Grain bear market helps the world poultry industry

Broiler Economics seriesPart of Series:

< Previous Article in Series

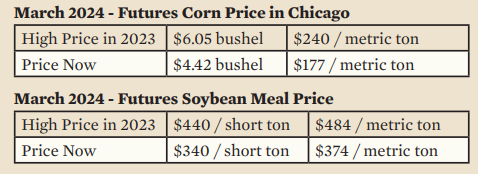

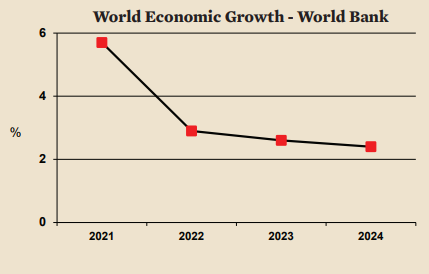

Corn and soybean meal prices are currently in a ferocious bear market. Ample world supplies combined with slow growth in demand is resulting in a windfall for the poultry industry. It is certainly not good news for grain producers, but it is great news for the poultry industry.

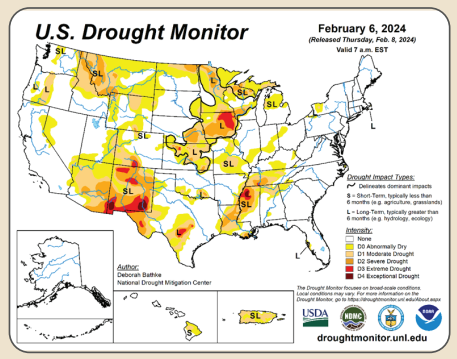

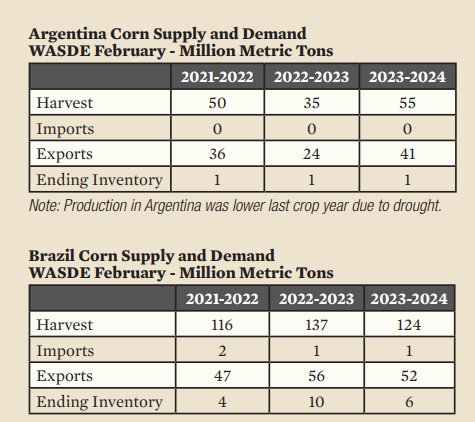

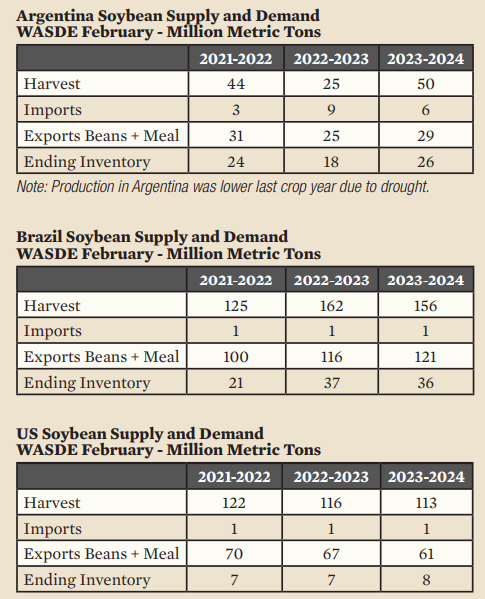

Of course, the low-price party can be ruined by a drought in one or more of the important growing areas. Argentina had a severe drought last year which affected production, but Brazil made up for the shortfall. This year, Argentina had better but not perfect weather while Brazil had worse weather. The combined total production of the two countries continues to grow, up 6 MMT last crop year and up 7 MMT this crop year. The US flirted with a drought last year but managed a good harvest. It is too early to tell about this year, but the drought monitor below shows some parts of the Corn Belt in various stages of drought.

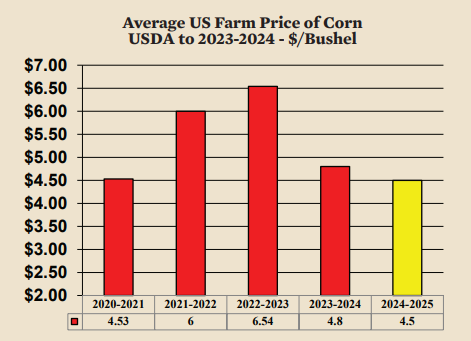

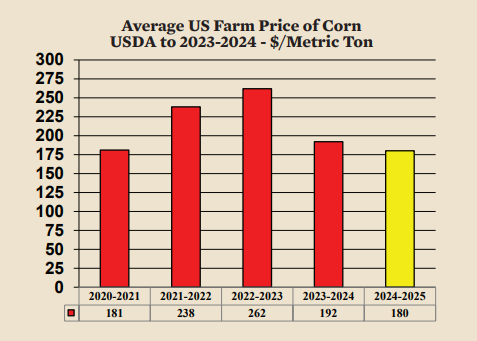

Is this the bottom of the bear market? It could be, however grain prices are tempered by a slow-growing world economy and increased grain supply. The bottom of the bear market might not come until crop year 2024-2025.

