GLOBAL POULTRY TRENDS 2014: Steady Rise in Chicken Meat Output for Africa and Oceania

In Africa and Oceania, chicken meat production increased by more than four per cent annually between 2000 and 2012, the most recent year recorded, reports industry analyst, Terry Evans, in his review of the poultry meat sector in those two regions.Africa Set to Produce Six Million Tonnes of Chicken

Africa currently accounts for almost 16 per cent of the world’s human population but only five per cent of global chicken meat production.

During the period 2000 to 2012, chicken meat production in Africa expanded by almost two million tonnes, recording an annual average growth rate of some 4.4 per cent per year. This was as little faster than world production, which returned a shade below four per cent. Hence Africa’s share of global output has increased slightly from 4.7 to a little below 5 per cent (Table 1).

| Table 1. Indigenous* chicken meat production (million tonnes) | |||||||||||

| Region | 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013E | 2014F |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Africa | 2.8 | 3.3 | 3.4 | 3.7 | 4.0 | 4.2 | 4.5 | 4.6 | 4.6 | 4.7 | 4.7 |

| Americas | 27.1 | 32.7 | 33.7 | 35.0 | 37.5 | 36.9 | 38.6 | 39.8 | 40.1 | 40.6 | 41.3 |

| Asia | 18.6 | 22.4 | 23.5 | 25.0 | 26.2 | 28.0 | 29.2 | 29.9 | 31.4 | 31.8 | 32.1 |

| Europe | 9.3 | 10.9 | 10.8 | 11.6 | 12.1 | 13.3 | 13.9 | 14.6 | 15.4 | 15.9 | 16.5 |

| Oceania | 0.7 | 0.9 | 1.0 | 1.0 | 1.0 | 1.0 | 1.1 | 1.2 | 1.2 | 1.2 | 1.2 |

| WORLD | 58.5 | 70.2 | 72.3 | 76.2 | 80.7 | 83.4 | 87.3 | 90.1 | 92.7 | 94.2 | 95.8 |

| *Meat from the slaughter of birds originating in a particular country, plus the meat equivalent of any such birds exported live. E 2013 and F 2014: 5m estimates and forecasts for chicken meat. Regional figures may not add up to the world totals due to rounding. Source: FAO for chicken meat. |

|||||||||||

The rate of growth in output is slowing with forward estimates pointing to an annual increase during the next decade of less than 2.5 per cent as poultry meat production expands from around 109 million tonnes in 2014 to 134.5 million tonnes in 2023. As chicken meat represents about 88 per cent of poultry meat production, it is anticipated that chicken output will rise from around 95 to 96 million tonnes this year, to more than 118 million tonnes by 2023, of which Africa might account for some six million tonnes.

| Table 2. Chicken meat production in Africa ('000 tonnes eviscerated weight) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Algeria | 235.3 | 249.6 | 250.6 | 249.5 | 252.6 | 251.8 | 252.8 |

