Rabobank's Poultry Q4 Report: The challenge of balancing volatile markets

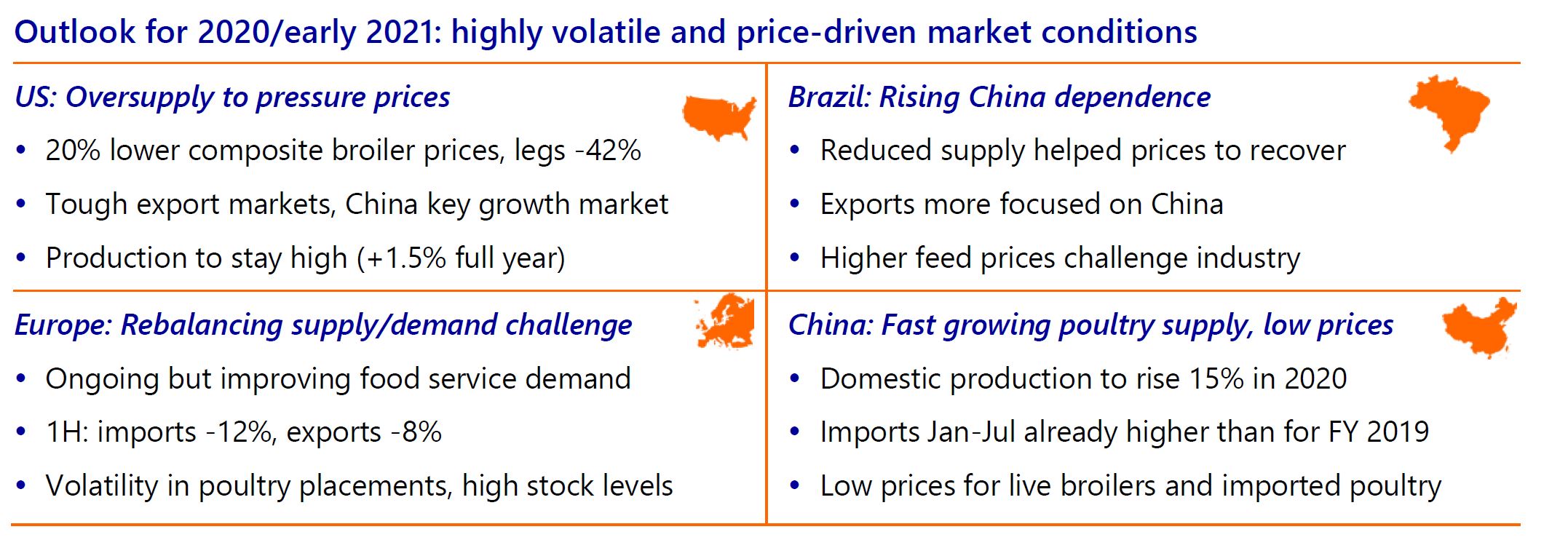

Moving through Q4 2020 and into 2021, the global poultry industry will operate in a volatile market context, with pressure coming from foodservice and wholesale markets, according to Rabobank's Q4 Poultry Report.

Possible new waves of Covid-19 will add to the market ups and downs, and the impact of a deep economic crisis will make markets more price-driven.

“Over the whole year, we expect a slight increase in global poultry production, mostly as a result of poultry expansion in China and Vietnam, where African swine fever has reduced pork availability, and also from expansion in the US. The rest of the world will be operating in an environment of shrinking production,” according to Nan-Dirk Mulder, Rabobank Senior Analyst – Animal Protein.

Global trade has become difficult, with most import markets reducing volumes. Trade into ASF-affected markets like China, the Philippines, and Vietnam has become more important, and this raises risks as local production recovers. Exporters like Brazil, the US, and Russia are focused on China, with export volumes expanding quickly, but with price concessions.

The key challenge for producers in such volatile markets is to balance supply and demand, and the experience so far this year shows how difficult this is.

Another market influencer is avian influenza which remains an ongoing risk. New cases have recently been found in Vietnam and Australia. The risk grows for Northern Hemisphere exporters with cold winter weather arriving soon to this region.