Grain prices continue to be favorable

Broiler Economics SeriesGrain prices worldwide continue to be favorable for the poultry industry. A huge harvest last year in the US of corn and soybeans combined with continued growth in production in South America means that poultry producers worldwide are likely to enjoy a robust bear market in grain.

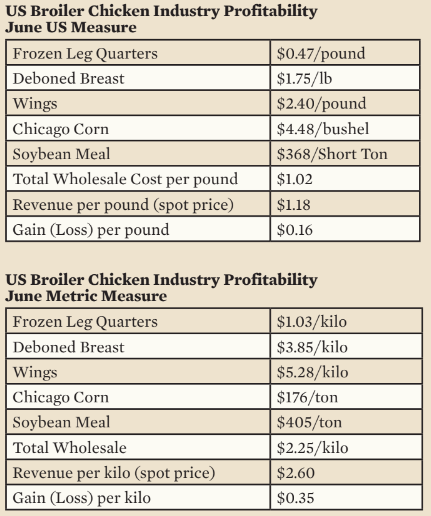

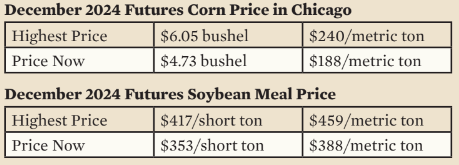

The benchmark price of corn in Chicago is now below $5 per bushel ($200 per ton) and is likely to stay low for the rest of the year as disappointing exports cause grain to pile up inside the US. Soybean meal is also a bargain due to the return of Argentina this year and the continued growth of total production in South America.

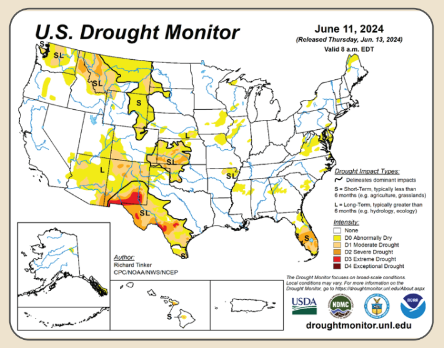

Prices could, of course, reverse direction if there is a drought in one or more of the important growing areas. It is too early to be sure about this year, but the US drought monitor below shows the Corn Belt in excellent shape. Overall, in South America conditions are favorable.

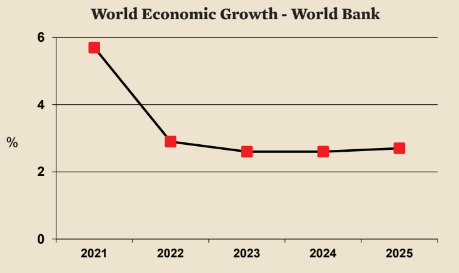

How long will the bear market in grain last? It could last through crop year 2025-2026 as the world economy continues to be sluggish and supplies remain ample. The World Bank expects that the half decade of 2020 to 2025 will have the slowest world economic growth in 30 years.

