Market trend: faster transition from backyard to commercial poultry farming

Increasing purchasing power is driving up meat consumption, especially chicken. Jalal Haddad believes that this is the perfect time for emerging markets to invest in their poultry sectors.Vegetarianism is growing in popularity in industrialized nations, but we need to remember that this is not a global trend. The reality is that dairy and meat consumption is growing by 2.1% and 1.9% respectively; two times as fast as population growth. At least, this was the situation before the pandemic. It is the emerging markets that are seeing the strongest growth in the consumption of animal products. For the local populations of these regions, it’s often a positive development. It means that their standard of living is improving and that their incomes are growing to a level that allows them to include meat and dairy in their diets. This trend is occurring especially in Africa and some parts of Asia. In these regions, the way in which meat is produced is shifting rapidly.

Purchasing power changes eating habits

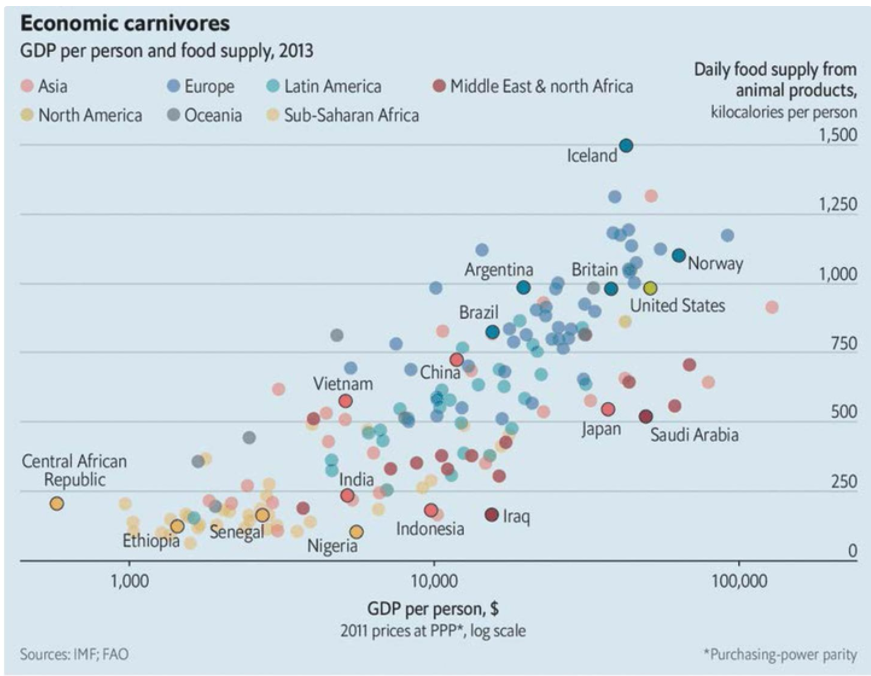

In economics, the consensus is that an increase in the purchasing power per capita impacts the rate of meat consumption in a country. On the other hand, many industrialized countries have reached a saturation point in terms of meat consumption. Poorer countries stand to gain significant purchasing power and therefore meat consumption will automatically increase as a consequence.

© The Economist

That is why the total number of animals continues to increase. Worldwide, the number of ruminants will rise even further: from 4.1 billion (in 2015) to 5.8 billion (in 2050). Poultry numbers are expected to increase at an even faster rate. This predicted growth presents a challenge for the agricultural sector because land and raw materials are finite resources. Worldwide, we will therefore have to start growing crops more efficiently, such as by optimizing crop yields and feed conversions.

Largest increase in demand for poultry

Meat consumption is on the rise, but why does poultry make up such a significant proportion of this increase? There are many reasons: the more affordable price certainly plays a role, it is quick and easy to cook, the meat contains little fat and lots of protein, chicken has a smaller environmental footprint, most religions have a tradition of eating poultry, and so forth. Many sociocultural factors and environmental trends account for this growth, which is occurring in both industrialized and emerging countries.

Investing in poultry supply chains

An expanding diet means that emerging markets need to prepare themselves to meet the growing demand. After all, dependence on imports creates few job opportunities and will not push a country’s economy forward. The FAO expects the number of chickens in Africa to quadruple by 2050. This means there will be a total of 7 billion chickens. Backyard chicken keeping will evolve into commercial poultry farming in the years ahead to supply the population with food. This also means a switch from feeding kitchen scraps to purchasing commercial feed. This will result in a bigger role for feed manufacturers.

As cities grow and the incomes of their inhabitants start to allow for more frequent consumption of animal proteins, supply chains will become more crucial. Breeding companies, hatcheries, veterinarians, transport and slaughterhouses: the entire supply chain will need to be established. The governments of these countries will play a steering role by stimulating new investments with subsidies. By using the poultry know-how of industrialized countries, these countries will be able to make the switch even faster.

Senegal and Nigeria are examples of countries where this transition is already in full swing. The number of chickens in Senegal has already increased astronomically from 24 million in the year 2000 to 60 million in 2019. To secure their poultry investments, poultry farmers must take precautions, such as by systematically vaccinating against Newcastle disease and Gumboro disease. NMA Sanders in Dakar (Senegal) has become a flourishing poultry company and retailer that produces an increasing volume of poultry feed each year (122 000 tons in 2017 and 140 000 tons in 2018). In Nigeria, the share of corn used for feed rose from 300 000 tons in 2003 to 1.8 million tons in 2015. It’s clear that the transition is already well underway in some African countries. The supply chain is organizing itself in preparation for the growing demand for poultry.

Conclusion: taking control with modern agricultural technology

In conclusion, it is clear that emerging markets are ramping up the meat and especially the poultry production, switching to commercial farming. This is due to three main elements.

- The first is a sign of better quality of life with increased income and change in sociocultural preference in food choice towards more meat consumption.

- The second element is the expected fast demographic increase in population growth in emerging markets.

- The third element, which is also demographic, is the higher urbanization rate globally, estimated at around 70% by 2050.

The adoption of modern farming technology in the emerging markets has benefits on several levels.

- The first is that it provides better economic sovereignty to these regions by having less dependence on imports, more balanced international trade, and creating new labor opportunities across the supply chain.

- The second level is that automation improves the efficiency of production in order to mitigate the environmental impact by optimizing on the used natural resources.

- The third level – which is very relevant nowadays and has a global perspective – is biosecurity. Modern and automated farming helps reduce tremendously the risks of generating and spreading animal diseases, by ensuring high standards of hygiene, and separation from pests, travelling birds and outside contaminants.

For these reasons, emerging markets need to continue on embracing modern farming technology as the main catalyst to support the growth in consumption of chicken products, in line with developed markets and in other agricultural industries.