More Slaughter Plants Needed for Locally Sourced Meat

Demand for locally sourced products in the US has increased in recent years, but producers often claim that a lack of slaughter facilities is a key reason that it is not expanding more quickly, writes ThePoultrySite editor-in-chief, Chris Harris.According to a new report from the USDA’s Economic Research Service, although the share of total US agricultural products sold through local food markets is small – direct-to-consumer sales accounted for 0.4 per cent of total agricultural sales in 2007 – it continues to develop.

According to the 2007 Census of Agriculture, direct-to-consumer marketing amounted to $1.2 billion in current dollar sales in 2007, compared with $551 million in 1997, a growth of 118 per cent, the report, Slaughter and Processing Options and Issues for Locally Sourced Meat by Rachel J. Johnson, Daniel L. Marti and Lauren Gwin says.

The 2007 numbers are the most recent available from the Census of Agriculture, which is conducted every five years by USDA’s National Agricultural Statistics Service; the 2007 results became available in early 2009. The 2012 census is currently being carried out.

The percentage of livestock operations selling product directly to consumers or retailers is much smaller than that for other agricultural products. In 2007, only 6.9 per cent of livestock operations participated in direct sales, compared with 44.1 per cent of all vegetable and melon farms (Martinez et al., 2010).

Among farms that sell locally produced food products – including local sales through intermediated channels – sales to the local level account for 65 per cent of gross farm sales for fruit, vegetable and nut farms, on average, but only 37 per cent for livestock and field crop farms.

The report says that limited slaughter and processing capacity is often cited – particularly by producers – as a key barrier to marketing their meat and poultry locally.

This report looks at the slaughter and processing capacity and options available to livestock producers selling into local markets, as well as the economic and other trade-offs of various options for animal slaughter, which could be hampering the growth of the local market for meat products.

The report says that although small, sales of foods sold via direct-to-consumer marketing have more than doubled over the last decade.

However, direct-to-consumer and intermediated sales of livestock products have not grown as rapidly as other food categories, despite apparent demand.

While a lack of local slaughter capacity is a hindrance in trying to meet growing demand, small processors claim that there is also a lack of throughput.

They demand enough predictable, year-round business to keep skilled workers and expensive equipment in operation.

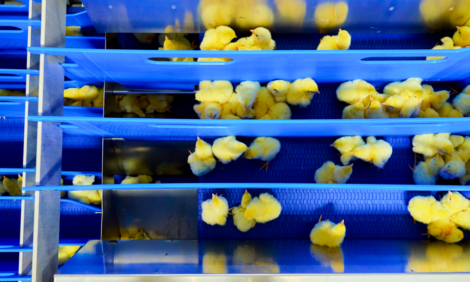

Currently, the vast majority of livestock and poultry slaughter in the United States is done in a relatively small number of very large facilities.

The report says that the industry has continued the trend of plant consolidation and growth among larger capacity operations.

Slaughtering animals at smaller State-inspected plants can also limit the marketing potential and expansion of local producers because they are restricted to sales just within the state.

As of June this year, no States yet take part in the Cooperative Interstate Shipment Program, which would allow shipments across state lines. Three states – Ohio, Wisconsin and North Dakota – are in various stages of development and training to be eligible to participate in the programme.

The report says that the regions of the United States that seem particularly deficient in local slaughter capacity are Texas, Oklahoma, Arkansas, Missouri, around the Appalachian Mountains, and scattered counties throughout the West, in the case of beef, the west coast, Colorado, the northern Midwest States, parts of Oklahoma and Texas, and many of the New England States in the case of pork, and the upper northeast quadrant of the United States as well as the Upper Midwest and the Pacific Northwest in the case of poultry.

However, the report stresses that these apparent gaps do not necessarily indicate that small slaughter facilities are needed or would be economically viable in those regions.

New methods for animal slaughter and processing geared toward local markets, for example, mobile slaughter units (MSUs), can help meet some of the need for increased slaughter capacity in localized areas and enable the growth of small livestock producers marketing products to consumers in their region or community.

Although MSUs may provide an opportunity for producers marketing locally sourced meat products, their small scale can also compromise the cost-effectiveness of the slaughter process, since more inputs are required per animal relative to larger fixed slaughter plants.

Given the current slaughter capacity and the number of units in operation now, the report says that the extent to which MSUs can help growth in local markets may be marginal in the short term.

The ERS report concludes that limited access to Federal and State-inspected slaughter facilities continues to be challenging for locally marketed livestock and meat products in some parts of the United States.

However, growth in small-scale slaughter, cut-and-wrap and processing facilities depends on whether producers in need of these services can provide enough throughput, for enough of the year, and pay a high enough fee for the services to make such facilities economically viable.

The small-scale characteristics of operations that produce, slaughter and process locally sourced meat and livestock products inhibit the producer’s and processor’s ability to benefit from economies of scale.

Innovations along the supply chain, such as more efficient distribution for local foods, including meat, and strategies to reduce high margin requirements from retailers would likely help marketing, the report says.

These innovations and others are in development and currently functioning in some regions of the United States.

However, expansion of the local meat sector will continue to depend on the willingness of consumers to pay premiums high enough to absorb the costs associated with the particular production program, processing, and the remainder of the supply chain.

Consequently, the ability of this market to grow depends on the sector’s capacity to broaden its consumer base in order to generate more consumer demand. This in turn depends on public perceptions about the value of local meat.

Further Reading

| - | You can view the full report by clicking here. |

July 2012