GLOBAL POULTRY TRENDS 2012 - Asia: a Key Chicken Meat Importer

Asian countries are among the key players in the import of broiler meat, writes Terry Evans in his examination of the trends in chicken trade in Asian countries. Only three countries in the region – Thailand, China and Turkey – export significant volumes of chicken meat.Differences in the ways in which trade figures are collected and/or reported mean that, on a global basis, there is an imbalance between the data presented for exports and imports. In general, the export total usually exceeds that for imports. A further problem can be that of double–counting when commodities are shipped to one country and then re-exported to another.

With regard to differences in the trade figures published by the USDA and FAO, it is important to remember that the FAO figures relate to all chicken meat and included the trade in chicken paws, while the USDA specifies that their trade figures exclude chicken paws, the trade between EU member countries and hen meat.

Whichever series of figures you peruse, it is clear that Asian countries are among the key players in the import trade of chicken meat. In 2009, the total quantity of fresh/frozen chicken meat imported into the region amounted to 4.3 million tonnes (Table 1). When prepared/processed chicken is included, this total rises to 4.8 million tonnes.

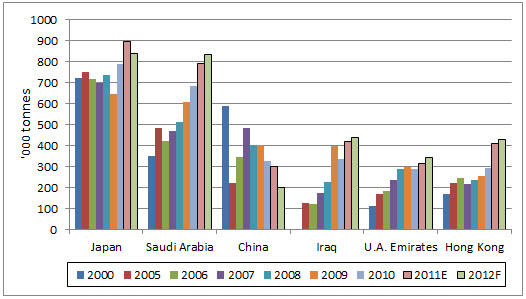

Based on USDA data, the seven countries listed (Table 2) currently account for purchases of almost 3.5 million tonnes a year compared with less than two million tonnes in 2000.

Leading buyer in the region is Japan with the latest estimate of purchases for 2011 just falling short of 900,000 tonnes (Table 2), of which, nearly half is prepared/cooked products. Note that the FAO data presented in Table 1 applies only to receipts of fresh/frozen chicken meat. According to a USDA GAIN report, the food–service sector uses significant quantities of imported broiler meat cuts, mainly from Brazil. An increase in domestic production is expected to lead to lower prices than last year and encourage Japanese shoppers to purchases local product at the expense of imports, which are consequently expected to dip by between four ot six per cent this year.

While Japan’s imports of all forms of chicken meat have been reasonably static at around 700,000 tonnes a year, the quantities purchased by Saudi Arabia have more than doubled in the past decade or so and are currently well in excess of 800,000 tonnes a year, with Brazil the leading supplier shipping about 630,000 tonnes to this market in 2011.

A few years ago, China was a major importer of both chicken meat and chicken paws. According to the USDA, lower pork prices have temporarily produced a switch in demand away from chicken. However, in general, the reductions have primarily come about as the result of the Chinese imposing anti–dumping (AD) and countervailing duties (COD) on US imports since 2010. This has been reflected in lower chicken imports from the US, such that the estimate for 2012 has been lowered towards 200,000 tonnes compared with around 400,000 tonnes back in 2009. Purchases of chicken paws are forecast to fall to 300,000 tonnes. However, US exports of paws in the first quarter of 2012 were higher than the year–earlier level.

Iraq has purchased increasing quantities of chicken since 2007 to the current level of around 350,000 tonnes, with Brazil, the US and Turkey the main suppliers.

Much of the chicken meat imported into Hong Kong is re-exported to mainland China. In 2009, for example, of the 715,000 tonnes received, some 460,000 tonnes were re-exported (Tables 1 and 3).

Both the United Arab Emirates and latterly, Viet Nam, have been increasingly active in the import market purchasing currently around 350,000 tonnes a year.

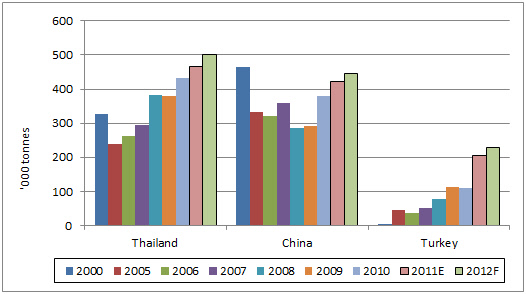

If the re–exports from Hong Kong are discounted, there are only three major exporters in the region, Thailand, China and a recent arrival on the export scene, Turkey. The total trade currently amounts to around one million tonnes a year (Table 4).

That the European Union decided to lift the restrictions on imports of fresh chicken from Thailand from 1 July 2012 is expected to result in exports of some 50,000 tonnes of uncooked Thai chicken meat into the EU during the second half of this year. Uncooked chicken exports from Thailand had been banned since 23 January 2004 after outbreaks of highly pathogenic avian influenza (HPAI) in that country. Regarding exports to the EU, Thailand currently has a quota of 92,600 tonnes of uncooked salted poultry meat while its quota for cooked chicken meat stands at 160,033 tonnes although Thailand is asking for this to be increased. Thailand’s exports to all countries are forecast to reach 500,000 tonnes in 2012.

Chicken exports from China have also trended upwards and are expected by the USDA to reach 445,000 tonnes this year, fuelled by strong demand from Japan and Hong Kong, her leading customers.

Increased purchases by Iraq – and to a lesser extent, Viet Nam and Tajikistan – have had a profound impact on exports from Turkey, which are now approaching 250,000 tonnes a year.

July 2012