Kuwait Poultry and Products Annual Overview - September 2005

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Annual 2005 report for Kuwait. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

In 2006, Kuwait’s broiler production is projected at 35,000 metric tons, most which would be consumed locally. Imports of frozen chicken are forecast at 95,000 metric tons, including 20,000 metric tons in chicken parts. Brazil will continue to be the chief competitor for the United States in the whole bird, bone-in and boneless chicken markets. The U.S. should expend its chicken parts market from 10,000 MT in 2005 to 12,000 MT in 2006 given strong demand generated in southern Iraq.

Executive Summary

In CY 2006, Kuwait’s broiler meat production is projected at 35,000 Metric Tons (MT),

representing a 6 percent increase over the 2005 production expectation of 33,000 MT. The

poultry-farming sector appears to have recovered from earlier setbacks resulting with

producers more optimistic about the future.

Two major producers account for 75 percent of the local production, while a third smaller

producer accounts for another 15 percent. 5-6 small producers provide the balance of

production. Of local broiler production, sixty percent is marketed as live, 5 percent as chilled

and the balance as frozen. Demand for live chickens, mainly from Kuwaiti nationals, is

declining due mainly for practicality reasons and for hygiene concerns.

CY2003 is the latest year official trade statistics are available. Major poultry importers advise

that import performance continues strongly. Demand from southern Iraq continues to spur

on the re-export market. Brazil remains the principal supplier, dominating both the whole

bird and parts markets. The U.S. share of the parts market is increasing gradually with

demand for leg quarters spurred on by the Iraqi market.

Local broiler production does not directly compete with imported broilers. Frozen local whole

chicken retails at prices 50-60 percent higher than imported frozen chicken. Local chilled

chicken retails at prices more than double that of imported frozen chicken. Price differences

are driven by high production cost, as most inputs must be imported. One of the two major

poultry operations produces 1.5-2.0 million quails annually, marketed mostly as chilled.

Finally, one smaller farm produces about 100,000 ducks annually, marketed mostly as live,

and to lesser extent, as chilled.

Production

In CY 2006, Kuwait’s broiler meat production is forecast at 35,000 metric tons (MT), showing

a 6 percent increase over production in 2005 that is expected to top 33,000 MT. Two major

producers account for 75 percent of local production, while a third, smaller producer

accounts for another 15 percent, with five to six small farms producing the balance. An

estimated 60 percent of local broiler production is marketed as live, 5 percent as chilled and

the balance as frozen. Only one percent of production goes for further processing. Demand

for live chickens, mostly from Kuwaiti nationals, is declining due mainly to practical reasons

and health concerns. Mortality runs at about 10-15 percent annually. Inadequate

veterinarian supervision and harsh climatic conditions are the principal causes.

Local broiler production does not complete directly with imported broilers. Local whole

frozen chicken retail at prices about 50-60 percent higher than imported frozen chicken,

while chilled chicken retail at prices more than double that charged for imported frozen

chicken. Price differences are driven by high production cost, as most inputs must be

imported. One of the two major poultry operations produces 1.5-2.0 million quails annually,

marketed mostly as chilled. Finally, one smaller farm produces about 100,000 ducks

annually, marketed mostly as live, and to lesser extent, as chilled. Production operations are

disbursed across the country with no concentration of farms found in one single area.

Major farms prepare own feed from imported ingredients. Corn is imported by the

government- owned Kuwait Flour Mills Company and is sold to farmers at a subsidized price.

Other ingredients, such as soybean meal, concentrates and pre-mixes, are imported by

private companies and sold to poultry farms at unsubsidized rates. The use of growth

hormones is not permitted. Conversion rate runs at about 2 to 1 in most farms, but falls to

1.8 to 1 on the well-managed farms. Chicken is usually slaughtered after 35 days weighing

1.3 kg, on average. Dressed weight is quoted at about 900 gms, on average.

