Food Outlook – Meat and Meat Products

Global meat markets in 2012 are expected to see a recovery of supplies in traditionally importing countries and strong competition for markets, according to the latest Food Outlook report from FAO. Near record prices are constraining consumption growth.Meat Prices Hover at Near–Record Levels

Global meat markets are likely to face heightened trade competition in 2012, at the same time that recovering

meat production in Asia is set to dampen growth in global

import demand. Overall, meat trade is expected to expand

by two per cent, to 29.2 million tonnes, much of which is

anticipated to be taken up by developing country exporters,

which could increase their share of the global trade to 44

per cent.

Disease outbreaks in 2011, drought–reduced cattle

inventories and high feed costs sustained international meat prices to near record levels in the first quarter of 2012. In

April, the FAO meat price index edged up to 182 points,

surpassing the record 181 points registered in November

2011.

Indications of slowing import demand, especially for pig and poultry meats, portents a potential moderation of meat prices in the coming months, which, along with high feed costs, is raising concern about the profitability of the meat sector in 2012.

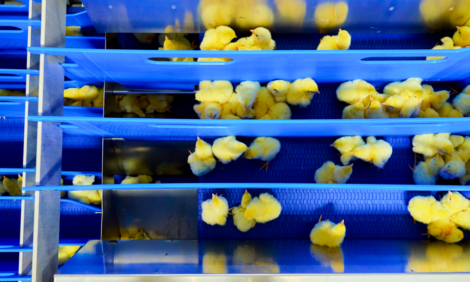

Poultry Meat

Poor returns to limit production growth in 2012

Growth of the poultry sector, historically one of the most

dynamic meats, is being dampened by high feed prices, the

resurgence of avian influenza (AI) outbreaks in Asia and ongoing

trade disputes. As a result, global output is forecast to

rise by only two per cent to 103.5 million tonnes in 2012.

Much

of the increase will likely originate in Asia, in particular in

China, India, Japan, the Republic of Korea and Turkey.

However, escalating cases of AI, with a record seven

countries in Asia reporting outbreaks in February, clouds the

region’s production outlook. In Bangladesh, an estimated

6,000 poultry farms have closed since the beginning of

the year because of AI and high feed costs.

In Africa, the

spread of AI to Egypt in early 2012 is expected to hinder the

development of the sector in the course of the year.

Declining output in the United States, as indicated

by falling chick placements in early 2012, and only slight

gains in the EU point to prospects for stable production

in developed countries. However, the sector is forecast to

grow by six per cent to 3.0 million tonnes in the Russian

Federation, which has launched 10 new investment

projects.

Despite producer concerns about sliding poultry

prices in early 2012, Brazil’s output is forecast to edge up

by three per cent to 12 million tonnes, while vertical integration

and high prices for other meats are supporting a two per cent

increase in output to 2.9 million tonnes in Mexico.

In Africa,

despite investments in some countries such as Namibia,

high feed prices and rising imports are hindering production

growth in Ghana, Angola, Benin and the Congo. At the

same time, imposition of anti-dumping duties on poultry

originating in the United States and Brazil is keeping South

Africa’s output on an upward trend.

Poultry trade outlook dominated by policy uncertainties

Despite the imposition of import restrictions by several

countries, world poultry trade is forecast to rise by three per cent

to 13.0 million tonnes in 2012, with expansion expected to be

sustained by larger deliveries to Hong Kong SAR, Viet Nam and Indonesia, as well as Saudi Arabia and the United

Arab Emirates. Imports by Saudi Arabia, the third largest

market after Hong Kong SAR and Japan, will be influenced by

the status of a government feed subsidy granted to national

poultry operations in 2011, the depletion of which is pushing

up poultry prices and stimulating import demand.

Deliveries

to the Russian Federation, which was the world’s largest

market until the imposition of restrictive import measures four

years ago, are expected to edge up somewhat, following a

WTO-induced increase in the poultry tariff-rate quota.

Rising

domestic demand will continue to boost imports by African

countries, in particular Egypt, Angola, Benin and Ghana,

with the resultant regional dependency on imports now

estimated at 24 per cent of domestic consumption, compared

to 18 per cent in 2009.

Import growth in Latin America and

the Caribbean will be led by Chile, Mexico and Venezuela.

By contrast, following the imposition of anti-dumping duties

on poultry originating in the United States, China may

buy less, although part of the product delivered to Hong

Kong SAR is likely to be re-exported to the mainland. The

application of anti-dumping tariffs on Brazilian product by

South Africa is likely to negatively influence Brazil’s deliveries

to South Africa in 2012, while improved domestic availability

is forecast to depress purchases by Japan.

The continued

imposition by India, a minor importer, of non-tariff barriers on

poultry and the resulting request by the US for consultations

under the dispute settlement provisions of the World Trade

Organization (WTO) is illustrative of the multiple constraints

facing international poultry trade.

As for poultry meat exports, a return to a more

favourable exchange rate may support a two per cent increase

in Brazilian shipments, despite the slow relisting of Brazilian

poultry plants by the Russian Federation. Exports from

Thailand will be supported by the EU decision in April to

lift an eight–year ban on raw poultry shipments by mid-year.

Similarly, sales by Turkey are likely to be boosted by the

granting of access to the Saudi Arabian market, after a

six-year ban. Strong regional demand, particularly from Chile

and Venezuela, are sustaining a steady growth in shipments

from Argentina. On the other hand, limited domestic

supplies and more restricted access to markets may dampen

growth in the United States to less than one per cent and even

result in declining shipments by the EU.

Further Reading

| - | You can view the full report by clicking here. |

|

| - | Go to our news item on this story by clicking here. |

May 2012