GLOBAL POULTRY TRENDS - Strong Growth in Egg Output Recorded in Africa and Oceania

Egg production in African countries has been increasing faster than the global rate, with Nigeria leading the league table of egg producers, reports industry analyst Terry Evans, while Australia continues to lead the field in Oceania.Africa Increases Its Global Egg Share

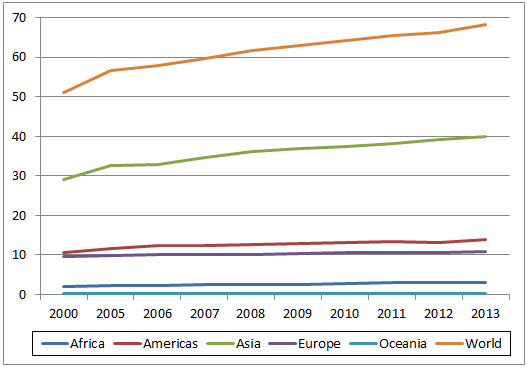

Egg production in Africa expanded by 3.8 per cent per year between 2000 and 2013. As this far exceeded the global growth rate of 2.3 per cent, Africa’s share of world output increased from 3.7 per cent to 4.5 per cent. In volume terms, production in Africa rose from 1.9 million tonnes to 3.1 million tonnes over this period (Table 1 and Figure 1).

| Table 1. World egg production (million tonnes) | ||||||||||

| Region | 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|

| Africa | 1.9 | 2.2 | 2.3 | 2.5 | 2.6 | 2.5 | 2.8 | 2.9 | 3.0 | 3.1 |

| Americas | 10.5 | 11.7 | 12.3 | 12.3 | 12.5 | 12.9 | 13.1 | 13.5 | 13.2 | 14.0 |

| Asia | 29.0 | 32.6 | 32.9 | 34.5 | 36.2 | 37.0 | 37.5 | 38.1 | 39.2 | 40.0 |

| Europe | 9.5 | 9.9 | 10.1 | 10.1 | 10.2 | 10.3 | 10.5 | 10.7 | 10.6 | 10.9 |

| Oceania | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 |

| WORLD | 51.1 | 56.6 | 57.9 | 59.6 | 61.8 | 62.9 | 64.2 | 65.4 | 66.3 | 68.3 |

| Totals may not add up due to rounding Source FAO |

||||||||||

Over the 13 years, the Americas recorded a growth rate of 2.2 per cent per year, while Asia returned 2.5 per cent. In stark contrast to the other regions, Europe’s egg industry expanded by only a shade over one per cent per year. With world egg output likely to reach 71.5 million tonnes this year, production in Africa could amount to some 3.3 million tonnes.

The individual country figures, which include hatching eggs, are presented in Tables 2 and 3. As in the other major regions, the bulk of production is accounted for by only a handful of countries.

