GLOBAL POULTRY TRENDS - Asia Leads Output of Duck and Goose Meat

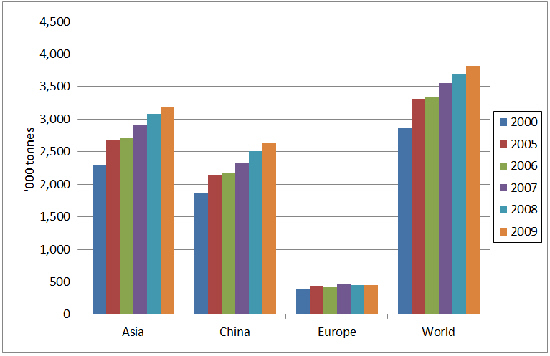

Worldwide, duck meat production increased by more than one million tonnes over the last decade and is forecast to have exceeded four million tonnes in 2010, writes poultry industry watcher, Terry Evans, while goose meat output globally is 2.5 million tonnes. Both markets are dominated by Asia, particularly China.With an annual average gain of almost 3.3 per cent, global duck meat production expanded by one million tonnes between 2000 and 2009. If this rate has been maintained since then, the four million tonnes level will have been exceeded in 2010. The bulk (84 per cent) of production takes place in Asia (table 1), this region having raised its share of the world total from just over 80 per cent in 2000 to almost 84 per cent in 2009.

Within Asia, not surprisingly, China dominates accounting for some 83 per cent of the total (up from 81 per cent in 2000) with an annual expansion rate of almost four per cent pushing output above 2.6 million tonnes in 2009. With the exception of Thailand, all of Asia's leading producers have seen their industries grow though the most spectacular have been Myanmar and Malaysia. Production in Myanmar more than doubled to 81,000 tonnes, while the industry in Malaysia grew by almost 70 per cent from 64,000 tonnes to 108,000 tonnes.

The only other region to exhibit sustained growth has been Europe, though here the annual growth rate has barely reached 1.5 per cent as output has climbed from 396,000 tonnes to 451,000 tonnes.

Although France is the biggest producer – accounting for 52 per cent of European production – its market share has declined with current output seemingly at a similar level to 10 years ago.

In contrast, the industry in Germany has doubled production over the past decade showing an annual average gain of a massive near eight per cent with output reaching nearly 63,000 tonnes in 2009.

Production in Hungary, Europe's third largest producer has stagnated in recent years, while the industry in the UK appears to have been in decline.

Little Trade in Duck Meat

World trade in fresh/frozen duck meat is small at around 150,000 tonnes a year. Difficulties in tracing the movement of duck meat on a global basis means that it is not possible to achieve a close balance between the quantities exported and imported. Nevertheless, it is clear (tables 2 and 3) that Asia and in particular China and Hong Kong are the key players in the duck meat trade.

In Europe, Hungary, Germany, the Netherlands and France are to the forefront regarding exports, while Germany, the UK and the Czech Republic are key countries with regard to imports.

It should be noted that sales and purchases of prepared duck meat are not included in these figures.

Worldwide annual per-capita duck consumption looks to be around 0.6kg; for the European Union, this figure will be nearer 1kg while in China, it will be closer to 2kg.

Goose Meat Tops 2.5 Million Tonnes

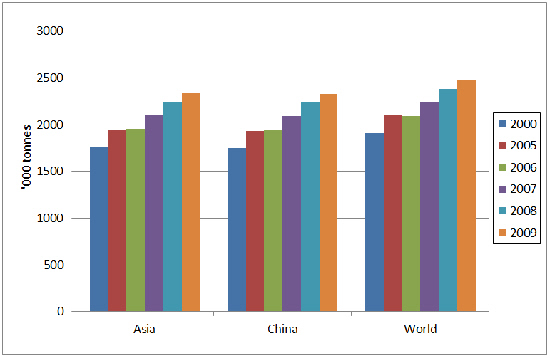

Nowadays, more than 2.5 million tonnes of goose meat are produced annually. Guinea fowl output is included in the FAOSTAT data but will contribute only a fraction to the total.

Asia is the only region in the world where goose meat production is on the increase and this is entirely due to the expansion in China where current output is considered to in the region of 2.4 million tonnes, representing some 94 per cent of world output compared with less than 92 per cent in 2000.

Just three countries – China, Poland and Hungary – account for almost 92 per cent of world goose meat exports.

Of the 16,200 tonnes exported by China in 2009, 90 per cent went to Hong Kong, while half of Hungary's shipments of 11,900 tonnes were bought by Germany with Austria taking 14 per cent.

Of the near 18,500 tonnes exported by Poland in 2009, Germany acquired some 75 per cent or nearly 14,000 tonnes.

As with duck meat, there are no figures on goose meat consumption but it would appear that the annual uptake per person worldwide averages less than 0.4kg while in China, the figure is likely to be nearer 1.7kg.

January 2012