Hy-Line W-80 meeting market needs worldwide

The world's fastest growing layer becoming leader in white-egg markets”The Hy-Line W-80 is the world’s fastest growing layer variety, becoming the preferred breed in world white-egg markets just a few short years from its introduction. Her high rate of lay, persistency of lay, strong shells, and efficient feed conversion throughout a long production cycle provides egg producers around the world with the best opportunity for profitability. The W-80’s robust yet docile temperament allows her to overcome the myriad of challenges in the field and is suitable for both cage and cage-free systems.

Consumer acceptance of white eggs has been positive in European states where size, quality, and cleanliness take priority over shell colour.

Europe cage-free producers turn to white eggs

Cage-free production has grown significantly over the past 30 years. It is the dominant production system in most of Europe and accounts for more than 30% of egg volume in the USA. In addition, many countries around the world are beginning to expand into cage-free systems to address egg-buyers’ requests and consumer demand for eggs produced in alternative systems.

With a push towards improved sustainability, many of Europe’s traditionally brown-egg markets are showing a rise in movement towards white-egg layers in cagefree systems. White-egg varieties have lower mature body weight than brown birds and therefore tend to convert feed to eggs at a slightly better rate. A higher proportion of the nutrients consumed by white egg layers are transferred into egg production, while the brown layer must support its higher body maintenance requirements. The estimated smaller environmental footprint of the white bird encourages producers to place more white birds in their quest to fulfil852 their sustainability goals.

In a market dominated by brown eggs, the UK is seeing a significant switch to the white-shelled variety, with Hy-Line’s W-80 playing a major role. With low feed intake and high egg output, coupled with the potential for longer laying cycles, the W-80 ticks a lot of boxes for egg producers, whilst retailers see white birds playing a significant part in their mission to lower the carbon footprint associated with everyday foodstuffs.

One major egg producer in the UK which has switched some of its production to white layers is Griffiths Family Farms, which supplies eggs to major retailers and the food service sector. The switch coincides with a change in production methods, as it replaces colony cage units with barn systems. Their first W-80s were housed last August and peaked at 98%. Strong early egg weight has helped achieve an egg mass of 17.4 kg at 64 weeks (target is 16.6 kg), whilst cumulative mortality is 5.05% (target is 6.4%).

Director Jonathan Griffiths explains the company’s move to white egg layers was driven 50/50 by farming considerations and interest from retailers. “From an egg production perspective, the efficiency factor is a major attraction,” he says, “as is the longer laying cycle.”

“We’re aiming for 90-weeks plus, which cuts down turnaround time. Retail customers are increasingly keen to try white eggs, whether that’s a pack of white-only or in a mixed pack with brown, and they are considering where white eggs may fit in a tiered free-range offer. At present, retailers are very pro-white eggs and customer uptake has been positive.”

Jonathan did believe, however, that the UK egg sector was in an unusual trading position, with the market recovering post the impact of Covid and Avian Influenza, shortness of supplies has encouraged consumers to reassess their egg choices. “That’s the bit we don’t know, how demand for white will be in a fully supplied market. But this period of turbulence provides the opportunity for consumers to get used to white eggs."

The growth in white egg layers is mirrored across Europe. For France and Poland, Hy-Line forecasts numbers will more than double by 2025 from last year’s bird base. Significant growth is also forecast for Italy, the Netherlands and Spain.

“As a business, we’re certainly going to continue increasing our numbers because we are very pleased with the bird performance we are seeing. We also have our egg processing plant so have the option of directing white eggs that way if necessary. And where we have fully dedicated flocks for processing, they will be white egg layers.”

...the W-80’s temperament is completely different...it is far more active around the system and less docile compared to a brown layer, but in many ways this makes it an easier bird to manage.” – John Widdowson, Hy-Line UK

Michael Griffiths, who works closely with the company’s retail customers, describes the current retail landscape as exciting. “Retailers are increasingly looking at delivering value to consumers particularly during these inflationary times, along with improving on-shelf availability. There is a cost benefit with reduced turnaround time, whites laying much longer also aids efficiency and supply to our customers,” says Michael. “For a retail buyer, the headline figure of five per cent reduction in carbon footprint along with the perceived welfare benefits associated with white layers is very appealing. Combine that with farmers who have had white layers not wanting to go back to brown birds and it’s an attractive picture.”

For producers used to brown layers, the behavioural traits of white birds can be something of an eye-opener, an aspect Hy-Line UK’s John Widdowson has learned. “After over 30 years working with browns, the W-80’s temperament is completely different but I’ve grown to like the bird very quickly,” says Widdowson, who provides the Griffiths’ farms with technical support. “It is far more active around the system and less docile compared to a brown layer, but in many ways this makes it an easier bird to manage.”

“Its desire to seek out the seclusion of the nests has led to very few non-nest eggs.” At week 25, combined floor and system eggs were less than 1% with the first flock, a trend that has continued with Griffiths’ subsequent flocks of W-80s. The growth in white egg layers is mirrored across Europe and when it comes to France and Poland, a forecast by Hy-Line predicts numbers will more than double by 2025 from last year’s bird base. Significant growth is also forecast for Italy, the Netherlands, and Spain, with the Netherlands already having seen its brown bird population reduce in favor of white strains from over 60% in 2003 to a little over 30% in 2021. Consumer acceptance of white eggs has been positive in European states where size, quality and cleanliness take priority over shell color. In addition to lower production costs, white egg laying varieties incidence of meat and blood inclusions are nearly non-existent.