| Table 2. Hen egg production in Africa ('000 tonnes) | |||||||

| Country | 2000 | 2005 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|

| Algeria | 101.0 | 175.0 | 193.6 | 260.5 | 279.7 | 309.0 | 347.3 |

| Angola | 4.3 | 5.2 | 4.9 | 5.0 | 5.0 | 5.0 | 5.1 |

| Benin | 7.2 | 7.2 | 11.1 | 9.9 | 10.7 | 11.6 | 12.5 |

| Botswana | 3.2 | 4.2 | 4.3 | 4.5 | 4.5 | 4.6 | 4.7 |

| Burkina Faso | 39.4 | 45.1 | 54.3 | 57.8 | 58.8 | 59.5 | 60.0 |

| Burundi | 3.0 | 3.1 | 3.1 | 3.0 | 3.1 | 3.1 | 3.2 |

| Cameroon | 13.0 | 13.4 | 14.9 | 15.0 | 15.0 | 15.5 | 16.0 |

| Cabo Verde | 1.9 | 1.8 | 2.1 | 2.2 | 2.2 | 2.2 | 2.3 |

| Central African Rep. | 2.1 | 2.2 | 2.7 | 3.1 | 3.2 | 2.5 | 2.6 |

| Chad | 3.6 | 3.7 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 |

| Comoros | 0.8 | 0.8 | 0.8 | 0.8 | 0.9 | 0.9 | 0.9 |

| Congo | 1.1 | 1.3 | 1.6 | 1.6 | 1.6 | 1.6 | 1.7 |

| Cote d'Ivoire | 33.0 | 28.7 | 30.0 | 32.0 | 33.0 | 40.4 | 46.0 |

| Dem. Rep. Congo | 7.0 | 6.9 | 8.7 | 8.9 | 9.0 | 9.0 | 9.0 |

| Egypt | 176.7 | 235.0 | 249.3 | 291.2 | 305.5 | 310.0 | 315.0 |

| Equatorial Guinea | 0.3 | 0.4 | 0.4 | 0.4 | 0.4 | 0.5 | 0.5 |

| Eritrea | 1.7 | 2.0 | 2.0 | 2.2 | 2.2 | 2.3 | 2.3 |

| Ethiopia | 28.6 | 35.0 | 39.0 | 39.0 | 39.6 | 40.0 | 41.0 |

| Gabon | 2.6 | 2.6 | 2.3 | 2.4 | 2.4 | 2.5 | 2.5 |

| Gambia | 0.7 | 0.8 | 0.9 | 0.9 | 0.9 | 1.0 | 1.0 |

| Ghana | 21.7 | 25.2 | 36.7 | 36.7 | 39.8 | 40.0 | 42.0 |

| Guinea | 12.2 | 18.6 | 23.5 | 23.6 | 24.5 | 24.5 | 24.5 |

| Guinea-Bissau | 1.0 | 1.1 | 1.3 | 1.3 | 1.4 | 1.4 | 1.4 |

| Kenya | 60.7 | 57.9 | 81.0 | 92.6 | 94.4 | 96.1 | 98.0 |

| Lesotho | 1.5 | 1.6 | 1.7 | 1.7 | 1.7 | 1.7 | 1.7 |

| Liberia | 4.2 | 4.6 | 5.0 | 5.2 | 5.4 | 5.5 | 5.0 |

| Libya | 60.0 | 63.1 | 62.2 | 62.5 | 63.0 | 63.6 | 60.0 |

| Madagascar | 14.9 | 15.1 | 16.2 | 16.1 | 16.6 | 17.0 | 17.0 |

| Malawi | 19.5 | 20.2 | 20.3 | 20.7 | 21.1 | 21.5 | 23.0 |

| Mali | 11.9 | 11.7 | 23.5 | 23.9 | 23.4 | 22.0 | 24.2 |

| Mauritania | 4.7 | 4.3 | 5.6 | 5.4 | 5.5 | 5.6 | 5.8 |

| Mauritius | 12.5 | 13.0 | 10.0 | 10.0 | 10.5 | 11.2 | 11.8 |

| Morocco | 235.0 | 232.0 | 200.0 | 244.0 | 265.0 | 272.0 | 278.0 |

| Mozambique | 1.7 | 9.8 | 21.9 | 27.1 | 35.0 | 46.9 | 45.0 |

| Namibia | 1.6 | 3.0 | 3.3 | 3.4 | 3.4 | 3.4 | 3.5 |

| Niger | 7.8 | 8.3 | 8.5 | 7.5 | 7.9 | 8.3 | 8.7 |

| Nigeria | 400.0 | 500.4 | 612.6 | 623.4 | 636.0 | 640.0 | 650.0 |

| Reunion | 5.1 | 6.0 | 5.9 | 6.7 | 6.7 | 7.0 | 7.0 |

| Rwanda | 2.2 | 2.7 | 2.9 | 2.9 | 2.9 | 3.0 | 3.0 |

| Sao Tome/Principe | 0.4 | 0.5 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 |

