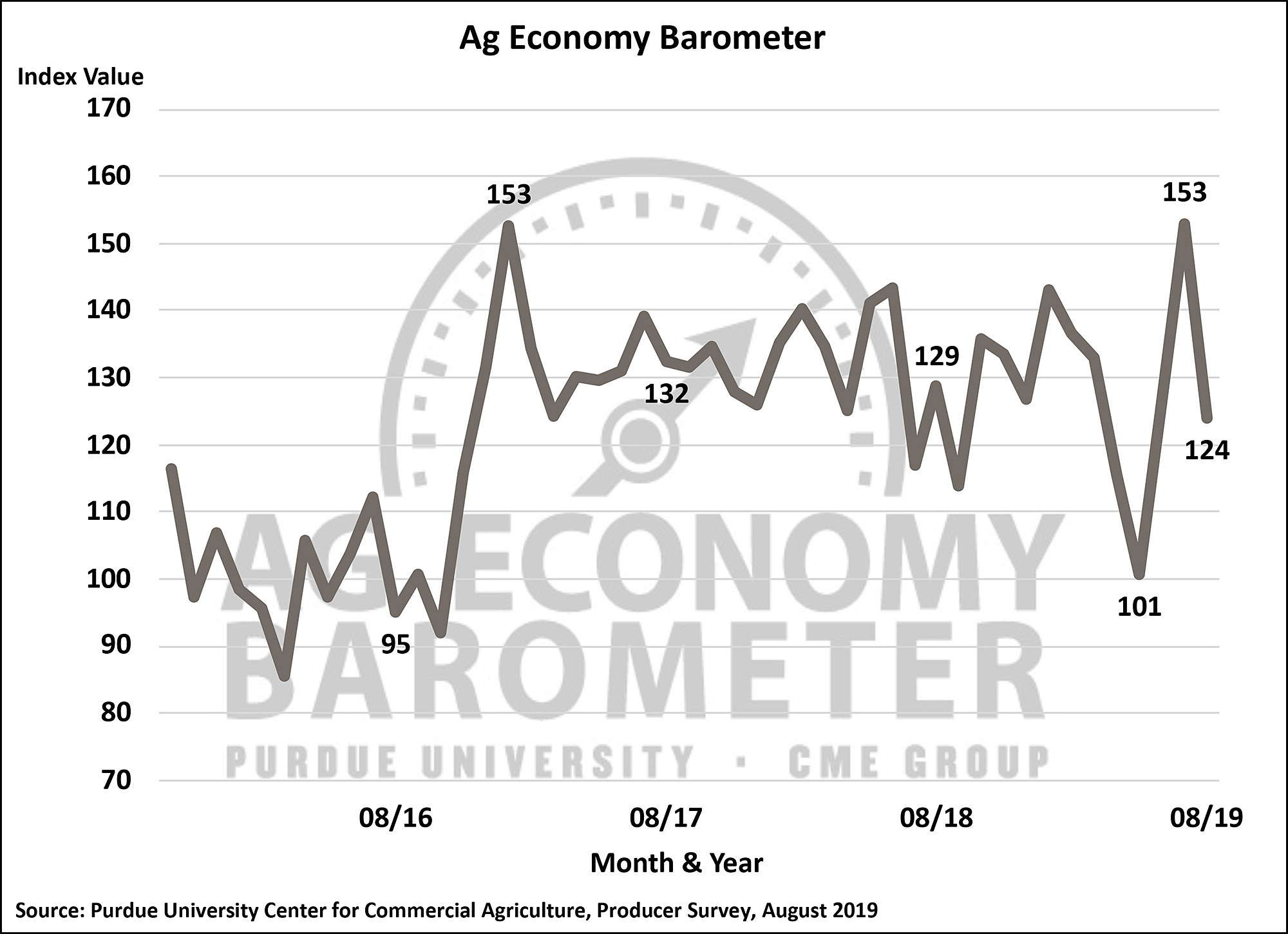

According to the Ag Economy Barometer, majority of farmers expect MFP payments in 2020The Purdue University/CME Group Ag Economy Barometer weakened significantly in August to a reading of 124, down 29 points from July. The barometer is based on a mid-month survey of 400 agricultural producers across the US and was conducted 12-20 August, with nearly all of the responses collected following USDA’s release of the 12 August Crop Production report.

© Purdue/CME Group Ag Economy Barometer/James Mintert

Farmers’ expectations for both current and future economic conditions also took a tumble. The Index of Current Conditions dropped 19 points and the Index of Future Expectations dropped 34 points in August, both compared with a month earlier.

“Sharp declines in most commodity prices during July and early August weighed heavily on farmer sentiment this month,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Centre for Commercial Agriculture. “While USDA’s announcement of the Market Facilitation Programme (MFP) payment rates did help alleviate concerns about 2019 income for many farmers, the big decline in the Index of Future Expectations indicates farmers are becoming more concerned about the future for US agriculture and their farms.”

In late July, USDA announced the per planted acre payment rates by county for the 2019 MFP, with payments to be made in three tranches. To learn farmers’ views regarding the MFP payments, two questions were posited on the August survey: first, to what degree does $16 billion in MFP payments to US farmers relieve their concerns about the impact of tariffs on their 2019 farm income; and second, in a follow-up question, do respondents expect USDA to provide payments to US farmers for the 2020 crop year.

Over two-thirds (71 percent) of respondents stated that they feel the 2019 MFP programme will either “completely or somewhat relieve” their concerns about tariffs’ impact on 2019 farm income. However, at the same time, nearly three out of 10 respondents (29 percent) said “not at all,” indicating that a significant minority of farmers think the MFP payments fall short of making up for income losses attributable to the ongoing tariff battles. When looking ahead to 2020, 58 percent of farmers in the August survey said they expect another MFP payment to be made to US farmers for the 2020 crop year, suggesting a majority of farmers are counting on payments from USDA helping to make up future income shortfalls.

Since March 2019, questions were added to the survey to assess farmers’ perspectives on how quickly they expect the soybean trade dispute with China to be resolved and whether the resolution will benefit US agriculture. During that time, farmers were almost evenly split on this issue with 55 percent indicating they felt it was unlikely, and 45 percent saying it was likely to be resolved quickly.

In subsequent months, the percentage of farmers saying they think it is unlikely that the trade dispute will be resolved soon increased, ranging from a high of 80 percent in May to a low of 68 percent in June.

In August, there was a modest sentiment shift as the percentage of producers expecting resolution soon rose to 29 percent from 22 percent in July, and the percentage of producers who felt resolution soon was unlikely declined to 71 percent from 78 percent in July.

When farmers were asked whether they think the trade dispute will ultimately be resolved in a way that benefits US agriculture, the results have been mixed over time. In March, over three-fourths (77 percent) of farmers in the survey said they expect a beneficial outcome to the trade dispute; however, that percentage declined in May to 65 percent before rebounding in July to 78 percent. In August, despite the decline, the percentage of farmers who expect a positive outcome to the dispute for US agriculture slipped to 72 percent.

Read the full August Ag Economy Barometer report here. The report includes insights into whether producers feel now is a good or bad time to make large investments in their farming operations and their expectations for farmland values. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars. Each month, James Mintert, director of the Purdue Center for Commercial Agricultural, provides a short video analysis of the barometer results, available here.