The Robust W-80 increases share in India

The W-80 is taking the India market by storm, with more and more producers adopting the breed each month. Historically, Hy-Line found the Indian market to be a difficult one to penetrate due to the country’s unique requirements, making it difficult to adapt the company’s existing products to the local conditions. Heat stress can present a formidable obstacle at times of the year when temperatures are 50°C. In addition, competing against a local breed that had been the dominant layer in the market for years with unique character traits that had adapted to the market and vice versa proved difficult.

The local breed has a very small egg weight profile with a short production cycle, which is quite different from most international markets. Hy-Line white egg product specifications were not ideal and required significant management requirements by local farmers to adapt the bird to these local realities.

The Indian market has great potential for expansion of egg production and consumption, as the country is now tied for most populous country in the world with 1.4 billion inhabitants. Egg consumption in India is very low relative to other countries around the world; however, due to the sheer size of the population, India is now considered to be close or just ahead of the USA in egg production, competing for the #2 world position.

The Hy-Line W-80 is the fastest growing breed in India, demonstrating longer production cycles, more hen-housed eggs, superior livability, more resistant shells, and better feed conversion than both local and international offerings in the market.

The India market requires a bird that tolerates and overcomes the obstacles of extreme heat, as regions of the country experience temperatures of 40 to even 50°C during the summer, inducing heat stress on the layers; very low dense feed rations offered to the birds; and the market is accustomed to very small egg weights in the 50 g range. To address the unique nature of the India market, Hy-Line elected to begin a breeding program in-country to customize the W-80 to the market through a local breeding program. Three years ago, Hy-Line placed W-80 lines on the Hy-Line India grandparent farm in order to select the birds which perform best in India in terms of egg weight (small), strong shells, early onset of lay, high peaks and good heat tolerance.

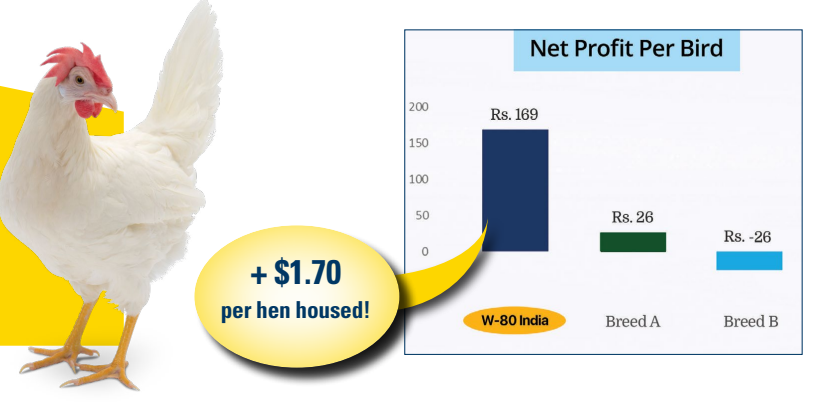

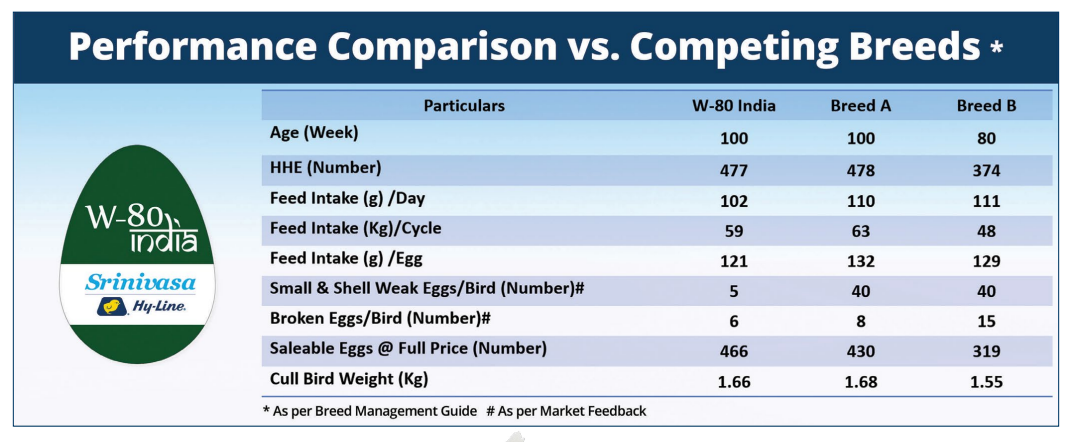

Today, the Hy-Line W-80 is the fastest growing breed in the market, demonstrating longer production cycles, more hen-housed eggs, superior livability, more resistant shells, and better feed conversion than the other local and international offerings in the market. Hy-Line supplies parent stock to Srinivasa who distribute chicks to egg producers throughout India. In head-to-head trials, the W-80 demonstrated the best profitability against the two leading competitor strains available in the market showing a 140 Indian Rupee (US$1.70) advantage per hen-housed through a complete cycle due to superior egg numbers and feed conversion.

The India market is on the verge of becoming the fastest growing day-old chick and egg production market in the world, should egg consumption trend upwards towards international levels. The Hy-Line W-80 meets the demands of the India egg producer for a highly productive, robust white-egg layer which provides the opportunity for maximum profitability. Hy-Line developed the current W-80 in the market to conform to the local conditions.

In head-to-head trials the W-80 demonstrated the best profitability against the two leading competitor strains available in the market, showing a 140 Indian Rupee (USD$1.70) advantage per hen-housed to 72 weeks due to superior egg numbers and feed conversion.