Corn

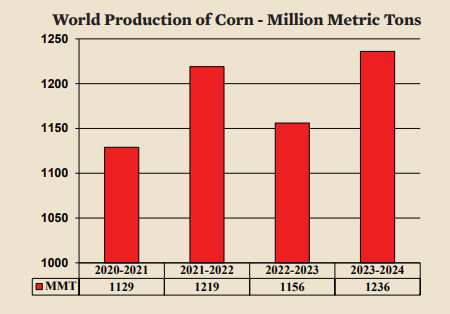

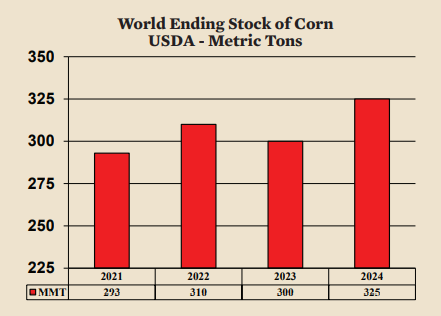

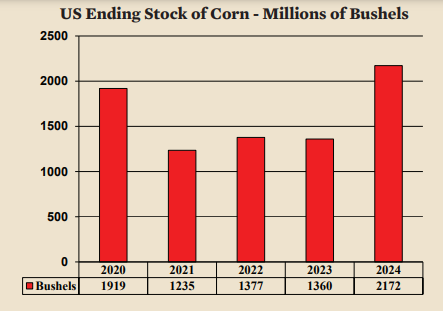

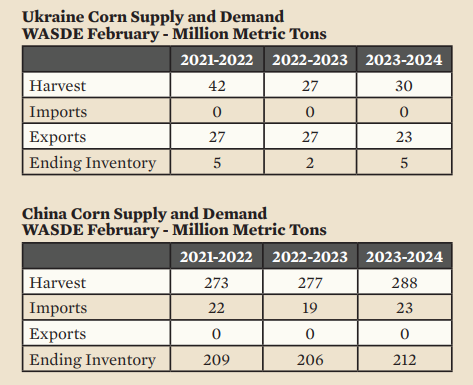

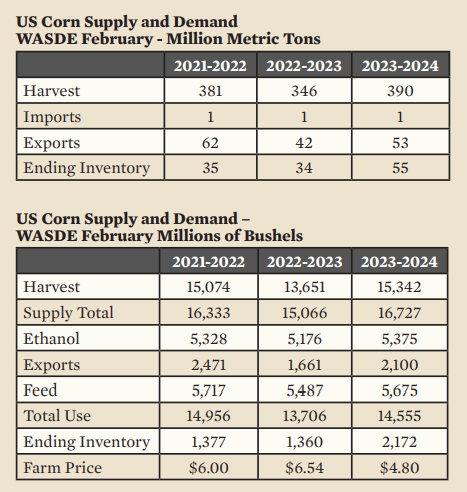

World corn production is expected to rise this crop year (2023- 2024) due to increases in the US, China, and Argentina. With higher production, and higher ending inventory, prices can be expected to average less than last crop year. The average price for last crop year was $6.54 per bushel ($262 per metric ton). The average is likely to be less than $5.00 ($200 per metric ton) this crop year and could be even lower next crop year if the bear market continues.