| Senegal | 10.4 | 20.2 | 26.6 | 27.4 | 28.9 | 27.4 | 26.0 |

| Seychelles | 2.2 | 1.2 | 1.3 | 1.1 | 1.3 | 1.4 | 1.4 |

| Sierra Leone | 4.6 | 3.7 | 9.9 | 10.8 | 12.0 | 12.0 | 12.0 |

| Somalia | 2.5 | 2.7 | 2.1 | 2.4 | 2.4 | 2.4 | 2.4 |

| South Africa | 318.0 | 365.5 | 450.0 | 473.0 | 511.0 | 535.0 | 540.0 |

| Sudan (former) | 34.0 | 30.0 | 32.0 | 35.0 | 38.0 | 38.5 | 38.5 |

| Swaziland | 1.1 | 1.3 | 1.1 | 1.2 | 1.2 | 1.2 | 1.2 |

| Togo | 6.3 | 8.0 | 9.3 | 9.3 | 9.3 | 9.5 | 10.0 |

| Tunisia | 82.0 | 84.0 | 88.0 | 92.0 | 92.6 | 97.7 | 98.5 |

| Uganda | 20.4 | 22.0 | 42.1 | 43.4 | 44.7 | 46.0 | 47.0 |

| United Rep. Tanzania | 33.8 | 36.3 | 31.2 | 32.5 | 32.5 | 33.3 | 33.3 |

| Zambia | 39.2 | 42.3 | 45.0 | 49.5 | 54.0 | 55.0 | 55.0 |

| Zimbabwe | 22.0 | 25.9 | 29.8 | 29.8 | 29.8 | 29.8 | 29.8 |

| AFRICA | 1,885.9 | 2,216.1 | 2,540.4 | 2,766.7 | 2,903.9 | 3,005.2 | 3,082.4 |

| WORLD | 51,045.9 | 56,615.7 | 62,896.9 | 64,162.2 | 65,367.1 | 66,293.5 | 68,262.5 |

| P provisional, - no data Countries producing less than 50 tonnes have been excluded Source FAO |

|||||||

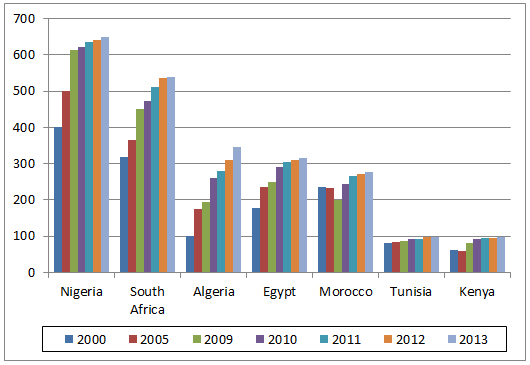

It is evident from Table 3 that the leading seven countries – Nigeria, South Africa, Algeria, Egypt, Morocco, Tunisia and Kenya – have a combined output of 2.3 million tonnes or more than three-quarters of the regional total. Some 22 of the 53 countries in the region produce less than 5,000 tonnes of eggs a year. Nevertheless, with the exceptions of Gabon, Somalia and the United Republic of Tanzania, all the industries recorded growth over the past decade or so.

Of particular note is that Uganda more than doubled its output with growth averaging above six per cent per year, while both Ghana and Guinea recorded average annual increases of more than five per cent.

| Table 3. Egg production ranking in Africa in 2013 ('000 tonnes) |

|||||||||||

| Country | Production | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Nigeria | 650.0 | ||||||||||