| Angola | 7.6 | 7.2 | 13.1 | 15.9 | 19.1 | 22.3 | 23.2 |

| Benin | 12.2 | 15.4 | 20.9 | 21.4 | 22.2 | 23.5 | 23.7 |

| Botswana | 3.6 | 4.8 | 5.0 | 4.5 | 4.4 | 5.7 | 6.0 |

| Burkina Faso | 27.0 | 30.8 | 33.7 | 35.3 | 37.2 | 38.3 | 38.8 |

| Burundi | 5.8 | 6.5 | 6.7 | 6.7 | 6.8 | 6.8 | 3.8 |

| Cameroon | 21.2 | 53.2 | 67.5 | 63.8 | 67.8 | 69.8 | 70.2 |

| Cabo Verde | 0.4 | 0.4 | 0.5 | 0.5 | 0.5 | 0.6 | 0.6 |

| Central African Rep. | 3.2 | 4.2 | 5.2 | 5.5 | 5.7 | 5.9 | 6.0 |

| Chad | 4.7 | 4.9 | 5.2 | 5.2 | 5.3 | 5.3 | 5.3 |

| Comoros | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 |

| Congo | 4.4 | 5.6 | 5.9 | 6.0 | 6.2 | 6.5 | 6.6 |

| Congo Dem. Rep. | 11.4 | 10.5 | 10.3 | 10.4 | 8.6 | 10.3 | 10.3 |

| Cote d'Ivoire | 21.9 | 21.7 | 22.6 | 23.2 | 34.7 | 33.2 | 33.4 |

| Egypt | 511.8 | 569.7 | 628.8 | 671.2 | 744.0 | 796.2 | 800.1 |

| Equatorial Guinea | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| Eritrea | 1.7 | 2.1 | 1.6 | 1.6 | 1.7 | 1.7 | 1.7 |

| Ethiopia | 37.6 | 42.5 | 48.3 | 50.4 | 59.2 | 53.9 | 60.4 |

| Gabon | 3.7 | 3.6 | 3.5 | 3.5 | 3.5 | 3.5 | 3.6 |

| Gambia | 1.0 | 1.0 | 1.1 | 1.2 | 1.3 | 1.2 | 1.5 |

| Ghana | 19.0 | 26.5 | 42.3 | 32.9 | 35.6 | 36.9 | 42.7 |

| Guinea | 4.1 | 5.6 | 6.7 | 6.7 | 6.4 | 6.2 | 6.3 |

| Guinea-Bissau | 1.1 | 1.4 | 1.6 | 1.7 | 1.8 | 1.9 | 1.9 |

| Kenya | 18.6 | 24.6 | 26.3 | 28.7 | 31.0 | 22.6 | 22.7 |

| Lesotho | 1.8 | 2.1 | 1.5 | 1.9 | 1.6 | 1.6 | 1.6 |

| Liberia | 6.4 | 8.5 | 10.0 | 10.4 | 10.9 | 11.4 | 11.6 |

| Libya | 96.9 | 99.1 | 120.2 | 124.8 | 128.7 | 123.5 | 124.2 |

| Madagascar | 31.7 | 35.4 | 36.1 | 36.9 | 36.3 | 36.0 | 36.3 |

| Malawi | 15.3 | 15.8 | 19.0 | 21.3 | 21.4 | 22.4 | 22.4 |

| Mali | 29.2 | 34.9 | 39.4 | 41.0 | 41.7 | 41.3 | 42.1 |

| Mauritania | 4.0 | 4.3 | 4.4 | 4.3 | 4.5 | 4.5 | 4.6 |

| Mauritius | 21.1 | 33.3 | 43.3 | 44.9 | 46.5 | 48.4 | 48.6 |

| Morocco | 238.3 | 361.1 | 436.2 | 486.5 | 558.8 | 586.2 | 556.4 |

| Mozambique | 28.8 | 17.1 | 24.2 | 29.7 | 28.3 | 27.0 | 22.7 |

| Namibia | 4.0 | 3.5 | 6.1 | 6.8 | 6.8 | 7.2 | 7.6 |

| Niger | 11.0 | 11.7 | 10.7 | 16.2 | 16.6 | 16.6 | 16.8 |

| Nigeria | 158.8 | 218.5 | 260.0 | 272.9 | 286.0 | 300.0 | 290.0 |

| Reunion | 13.3 | 14.1 | 15.0 | 15.7 | 16.8 | 17.0 | 17.2 |

| Rwanda | 1.4 | 2.3 | 2.4 | 2.2 | 2.1 | 2.1 | 2.2 |

| Sao Tome/Principe | 0.6 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 |