Corn

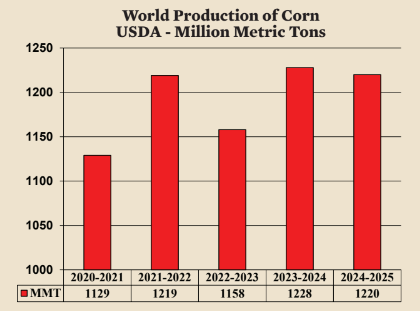

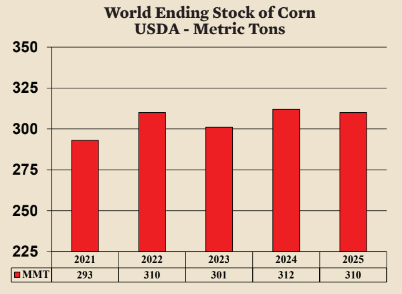

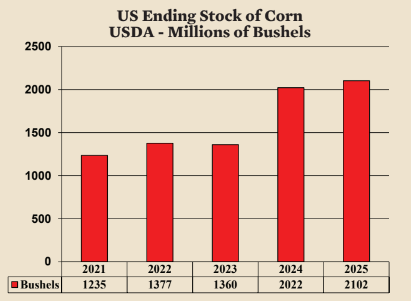

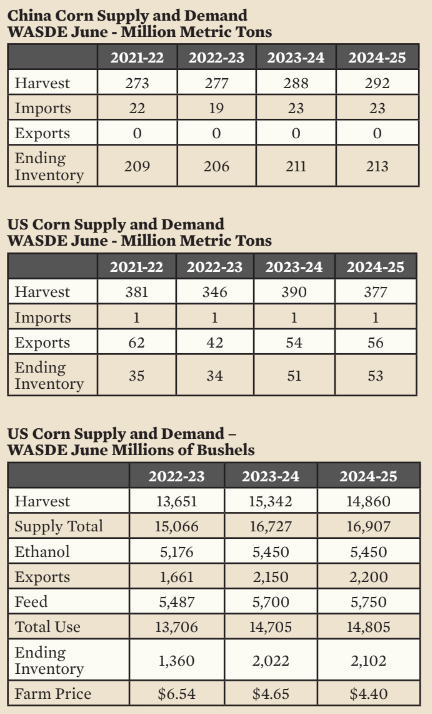

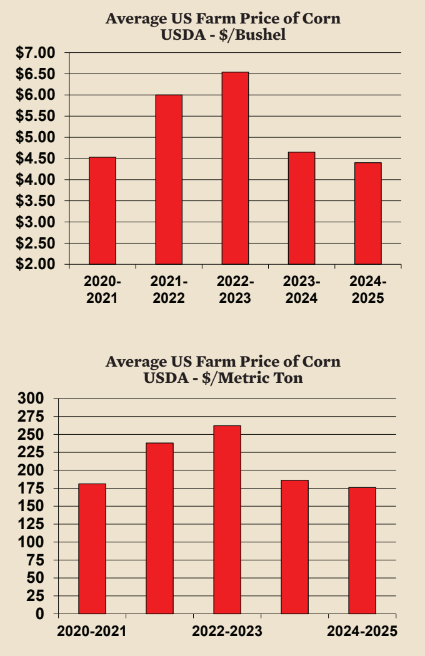

The latest WASDE report projects that world corn production will continue to be ample in crop year 2024-2025. With two crop years of higher production and higher ending inventory, prices can be expected to continue falling. The average farm price in the US last crop year was $6.54 per bushel ($262 per metric ton). The average this crop year will end up less than $5.00 ($200 per metric ton) and is likely to be even lower next crop year. An average price of $4.40 ($176 per metric ton) is projected by the USDA.

