GLOBAL POULTRY TRENDS: World Egg Production Sets a Record Despite Slower Growth

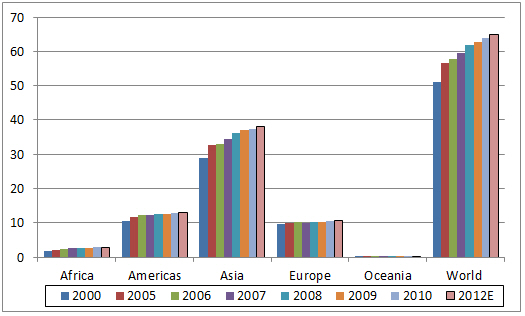

World egg production will likely reach a record 65.5 million tonnes in 2013 despite the rate of growth having slowed, writes Terry Evans, industry watcher. Twenty per cent of all eggs are produced in the Americas.Between 2000 and 2010, global egg output expanded by more than two per cent a year from 51 million tonnes to 63.8 million tonnes (Table 1). However since then, the annual increase appears to have barely averaged one per cent and bearing in mind the continued pressure on production costs and on consumer purse-strings, it seems likely that future growth will be nearer one than two per cent.

In most instances, the production figures relate to the output of all hen eggs including hatching eggs for both the layer and table chicken flocks. Globally, it is considered that hatching eggs represent about five per cent of the total although for individual countries, the proportion of hatching eggs varies greatly depending on the size of the meat chicken industry. Consequently, in some instances, the proportion of hatching eggs in the total will be small but, at the other extreme - for example, in the US and Brazil where hatching eggs represent between 12 per cent and 15 per cent of total egg output, respectively.

Annual rates of growth vary between the regions (Table 1 and Figure 1). While the increase worldwide between 2000 and 2010 averaged 2.3 per cent a year, Africa recorded an average annual expansion of 3.7 per cent. Asia managed an annual growth of 2.6 per cent, while the Americas and Oceania each notched up an increase of a shade over two per cent. Expansion was slowest in Europe with a gain of only 1.1 per cent a year.

As a result of these differences, Africa managed to increase its share of the global total from 3.8 per cent to 4.3 per cent. The contribution from the Americas has eased back a little from 20.4 per cent to 20.1 per cent, while Asia has increased its share from 56.9 per cent to 58.7 per cent. Europe's share contracted from 18.6 per cent to 16.5 per cent. If hatching eggs were deducted from the output figures, the percentages would change a little but it would not alter the general view of an increase in production and market share in Asia and Africa, stagnant growth at best in the Americas and a reduction in Europe.

With regard to layer numbers, the Food and Agriculture (FAO) estimates that in 2010 there were almost 6,556 million layers worldwide, of which, 509 million were in Africa, 1,053 million in the Americas, 4,211 million in Asia, 765 million in Europe and some 18 million in Oceania.

The Americas Produces One-Fifth of All Eggs

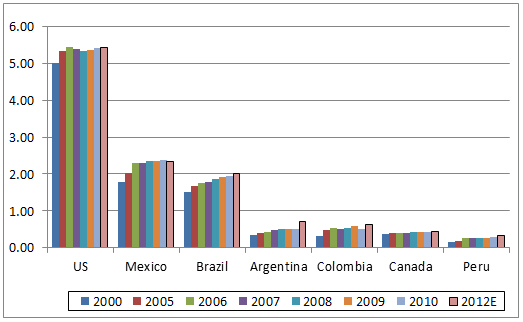

The region of the Americas produces almost 20 per cent of all eggs. However, industry growth since 2005 has not matched that achieved in Asia hence the Americas' share of the global total has slipped a little from 20.7 per cent in 2005 to an estimated 19.9 per cent in 2012. As in all the regions, only a handful of countries account for the bulk of production.

In the Americas in 2010, just five countries - the US, Mexico, Brazil, Columbia and Argentina - produced some 10.8 million tonnes of eggs or 84 per cent of the regional total (Tables 2 and 3) although as mentioned earlier, in both the US and Brazil, a significant proportion of the total will be hatching eggs for the table chicken industry.

Growth rates within the region show marked differences. In the US, the leading producer by far, production between 2000 and 2010 increased by less than one per cent a year in contrast to gains of between 2.6 per cent and 2.9 per cent in Brazil and Mexico. The industries in the next two countries in the production league table, Columbia and Argentina, expanded by some 4.7 per cent and 4.4 per cent a year respectively. So, while Mexico, Brazil, Columbia and Argentina increased their shares of the regional total, the USA's contribution actually declined from 48 per cent to almost 42 per cent between 2000 and 2010.