Soybeans

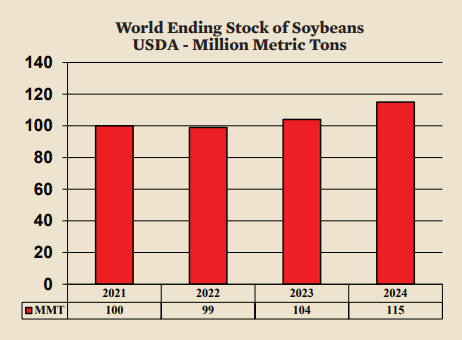

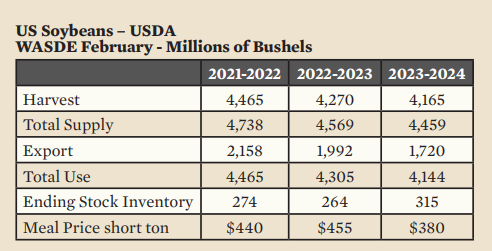

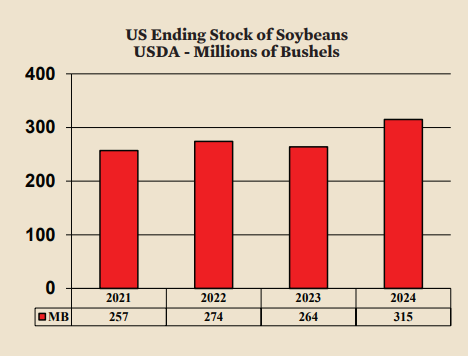

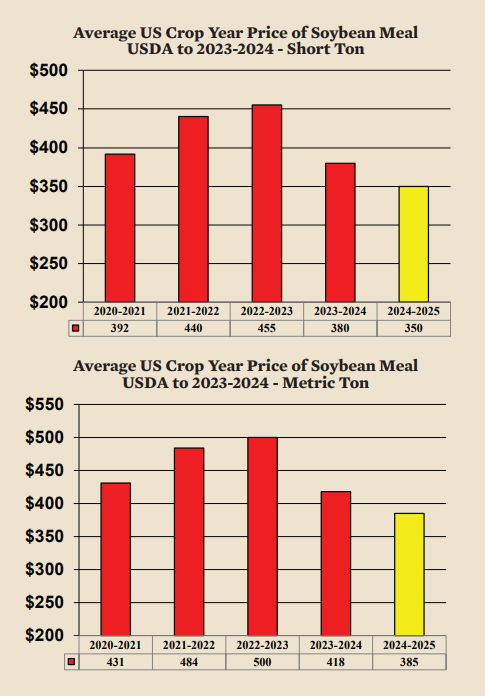

Production in South America increased 10 MMT last crop year despite a severe drought in Argentina. The enormous capacity of Brazil to increase soybean production negated the effect of the drought in Argentina. This crop year will see an even larger increase in South America with much higher production in Argentina and slightly lower production in Brazil. Production of soybeans in South America (Argentina, Brazil and Paraguay) is now twice as high as production in the US (221 MMT versus 113 MMT). More importantly, exports of beans and meal combined are 2.5 times as high as exports from the US. As a result, the most important clues as to what will happen to the future supply of soybeans and SBM now come from South America, not the US. Rising production in South America suggests that soybean meal will average no more than $380 in this current crop year ($418 per metric ton) as the USDA suggests and may drop further next crop year.

As a result of much higher production in Argentina, world ending stocks are expected to be higher this crop year. Therefore, the current lower prices for soybeans and soybean meal can be expected to persist.

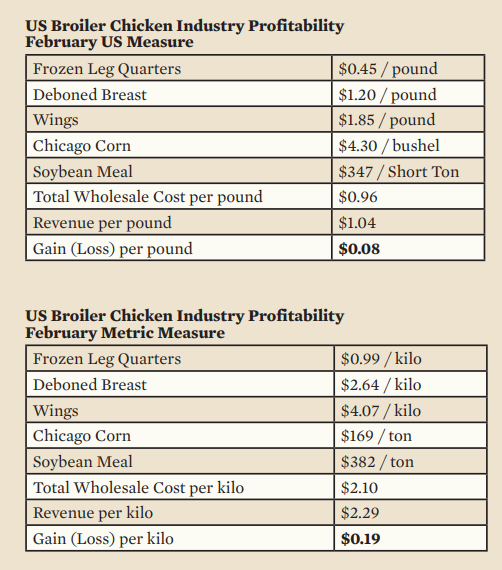

Chicken Industry

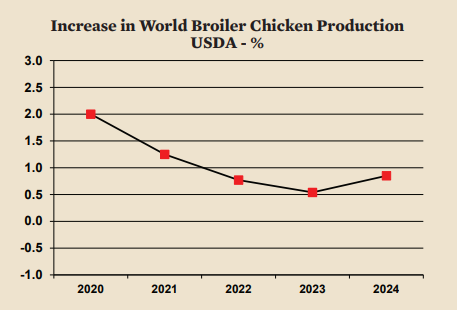

The world chicken industry expanded just 0.5% last year. Slow growth was due to a slowing world economy and relatively high grain prices in addition to some losses due to avian influenza. Despite lower grain prices, world production growth this year is again expected to be low; only 0.85%. With relatively few chickens and depressed grain prices, 2024 should be an excellent year for the world poultry industry.

