GLOBAL POULTRY TRENDS - Chicken Continues to Gain Popularity in Asia

Relatively high meat prices will act as a brake on meat consumption in 2011, particularly in the developed economies where the recession has bitten deeply, writes Terry Evans in his overview of broiler meat consumption trends in Asia. However, on the bright side, economic growth in some developing countries may well give consumption a boost, particularly for competitively priced chicken meat.Because chickens have a better feed conversion than their competitors, higher feed prices may benefit chicken sales in developed economies as consumers switch from the more expensive meats. But, in those developing economies that have not witnessed real income growth, increases in poultry prices may cause some consumers to stop buying chicken. There are indications that the availability of feed ingredients will expand as cereal producers react to higher prices. This could help reduce the rate of food price inflation in the short term.

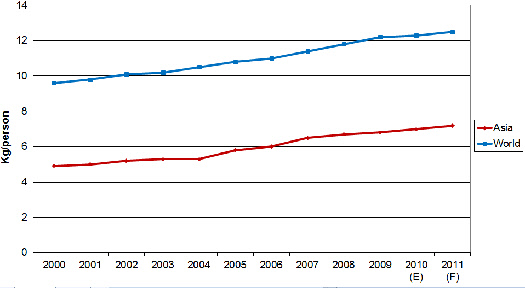

Globally in 2011, our estimates indicate that chicken uptake could show a gain from 12.3kg to 12.5kg per person, while in Asia the average eaten could reach 7.2kg as against 7.0kg for 2010.

Some 4.2 billion people live in Asia accounting for a little more than 60 per cent of the global total (table 1). According to the Food and Agriculture Organization (FAO), close to one billion people globally were undernourished in 2010, despite an anticipated decline (the first in 15 years) largely attributable to a more favourable economic environment, particularly in developing countries and a fall in food prices. That food prices are now increasing again will make life much more difficult for the poorer members of societies.

Some 98 per cent of the undernourished live in developing countries and some 62 per cent are found in Asia and the Pacific, with over 40 per cent living in China and India.

Rising real incomes and population growth boost the demand for meat and poultry products in particular. There are no direct measurements of consumption the published data being derived from estimates of available supplies divided by estimates of the population. As these calculations provide so much room for errors, it can be argued that in general terms, it is almost pointless expressing consumption data in fractions of a kilogram, which is why the estimates for chicken uptake shown in table 1 are to the nearest whole kilogram. These figures, calculated by the USDA, are only available for a relatively few countries. A more comprehensive coverage is provided by the FAO but these figures relate to the uptake of poultry meat and not chicken consumption, though in many instances these are the same figures, where the quantities of other poultry eaten are negligible. In fact, the FAO calculates the figures to the second decimal place but, as indicated earlier, measuring consumption to this degree is seldom meaningful. However, in a country where the human population is large, real as distinct from theoretical, increases in uptake of even 0.1kg can translate into sizeable quantities of poultry meat. For example a 0.1kg rise in China would equate with an increase in consumption of 140,000 tonnes of chicken!

During 2010, China is estimated to have produced 12.6 million tonnes of chicken meat. Imports, including paws, exceeded 830,000 tonnes, while exports amounted to some 412,000 tonnes. These figures point to an estimated consumption of around 9.5kg per person per year, which is projected to reach a record 10kg this year.

Greater efficiency in converting feed to food means that although prices for all meats have increased, chicken has at least maintained its competitive position. The bulk of retail sales in China are paws, wings and legs, as domestic households consider breast meat to be rather tasteless, according to a USDA Gain report. The breast meat is mainly consumed in restaurants.

Assuming that the data for chicken meat production in India, as presented by the USDA is correct, consumption currently stands at 2.2kg per person per year although we have seen calculations indicating that the total uptake could be as high as 3.2 million tonnes pointing to an average consumption of around 2.6kg per person per year. But, as some 40 per cent of the population is considered to be vegetarian, it can be argued that, of those Indians who do eat meat, the average uptake is nearer 3.7kg, based on the lower estimate of production or as high as 4.4kg based on the higher figure. Indians prefer fresh chicken bought from the so-called 'wet' markets, believing them to have a better taste and texture. In the last 10 years or so, India's GDP per person doubled and it is expected to double again in less than another decade. This economic growth will be the driver for many changes in India's poultry industry and particularly in the demand for chicken.

In Japan, the state of the economy has had a major impact on a chicken market where leg meat is preferred to breast meat. Deflation and a relatively high level of unemployment is likely to limit consumer spending in the near future though it is felt that, in contrast to the beef and pork markets, chicken demand will benefit from the spending actions of price and value conscious consumers.

Domestic chicken consumption in Thailand is expected to grow some five per cent this year as, according to a USDA Gain report, chicken remains the most popular and affordable meat. Demand will also benefit from population growth and more importantly from a GDP increase projected at between 6.5 per cent and 7.5 per cent. An expansion in demand is also anticipated in response to the promotions of ready-to-eat chicken by fast food restaurants and also food processors. This ready-to-eat market is expected to expand by 10 to 15 per cent a year over the next five years.

Although production in the Republic of Korea has again been hit by outbreaks of H5N1 highly pathogenic avian influenza (HPAI), chicken consumption has risen in response to a shortage of pork, high red meat prices and fears about radiation-contaminated seafood from Japan, according to the USDA's Foreign Agriculture Service. Dietary patterns are changing as a result of rising incomes and an increase in healthy eating. Also, mandatory country-of-origin labelling (COOL) in restaurants appears to have given the consumption of domestic chicken a boost. That these COOL labelling requirements have now been extended to include the fast-food delivery business should also give a fillip to domestic chicken meat sales.

Only Saudi Arabia and Iran possess larger oil reserves than Iraq, where oil exports are expected to be the key to the growth of this country's economy. A massive boost to the per capita GDP has rapidly expanded the uptake of chicken to the current estimate of around 18kg/person compared with only 10kg just a few years ago. Not only will real incomes continue to rise, but also the population (currently of around 30 million) is expected to exceed 50 million by 2035, contributing to significant further increases in the quantities of chicken consumed.

In Malaysia, there are no dietary or religious restrictions on chicken meat eating. Also, as in most other countries, chicken is considered to be the cheapest form of meat protein. Again it is seen that the growth of the food service sector has given an impetus to chicken consumption.

October 2011