| South Africa | 540.0 | ||||||||||

| Algeria | 347.3 | ||||||||||

| Egypt | 315.0 | ||||||||||

| Morocco | 278.0 | ||||||||||

| Tunisia | 98.5 | ||||||||||

| Kenya | 98.0 | ||||||||||

| Burkina Faso | 60.0 | ||||||||||

| Libya | 60.0 | ||||||||||

| Zambia | 55.0 | ||||||||||

| Uganda | 47.0 | ||||||||||

| Cote d'Ivoire | 46.0 | ||||||||||

| Mozambique | 45.0 | ||||||||||

| Ghana | 42.0 | ||||||||||

| Ethiopia | 41.0 | ||||||||||

| Sudan (former) | 38.5 | ||||||||||

| United Rep. Tanzania | 33.3 | ||||||||||

| Zimbabwe | 29.8 | ||||||||||

| Senegal | 26.0 | ||||||||||

| Guinea | 24.5 | ||||||||||

| Mali | 24.2 | ||||||||||

| Malawi | 23.0 | ||||||||||

| Madagascar | 17.0 | ||||||||||

| Cameroon | 16.0 | ||||||||||

| Benin | 12.5 | ||||||||||

| Sierra Leone | 12.0 | ||||||||||

| Mauritius | 11.8 | ||||||||||

| Togo | 10.0 | ||||||||||

| Dem. Rep. Congo | 9.0 | ||||||||||

| Niger | 8.7 | ||||||||||

| Reunion | 7.0 | ||||||||||

| Mauritania | 5.8 | ||||||||||

| Angola | 5.1 | ||||||||||

| Liberia | 5.0 | ||||||||||

| Botswana | 4.7 | ||||||||||

| Chad | 4.0 | ||||||||||

| Namibia | 3.5 | ||||||||||

| Burundi | 3.2 | ||||||||||

| Rwanda | 3.0 | ||||||||||

| Central African Rep. | 2.6 | ||||||||||

| Gabon | 2.5 | ||||||||||

| Somalia | 2.4 | ||||||||||

| Cabo Verde | 2.3 | ||||||||||

| Eritrea | 2.3 | ||||||||||

| Congo | 1.7 | ||||||||||

| Lesotho | 1.7 | ||||||||||

| Guinea-Bissau | 1.4 | ||||||||||

| Seychelles | 1.4 | ||||||||||

| Swaziland | 1.2 | ||||||||||

| Gambia | 1.0 | ||||||||||

| Comoros | 0.9 | ||||||||||

| Sao Tome/Principe | 0.6 | ||||||||||

| Equatorial Guinea | 0.5 | ||||||||||

| Source FAO | |||||||||||

Nigeria is the largest egg producer output having recorded a near four per cent per year gain to reach 650,000 tonnes in 2013 (Tables 2, 3, 4 and Figure 2) although data from another source points to an annual figure closer to 700,000 tonnes.

A recent research study by the Department of Agricultural Economics, Extension and Rural Development at Imo State University has recommended that there is a great need to: improve producers’ access to credit; encourage producers to form co-operatives; subsidise certain inputs; improve infrastructure facilities, especially roads which would reduce spoilage, shorten the chain of distribution and reduce transport costs.

| Table 4. Leading egg producing countries in Africa ('000 tonnes) | ||||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|

| Nigeria | 400 | 500 | 581 | 613 | 623 | 636 | 640 | 650 |

| South Africa | 318 | 366 | 473 | 450 | 473 | 511 | 535 | 540 |

| Algeria | 101 | 175 | 184 | 194 | 261 | 280 | 309 | 347 |

| Egypt | 177 | 235 | 356 | 249 | 291 | 306 | 310 | 315 |

| Morocco | 235 | 232 | 192 | 200 | 244 | 265 | 272 | 278 |

| Tunisia | 82 | 84 | 89 | 88 | 92 | 93 | 98 | 99 |

| Kenya | 61 | 58 | 77 | 81 | 93 | 94 | 96 | 98 |

| Source FAO | ||||||||

During the review period, the egg industry in South Africa expanded by more than four per cent per year. Data provided by the South African Poultry Association, based on specific production standards and a forecasting model, indicate that, having reached a record 25 million layers in 2012, the number contracted to 24.4 million in 2013 and further to 23.5 million in 2014 as a result of the impact of higher input costs and a weaker domestic market demand. However, this year is witnessing a recovery with the latest forecast to June 2015 of 24.7 million birds.

In terms of egg output, the 2012 record average was 412,100 cases per week. Following the trend in layer numbers, this figure contracted to 387,000 cases in 2014, while the latest forecast stands at 409,000 cases per week for 2015. South Africa’s representative at the International Egg Commission (IEC) considers that egg output in 2013 contracted to 428,000 tonnes from 439,000 tonnes in 2012.