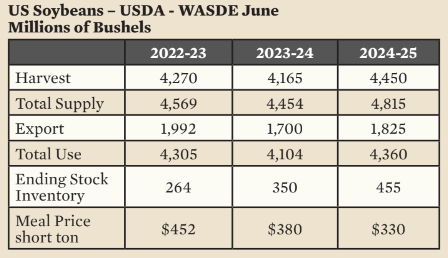

Soybeans

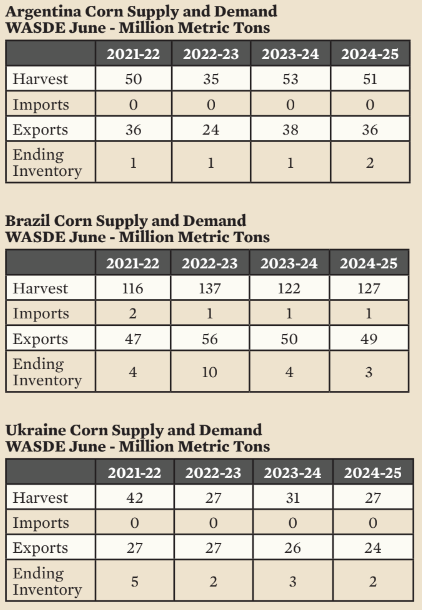

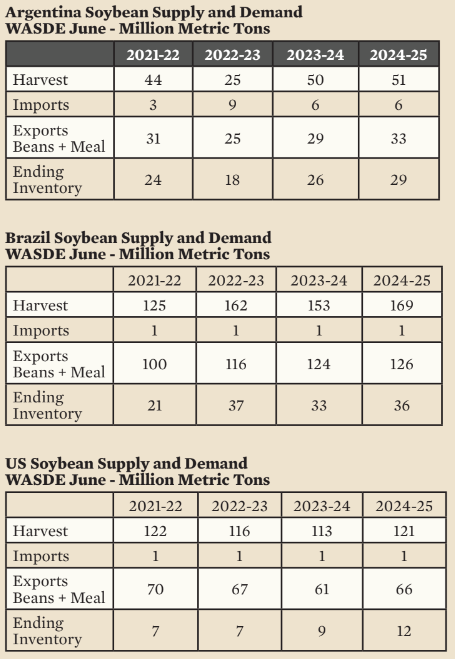

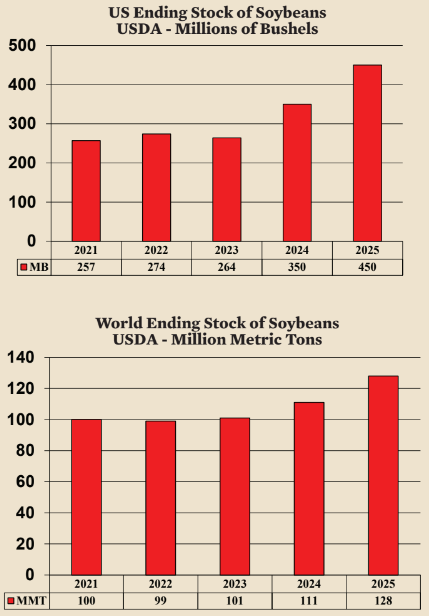

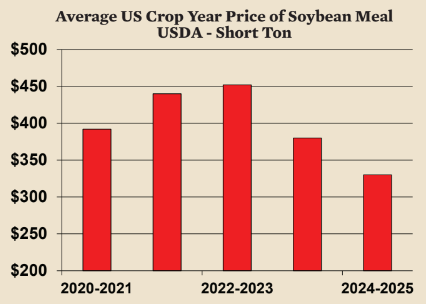

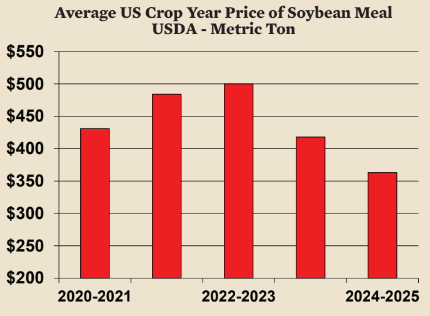

Between crop year 2022-2023 and crop year 2024-2025 production in South America is expected to increase 36 MMT. The enormous capacity of Brazil to increase soybean production combined with the production of Argentina and Paraguay results in South America now representing 55% of world production. The exports of beans and meal from South America are 2.5 times as high as exports from the US. Continued rising production in South America means that the US benchmark price of soybean meal will average no more than $380 in this current crop year ($418 per metric ton) and is likely to drop to $330 ($363 per metric ton) next crop year.

As a result of much higher production in Argentina, world ending stocks will be higher this crop year. US ending stocks will be higher as well. Higher ending inventories are, of course, likely to lead to lower prices.