| Senegal | 23.0 | 29.0 | 41.0 | 39.3 | 45.4 | 55.7 | 56.6 |

| Seychelles | 1.0 | 0.8 | 0.8 | 0.6 | 0.8 | 0.9 | 0.9 |

| Sierra Leone | 5.4 | 4.5 | 9.0 | 11.9 | 13.0 | 13.7 | 13.9 |

| Somalia | 3.2 | 3.7 | 3.3 | 3.1 | 3.5 | 3.5 | 3.6 |

| South Africa | 818.7 | 948.7 | 1,327.5 | 1,387.3 | 1,473.4 | 1,485.6 | 1,488.6 |

| Sudan (former) | 25.8 | 26.0 | 25.6 | 27.3 | 37.3 | 39.3 | 44.3 |

| Swaziland | 3.8 | 5.2 | 4.0 | 4.0 | 4.5 | 4.6 | 4.7 |

| Tanzania Un. Rep. | 44.2 | 51.2 | 48.6 | 48.3 | 53.5 | 54.2 | 55.2 |

| Togo | 12.0 | 17.6 | 20.6 | 26.0 | 28.4 | 29.6 | 31.2 |

| Tunisia | 86.0 | 86.3 | 101.8 | 101.8 | 111.6 | 106.9 | 126.3 |

| Uganda | 43.6 | 50.4 | 44.1 | 50.3 | 56.3 | 60.2 | 61.0 |

| Zambia | 35.0 | 39.4 | 38.3 | 40.0 | 42.5 | 42.8 | 43.8 |

| Zimbabwe | 33.5 | 52.2 | 61.4 | 62.5 | 61.8 | 64.1 | 64.6 |

| AFRICA | 2,755.4 | 3,269.7 | 3,963.0 | 4,164.9 | 4,495.8 | 4,611.5 | 4,621.7 |

| Source: FAO | |||||||

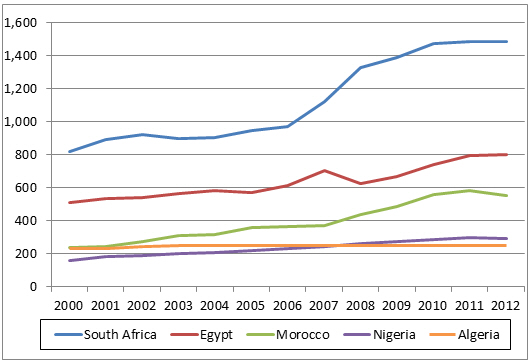

Seven African countries are already producing more than 100,000 tonnes a year, their combined output amounting to some 3.64 million tonnes or just under 79 per cent of the regional total. Nevertheless, those interested in the development of this region should also take note of the other countries which have recorded good growth since 2000; only a handful have suffered a cut-back in production (Table 2). However, almost all the countries have noted a slowdown in the rate of expansion in the latter part of the review period. This has been particularly evident among the leading producing nations (Figure 1).

| Table 3. Chicken meat production ranking in Africa in 2012 ('000 tonnes) |

|||||||||||

| Country | Production | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| South Africa | 1,488.6 | ||||||||||