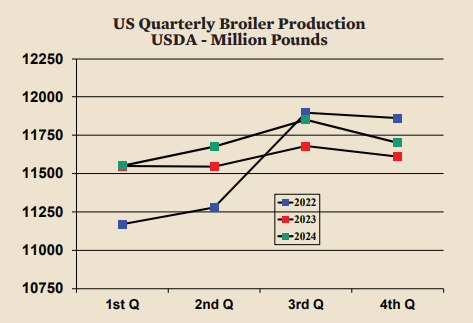

US production accelerated in 2022 leading to a sharp decline in wholesale prices. Low prices led to a decrease in year-to-year production in 2023. For all of 2023, percentage growth was only 0.4%. For 2024, the USDA predicts that growth will accelerate to nearly one percent.

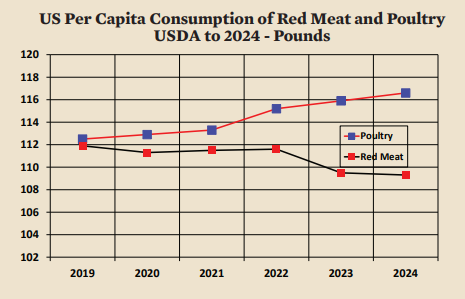

Poultry per capita consumption in the US has been rising recently while red meat per capita declined. Between 2022 and 2024, red meat per capita consumption fell by two pounds (1 kilo) while poultry consumption rose by one pound (1/2 kilo). In 2024 the beef industry is likely to reach the bottom of the beef cycle and production could increase in 2025 and beyond. It is interesting to note that total meat consumption increased only 1.5 pounds (0.7 kilo) from 2019 to 2024.

The future may be a zero-sum game where total red meat and poultry consumption is relatively stable. In a zero-sum game, the increase in consumption of one meat would be matched by a decline in another meat. If that is true, it is likely that total red meat consumption per capita will continue to decline slowly.

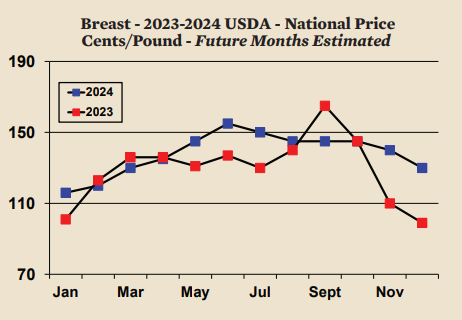

Deboned Breast

Deboned breast meat prices fell in the last few months of last year but recuperated in the first two months of this year. Overall, prices this year are likely to be slightly higher than last year. Reduced supplies of red meat this year and a relatively robust US economy should help support the price of deboned breast.

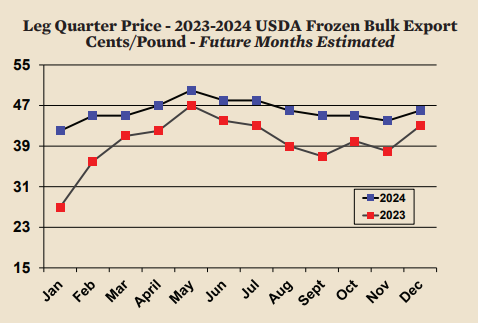

Frozen Leg Quarters for Export

Strong international demand for frozen leg quarters sent prices higher last year. Prices can be expected to continue to increase in 2024 to a high of approximately 50 cents per pound ($1.10 per kilo) baring trade issues that restrict commerce.

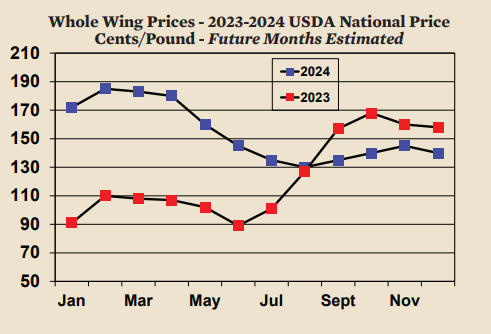

Wings

Wing prices are off to a remarkable start this year. The price is 75 cents per pound ($1.65 per kilo) higher than last year at this time. Wings have soared high above that of deboned breast, not a sustainable situation. Wings can be expected to fall if deboned breast prices remain lower than wings.

Due to the firm demand for chicken and low price of grain, chicken production in the US is currently profitable and is likely to continue to be profitable throughout the year.