GLOBAL POULTRY TRENDS: Turkey Meat Trade Flat

There has been little change in the volume of turkey meat traded around the world in the first decade of the century, according to industry watcher, Terry Evans.To say that the global trade in turkey meat is unexciting would be an understatement as the total quantities of fresh/frozen product exported between 2000 and 2010, according to FAO data, showed little movement around an annual average of some 900,000 tonnes (Table 1).

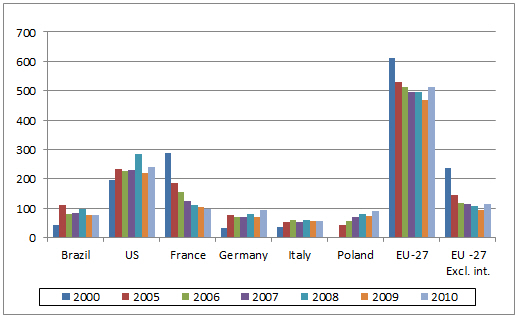

During this period, EU exports contracted from 611,000 tonnes to 470,000 tonnes in 2009 recovering to 513,000 tonnes in 2010. But, if trade between fellow EU countries is excluded, third-country exports fall from 238,000 tonnes a year in 2000 to 114,000 tonnes in 2010 (Table 1 and Figure 1). So, in broad terms, if only EU business with third countries is included, the global total exports average between 500,000 tonnes and 600,000 tonnes a year.

The data for individual countries reveals that a massive reduction has occurred in France's exports of fresh/frozen turkey meat from 287,000 tonnes in 2000 to only 97,000 tonnes in 2010. This primarily reflects the cut-back that has occurred in production. Exports from the Netherlands in 2010 were half the 2000 level. Of particular note is how Poland has been much more active in this trade since joining the European Community in 2004 with sales in 2010 close to 90,000 tonnes of which nearly 39,000 tonnes were purchased by West Germany. Since 2010, EU exports of all forms of turkey meat (fresh, chilled, frozen and processed) to third countries are considered to have increased from 134,000 tonnes to 150,000 tonnes in 2012.

The leading exporter of turkey meat is the US with the latest estimates amounting to 319,000 tonnes in 2011, rising to 336,000 tonnes in 2012 although for 2013, a reduction is foreseen to around 313,000 tonnes. Forecasts indicate no significant increases in sales with the most optimistic estimate for 2021 by America's Food and Agricultural Policy Research Institute (FAPRI) stands at just 332,000 tonnes. Over the first six months of 2012, cumulative exports climbed 11 per cent to nearly 166,000 tonnes. Sales to Mexico went up by five per cent to almost 90,000 tonnes although shipments to China, America's second most important market, actually contracted by 16 per cent to a little above 18,000 tonnes. Of the total exported, 78 per cent or 129,000 tonnes were bought by just five countries - Mexico, China, Hong Kong, Canada and the Philippines. Mexico alone accounted for 54 per cent.

Brazil is the second largest exporter of turkey meat behind the USA, the total for 2011 being assessed at 140,000 tonnes and one forecast sees this figure rising towards 155,000 tonnes in 2012 and further to 160,000 tonnes in 2013. The first half of 2012 witnessed a large nearly 13,700 tonnes (21 per cent) increase in the trade to 78,000 tonnes. This gain was primarily due to increased sales to the EU of some 5,400 tonnes to more than 39,000 tonnes, an extra 3,900 tonnes to South Africa at 9,300 tonnes and 3,900 tonnes more to Benin taking 8,700 tonnes. If this trend is maintained, total exports in 2012 could approach 170,000 tonnes. However, it remains to be seen how the increase in feed costs will impact on production in 2013, while also it is generally considered that exports to the EU will decline, in which case, the upward trend in exports may well be halted.

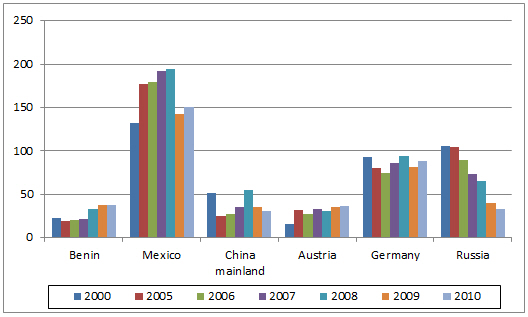

Mexico is easily the leading turkey meat importer (Table 2 and Figure 2) with peak receipts of fresh/frozen products almost reaching 195,000 tonnes in 2008. After a sharp drop in purchases in 2009, imports have increased annually and are expected to amount to some 164,000 tonnes in 2012. According to a recent US GAIN report, mechanically deboned meat both chilled (69 per cent) and frozen (19 per cent) tend to comprise 88 per cent of total imports, while whole birds represent 11 per cent, with one per cent being smoked turkey.

Excluding intra-Community trade, the quantity of fresh/frozen turkey meat imported into the EU between 2006 and 2010 has been small at less than 23,000 tonnes a year (Table 2) although this trade in all forms of turkey meat is currently put at around 90,000 tonnes.

Ten years ago, the Russian Federation imported almost 165,000 tonnes of fresh/frozen turkey meat but this quantity has since declined sharply and is considered to have amounted to just 30,000 tonnes in 2012 while one forecast for 2013 puts it at only 20,000 tonnes.

In 2011, South Africa bought 24,200 tonnes of turkey meat, five per cent less than in the previous year. However, in the first quarter of 2012, purchases jumped by 17 per cent to more than 7,000 tonnes.

December 2012