| Egypt | 800.1 | ||||||||||

| Morocco | 556.4 | ||||||||||

| Nigeria | 290.0 | ||||||||||

| Algeria | 252.8 | ||||||||||

| Tunisia | 126.3 | ||||||||||

| Libya | 124.2 | ||||||||||

| Cameroon | 70.2 | ||||||||||

| Zimbabwe | 64.6 | ||||||||||

| Uganda | 61.0 | ||||||||||

| Ethiopia | 60.4 | ||||||||||

| Senegal | 56.6 | ||||||||||

| Tanzania Un. Rep. | 55.2 | ||||||||||

| Mauritius | 48.6 | ||||||||||

| Sudan (former) | 44.3 | ||||||||||

| Zambia | 43.8 | ||||||||||

| Ghana | 42.7 | ||||||||||

| Mali | 42.1 | ||||||||||

| Burkina Faso | 38.8 | ||||||||||

| Madagascar | 36.3 | ||||||||||

| Cote d'Ivoire | 33.4 | ||||||||||

| Togo | 31.2 | ||||||||||

| Benin | 23.7 | ||||||||||

| Angola | 23.2 | ||||||||||

| Mozambique | 22.7 | ||||||||||

| Kenya | 22.7 | ||||||||||

| Malawi | 22.4 | ||||||||||

| Reunion | 17.2 | ||||||||||

| Niger | 16.8 | ||||||||||

| Sierra Leone | 13.9 | ||||||||||

| Liberia | 11.6 | ||||||||||

| Congo Dem. Rep. | 10.3 | ||||||||||

| Namibia | 7.6 | ||||||||||

| Congo | 6.6 | ||||||||||

| Guinea | 6.3 | ||||||||||

| Central African Rep. | 6.0 | ||||||||||

| Botswana | 6.0 | ||||||||||

| Chad | 5.3 | ||||||||||

| Swaziland | 4.7 | ||||||||||

| Mauritania | 4.6 | ||||||||||

| Burundi | 3.8 | ||||||||||

| Somalia | 3.6 | ||||||||||

| Gabon | 3.6 | ||||||||||

| Rwanda | 2.2 | ||||||||||

| Guinea-Bissau | 1.9 | ||||||||||

| Eritrea | 1.7 | ||||||||||

| Lesotho | 1.6 | ||||||||||

| Gambia | 1.5 | ||||||||||

| Seychelles | 0.9 | ||||||||||

| Sao Tome/Principe | 0.7 | ||||||||||

| Cabo Verde | 0.6 | ||||||||||

| Comoros | 0.5 | ||||||||||

| Equatorial Guinea | 0.2 | ||||||||||

| Source: FAO | |||||||||||

Chicken meat output in the biggest producer, South Africa, expanded by more than five per cent per year from 2000 to 2012 as it climbed from 819,000 tonnes to almost 1.5 million tonnes (Table 2, Figure 1).

According to Marthinus Stander, Chair of the South African Poultry Association’s Broiler Organising Committee, recent years have been extremely difficult for the broiler sector, which has been under the pressures of cost rises, increased imports and a depressed domestic demand for chicken. This caused a number of long-established companies to go out of business in 2013.

Broiler slaughterings in 2013 declined by 0.4 per cent on the 951 million processed in 2012. Chicken production in 2013, including subsistence farming and depleted breeders from the broiler and layer sectors, came close to 1.7 million tonnes. On top of this, the market received some 355,000 tonnes of frozen imported broilers, pushing total consumption over two million tonnes.

No significant increase in production is anticipated in South Africa in 2014 although an improvement in the overall financial environment in the first six months of the year could give impetus to a slight increase in production during the second half of the year.

Production in Morocco slipped back by five per cent to 556,000 tonnes in 2012, having recorded a growth of more than eight per cent per year to 2011.

The chicken industry in Nigeria reported an annual growth rate of six per cent to 2011 but, like many other countries both inside and outside this region, economic pressures led to a cut-back in 2012. However, forecasts to 2021 postulate production climbing to around 400,000 tonnes a year.

Production in Algeria, Africa’s fifth largest chicken producer is 'flat', having not shown any significant signs of growth since 2003.

Chicken Production in Oceania Led by Australia and New Zealand

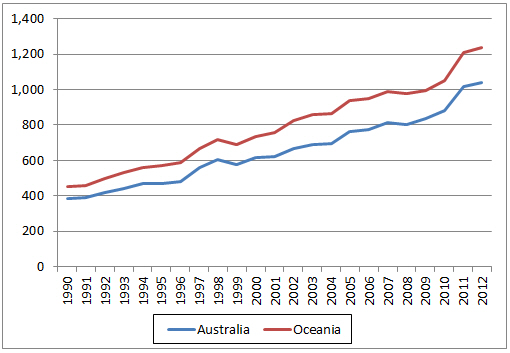

Chicken meat production in Oceania in 2012 represented some 1.3 per cent of the world total of 92.7 million tonnes. Between 2000 and 2012, output grew by 4.4 per cent per year or 68 per cent from 736,000 tonnes to 1.24 million tonnes (Table 4).