Hatching eggs for broiler production are imported from India and Egypt while hatching eggs

and day-old-chicks for layers are imported primarily from Saudi Arabia.

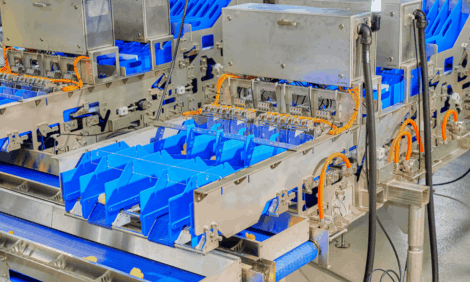

All major farms run up-to-date operations and routinely upgrade and expand facilities with

the latest technology and equipment. The Government of Kuwait does not provide any direct

support to the poultry sector. Cost of water and electricity is the cheapest in the Middle East.

The largest three farms run own slaughterhouses while other farms market their stocks live.

The second largest producer started and supplies a fast food chain that appears similar to

Kentucky Fried Chicken. The company expects to open its 60th restaurant in the very near

future. That company also exports paws, necks, livers, etc… to markets such as China and

several African countries.

Consumption/Utilization/Stocks

Kuwaiti consumers, who constitute about 40 percent of the 2.5 million populations, prefer

locally produced live and chilled broilers. Its appeal, despite its high price, is its perceived

freshness (locally slaughtered) and its perceived compliance to Islamic Halal requirements.

Local whole frozen chicken retails at prices about 50-60 percent higher than imported frozen

chicken, while chilled local chicken retails at prices more than double of the imported frozen

chicken prices. Expatriates, particularly those with low incomes, consume cheaper, imported

frozen chicken. This audience prefers individually wrapped oval shaped white skinned frozen

chicken in the 800-1,000 gram size range. Brazilian, Saudi Arabian and European chicken

better meet these preference requirements thus are in higher demand than U.S. chicken,

which serves mostly the high-end HRI sector.

Chicken meat is gaining in popularity versus red meats because of increasing health

awareness; lower cost, the BSE scare in Europe and North America and the ecological

problems that Kuwait’s seafood industry has encountered in recent years. Some small

cafeterias and restaurants are starting to utilize leg quarters, which is a positive development

for U.S. chicken prospects in the Kuwaiti market.

In 2005 total chicken meat consumption is forecast at 101,000 metric tons, of which 12,000

metric tons or 12 percent is of parts. Per capita chicken meat consumption is forecast at

about 41 kg. Total chicken meat consumption is expected to increase 3-4 percent annually,

driven in part by the above referenced reasons. Consumption of poultry parts is expected to

increase due to their practicality.

Kuwait enjoys one of the highest per capita incomes in the world, which is expected to

increase further due to the recent spikes in world oil prices. Income distribution is not even,

however. While most Kuwaiti nationals enjoy relatively high incomes, most expatriate

workers, particularly those from the Asian sub-continent, work for low wages. This explains

the country’s overall preference for whole chickens vis-à-vis parts.

Retail prices for Brazilian whole chickens, by far the dominant origin in the Kuwaiti market,

range from $2.21-$2.30/kilogram, depending on brand. The Saudi Arabian brands available

retail at about $2.60/kilogram, while the Danish and French brands are retailing at $2.00 -

2.15/kilogram. Kuwaiti origin frozen whole chicken is retailing at $2.85/kilogram.

Consumption comprises of broilers only. Local spent hens are discarded or recycled in the

feed industry as local regulations prohibit such birds from entering the food market.

Kuwait does not have an official stock holding program. Producers and importers prefer to

maintain minimal stocks, defined as supply to satisfy one month’s market requirements.

Trade/Marketing

Strong Kuwaiti poultry re-export activities to Iraq are expected to continue through 2005 and

2006. In the absence of official government trade statistics, Post projects Kuwaiti poultry

imports in 2005 to reach 88,000 MT (whole birds - 70,000 MT, Parts - 18,000 MT, particularly

leg quarters), and in 2006 to reach 95,000 MT (whole bird - 75,000 MT, parts - 20,000 MT).