Fastest growing industry among the top seven producers is Algeria which has returned a massive near 10 per cent per year expansion as output increased from 101,000 tonnes in 2000 to 347,000 tonnes in 2013. In doing so Algeria displaced Egypt as the third largest producer.

High feed prices and the banning of the transportation of poultry between Governorates led to a cut-back in egg production in Egypt from the 2008 record of 356,000 tonnes (Table 4). However, while a good recovery has become evident since 2009 annual output has still not reached the 2008 level.

Egg production in Morocco declined between 2000 and 2009, but has since recorded rapid growth of almost 9 per cent per year to reach 278,000 tonnes in 2013.

Growth in Tunisia at 1.5 per cent per year has been much slower than the 3.7 per cent achieved by Kenya such that by now, annual production in Kenya could well have surpassed that in Tunisia.

Rising Egg Production in Oceania

Egg production in Oceania primarily reflects developments in Australia and, to a lesser extent, New Zealand.

That output in the region as a whole grew by 3.6 per cent per year between 2000 and 2013 is hardly surprising when the picture for Australia reveals an increase of 4.1 per cent per year.

According to FAO figures, production in Australia amounted to 241,000 tonnes in 2013 (Table 5). The flock of around 16.5 million birds is found on some 270 farms. Some 68 per cent of the birds are kept in cages with 25 per cent on free range and seven per cent in barn systems.

Although the FAO data, which incidentally includes hatching eggs for both layers and broilers, points to a large increase in egg output in 2013, data provided by the Australian Egg Corporation Ltd (AECL) indicates little change in production between 2013 and 2014 at around 397 million dozen, though the value of sales in 2004 was considerably higher.

Australia’s representative at the International Egg Commission reports that egg output in 2013 amounted to some 288,000 tonnes against 290,000 tonnes in 2012. The industry is considered to be mature hence future growth, at around 2.6 per cent per year to 2019-20, is not envisaged to be as large as in the recent past.

In New Zealand, the increase in production averaged less than two per cent per year to 2013, but since 2009 growth has slowed to around one per cent. There are only 120 or so flocks totalling around 3.3 million birds.

Some 82 per cent are currently housed in conventional cages but these will have to be phased out by 2022 and will likely be mainly replaced by colony cages. About 15 per cent of the flock is currently on free range with three per cent in barns.

| Table 5. Hen egg production in Oceania ('000 tonnes) | |||||||

| Country | 2000 | 2005 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|

| Australia | 143.0 | 138.6 | 159.3 | 174.0 | 205.2 | 214.7 | 240.9 |

| Fiji | 3.2 | 3.8 | 3.5 | 5.7 | 5.5 | 6.0 | 6.0 |

| French Polynesia | 1.4 | 2.4 | 2.7 | 2.8 | 2.7 | 2.8 | 2.9 |

| Guam | 0.8 | 0.8 | 0.8 | 0.9 | 0.9 | 0.9 | 0.9 |

| Kiribati | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.4 | 0.4 |

| Micronesia | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| New Caledonia | 1.5 | 1.7 | 1.7 | 1.8 | 1.7 | 2.1 | 2.0 |

| New Zealand | 43.0 | 50.9 | 51.8 | 52.3 | 51.1 | 53.5 | 54.0 |

| Papua New Guinea | 4.5 | 4.8 | 4.8 | 5.0 | 5.1 | 5.3 | 5.3 |

| Samoa | 0.3 | 0.3 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 |

| Solomon Isl. | 0.4 | 0.5 | 0.6 | 0.7 | 0.7 | 0.7 | 0.7 |

| Tonga | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 |

| Vanuatu | 0.3 | 0.4 | 0.8 | 0.6 | 0.7 | 0.7 | 0.7 |

| OCEANIA | 199.4 | 205.3 | 227.4 | 245.1 | 274.9 | 287.9 | 314.7 |

| WORLD | 51,045.9 | 56,615.7 | 62,896.9 | 64,162.2 | 65,367.1 | 66,293.5 | 68,262.5 |

| P = provisional; - no data Countries producing less than 50 tonnes have been excluded Source FAO |

|||||||

July 2015