Canada's egg industry has expanded by about 1.5 per cent a year. Production in Peru actually increased by almost six per cent a year but from a low base of just over 160,000 tonnes in 2000 (Table 2).

Egg production in the US is expressed in millions of dozens, the total having risen from 7,630 million dozen in 2010 to 7,655 million dozen in 2011, with the latest estimate for 2012 at 7,700 million dozen but forecast for 2013 points to a fall of one per cent to around 7,610 million dozen. Hatching eggs represent around 12 per cent of these totals. In volume terms, the quantity of table eggs produced is around 4.7 and 4.8 million tonnes, with some 93 per cent being considered to be white-shelled eggs.

The five largest egg producing States - Iowa (with 52.3 million layers), Ohio (26.9 million), Pennsylvania (24.4 million), Indiana (22.8 million) and California (18.9 million) represent around 50 per cent of all US layers. Currently some 87 per cent of total production is in the hands of 61 companies, each owning more than one million birds, 16 of which have over five million.

Some 94 per cent of output comes from conventional cages but an agreement between United Egg Producers (who represent some 80 per cent of US egg production) and the Humane Society of the United States (HSUS) will result in the industry moving from what is primarily a conventional cage production business to enriched colony housing giving 124 square inches or 800 square centimetres per white layer and 144 square inches or 929 square centimetres for brown-egg birds by the end of 2029.

According to Maro Ibarburu-Blanc, an economist at the Egg Industry Center, quoted in Egg Industry, the trend towards larger layer farms with in-line egg packing, and greater industry consolidation will continue as the move towards enriched colony production systems will increase both capital and feed costs. There will likely be a regional shift towards the southern States, as it is anticipated that supplemental heating may be required in houses in parts of the Mid- and north-west in winter to maintain the optimum temperature for bird performance, as bird density will be lower in the enriched colonies than in conventional cages. The view is that medium-sized farms with fewer than one million birds will either get bigger or cease production, while the really small farms could stay in business as niche marketers.

USDA long-term projections foresee growth in US production but at less than one per cent a year as total output rises from 7,607 million dozen in 2013 to 8,043 million dozen in 2021.

The egg industry in Mexico managed to expand by more than three per cent a year in the decade to 2010 during which time, annual output rose from 1.79 million tonnes to 2.48 million tonnes, according to the Union Nacional de Avicultores. In 2011, the gain was not quite as rapid at 2.5 per cent output rising to 2.54 million tonnes, despite higher production costs. However, the Los Altos region of the Jalisco State was hit by an outbreak of H7N3 avian influenza in June 2012 that resulted in the loss of some 22 million layers, which represented some 15 per cent of the country's egg production. Jalisco produces 55 per cent of Mexico's table eggs, the majority coming from the Los Altos region, the only area affected by the outbreak. As a result, the upward trend in annual production will have been reversed in 2012 to less than 2.4 million tonnes. At the time of writing, a recovery was underway. The ratio of white to brown eggs is put at 95:5.

Although, according to the FAO, egg output in Brazil (commercial, plus backyard and hatching) is almost two million tonnes a year, possibly 15 per cent or more of the total are hatching eggs, which would put the estimate of table eggs at around 1.7 million tonnes. Egg consumption currently is some 8.5kg per person and year, which is below the average for the Americas. However, with a human population currently estimated at 200 million, even a tiny increase in uptake per person will require a significant increase in the quantity of eggs produced to meet the additional demand. As in most other countries, while the difficult financial climate will likely apply a brake to the rate of growth, the upward trend in output should continue. White-shelled eggs represent approximately 75 per cent of the total.

Argentina and Columbia are neck and neck in the race to capture the fourth place in the production league (Table 4). The data presented by the FAO for the period 2000 to 2010 (Table 2) indicates that Columbia's industry was marginally the larger of the two. However, the opposite picture is indicated by more recent figures published by the International Egg Commission (IEC), which puts egg output in 2011 in Argentina at 721,000 tonnes compared with 640,000 tonnes in Columbia. But, the average egg weight in Argentina was assessed at 63.5g, despite the brown to white egg ratio being put at 42 to 58, while the average egg weight in Colombia was estimated to be just 60g. Should the average egg weight for Colombia be understated, Argentina would still have the edge but the difference between the two countries would be much closer. The long-term outlook for both these countries has to be for continued growth.

While Canada might reasonably expect future growth to average more than one per cent a year, the gap between its output and that of the fifth-largest producer in the region, Peru, will continue to close, especially if Peru can maintain its much faster annual growth rate. While production in Peru is almost entirely brown-shelled, almost the opposite is true in Canada where the white to brown egg ratio is 90 to 10.

January 2013