In 2004, Kuwait imported 77,000 MT total poultry meat.

Brazil is the principal supplier of frozen whole chicken holding an estimated 75 percent

market share. Brazil’s dominance in this market is underpinned by a public perception that

Brazilian producers adhere more closely to Islamic Halal slaughter procedures than European

and U.S. counterparts. Saudi Arabian suppliers have benefited, albeit to a smaller degree,

by this perception despite the 20 percent price difference between its products and that from

Brazil or Europe. Brazilian suppliers dominate the market because of competitive prices,

attractive packages and intensive marketing efforts, including print media and TV

advertising. Brazilian parts are also popular with local consumers due to their smaller sizes

and attractive retail tray packs. Brazilian suppliers are known for their ability to meet

importers’ requirements.

The U.S. is the second largest supplier to Kuwait due to its competitively priced leg quarter.

Saudi Arabia is the third largest supplier to the market, its only external market. EU market

share is diminishing due to more unfavorable production and export environment - reduced

EU export subsidy, higher cost of production, weak exchange rate vis-à-vis the U.S. dollar.

China and Thailand were banned from the market over control problems with avian influenza.

In 2005, the United States is expected to supply about 10,000 MT of chicken parts, mainly

leg quarters, to the Kuwaiti market. In 2006, such U.S. exports are projected at 12,000 MT.

However, U.S. supplier shift from the customer preferred 2-lb. tray to bags for packing boned

chicken parts could have an adverse consequence for U.S. trade in this highly competitive

market. U.S. leg quarters are imported mainly for re-export to Iraq.

The Kuwait poultry trade is dominated by 6-7 large companies, which account for 80 percent

of all poultry meat imports. All import established Brazilian, Saudi Arabian, Danish and

French brands. Another 5-10 smaller trading houses account for the balance of imports.

Near term projections reflect annual chicken meat import growth at 3-4 percent. Driving this

projection is increasing consumer preference for chicken meat rather than other meats and

to a lesser degree increasing growth in population.

Brazilian and to a much lesser extent European chicken brands grew in popularity because of

their small sizes, competitive prices and aggressive marketing. U.S. whole chicken is not

competitive with products imported from Brazil and Denmark. Brazil and the United States

share, albeit unequally, the boned chicken parts market. Currently several U.S. chicken part

brands are available in the market.

Brazil replaced China and Thailand in the boneless market when those two countries were

banned for on-going avian influenza problems. Boneless parts, normally packed in 1 or 2 kg

packages, are popular both with consumers and with restaurants, particularly "Shawarma"

sandwich shops, because of their practicality. However, their high price is an impediment to

wider household use.

Turkey meat, imported mainly from the United States and Brazil, is imported in limited

quantity. In 2003 when the U.S. military established a presence in Kuwait, imports of turkey

and its products surged to 1100 MT versus the annual average of about 200 MT. Turkey

consumption remains seasonal and concentrated mostly around the Thanksgiving -

Christmas holiday period. Duck meat, imported mainly from the United States, France and

Canada, is estimated at 80 tons annually.

Presently frozen whole chickens from all sources averages $1,400-$1,430/MT, CIF Kuwait. At

the beginning of 2005 the price was $1,000/MT. Currently whole chicken from Saudi Arabia

is quoted at $1,700/MT.

Both importers and domestic producers of poultry are well equipped with excellent cold

storage warehouse facilities and refrigerated trucks for distribution. Both sectors are staffed

with well-trained sales representatives. Major retailers are constructing state-of-the-art

super-and hypermarkets and are focusing on customer service to ensure that their products

are ideally presented and marketed to consumers.

Further Information

To read the full report please click here

Source: USDA Foreign Agricultural Service - September 2005