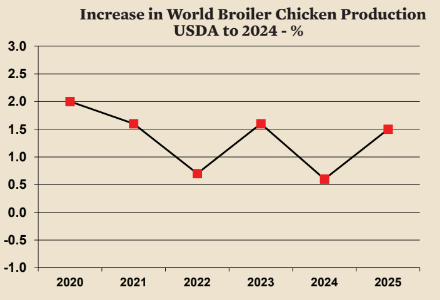

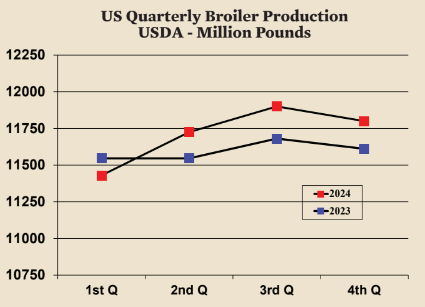

Chicken Industry

Slow growth in the world economy in the first half of this decade, in addition to high grain prices until recently, was reflected in the slow growth of world chicken production. Growth has averaged just over 1% recently. It is likely that growth will accelerate starting in 2025 and rise to an average of 2% for the last half of the decade. Low prices in the US in 2023 led to an increase of only 0.4% last year. For 2024, the USDA predicts that growth will increase slightly to 1%.

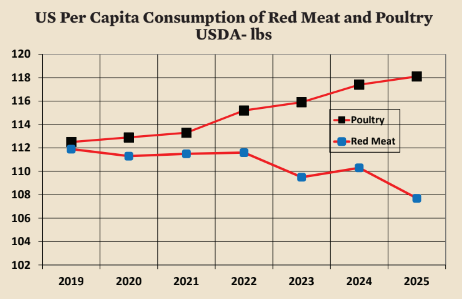

Poultry per capita consumption in the US has been stealing market share from red meat. Between 2021 and 2025, red meat per capita consumption fell by 4 pounds (1.8 kilos) while poultry consumption rose by the same amount. It is interesting to note that total meat consumption stayed the same between 2021 and 2025. Current trends would seem to indicate that future growth in total meat consumption per capita in the US might be minimal and therefore there will a zero-sum game rivalry between red meat and poultry.

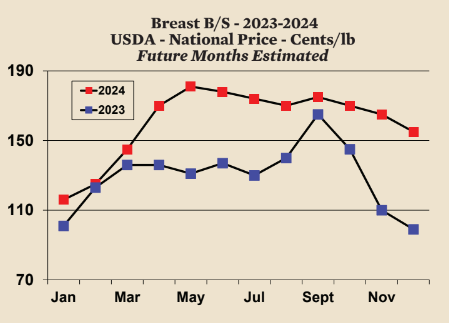

Deboned Breast

The spot prices of deboned breast in the US rose surprisingly fast in the first five months of 2024 helped by high prices for competing meats. For example, the all-fresh retail price of beef

was a record $7.69 per pound in May. In addition, a relatively robust US economy with low unemployment helped support the price. For the entire year the average price of deboned breast is likely to be significantly higher than last year.

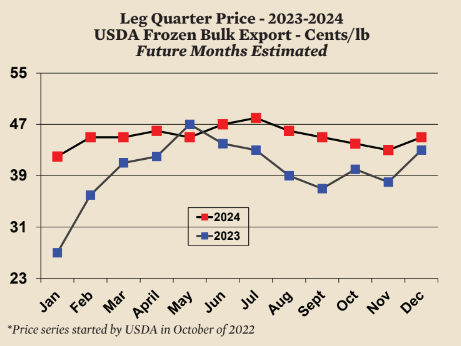

Frozen Leg Quarters for Export

Spot prices for frozen leg quarters are slightly higher than last year and can be expected to continue to be slightly higher. Trade issues and the strong dollar are reducing the potential price of leg quarters.

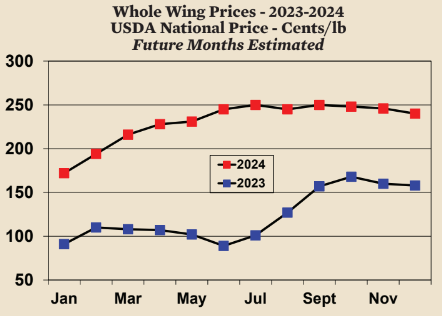

Wings

Wing prices are off to a remarkable start this year. The price is now $1 per pound ($2.50 per kilo), more than double the price last year at this time. Wing prices can be expected to remain high in line with higher deboned breast prices.

Due to the firm demand for chicken and low price of grain, chicken production in the US is currently profitable, when calculated using spot prices, and is likely to continue to be profitable throughout the year.