It is clear from this table and Figure 1 that the regional total is almost entirely dependent upon developments in Australia and, to a much lesser extent, New Zealand; their combined output in 2012 of 1.21 million tonnes equating with almost 98 per cent of the total for Oceania.

| Table 4. Chicken meat production in Oceania ('000 tonnes eviscerated weight) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| American Samoa | * | * | * | * | * | * | * |

| Australia | 613.6 | 760.5 | 803.7 | 834.5 | 883.2 | 1,017.5 | 1,039.7 |

| Cook Isl. | * | * | * | * | * | * | * |

| Fiji | 8.1 | 11.8 | 14.2 | 11.7 | 14.3 | 20.4 | 15.7 |

| French Polynesia | 0.5 | 0.5 | 0.5 | 0.5 | 0.4 | 0.5 | 0.5 |

| Guam | * | * | * | * | * | * | * |

| Kiribati | 0.3 | 0.5 | 0.7 | 0.7 | 0.8 | 0.8 | 0.8 |

| Micronesia Fed. St. | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

| Nauru | * | * | * | * | * | * | * |

| New Caledonia | 0.8 | 1.0 | 0.9 | 0.8 | 0.9 | 0.8 | 0.9 |

| New Zealand | 105.3 | 158.5 | 146.8 | 136.9 | 144.4 | 159.9 | 171.5 |

| Niue | * | * | * | * | * | * | * |

| Papua New Guinea | 5.4 | 5.6 | 5.8 | 5.8 | 5.8 | 5.9 | 6.0 |

| Samoa | 0.4 | 0.5 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 |

| Solomon Isl. | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 |

| Tokelau | * | * | * | * | * | * | * |

| Tonga | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 |

| Tuvalu | * | * | * | * | * | * | * |

| Vanuatu | 0.4 | 0.6 | 1.0 | 1.0 | 0.8 | 0.8 | 0.8 |

| Wallis/Futuna Isl. | * | * | * | * | * | * | * |

| OCEANIA | 735.7 | 940.4 | 975.3 | 993.4 | 1,052.1 | 1,208.1 | 1,237.4 |

| E = estimated; * less than 50 tonnes; - less than 100,000 tonnes Source FAO |

|||||||

Although on a much smaller scale, it is worth noting that output in Fiji doubled during this period to around 16,000 tonnes.

Two large integrated companies Baida and Ingham Enterprises, produce more than 70 per cent of the broilers in Australia, the balance of the market being, in the main, supplied by a handful of medium-sized privately-owned companies each producing between three and nine per cent of national output.

According to the Australian Bureau of Statistics (ABS), production in 2011/12 amounted to 1.03 million tonnes from some 565 million birds yielding an average eviscerated weight of 1.8kg. In 2010, it is assessed by the Australian Chicken Meat Federation that a 2-kg liveweight bird was produced in around 35 days with a feed conversion of 1.7:1. The corresponding figures for 2000 were 39 days and 1.84:1, respectively.

According to the Australian Bureau of Agricultural Resource Economics and Sciences (ABARES), the chicken industry has expanded by some four per cent per year over the past decade and consequently provides 25 per cent of Australia’s meat production compared to 18 per cent 10 years ago. Output in 2012/13 is put at 1.05 million tonnes.

A further three per cent expansion is envisaged for 2013/14 to 1.08 million tonnes, while a similar increase is projected for 2014/15 to 1.1 million tonnes. By 2018/19, production is forecast to reach 1.25 million tonnes, at which time, it could represent 28 per cent of Australia’s meat production.

Chicken production in New Zealand also recorded a growth of a little more than four per cent per year over the period 2000 to 2012 as output went up from 105,000 tonnes to 172,000 tonnes.

Two companies dominate the scene - Tegel Poultry (Affinity Equity Partners) and Inghams New Zealand.

November 2014