Thailand Poultry and Products Semi-Annual Overview - February 2005

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Semi-Annual 2005 report for Thailand. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Despite the fact that the HPAI outbreak severely affected the Thai broiler industry in 2004

and a growing concern over a possible human-to-human transmission caused by this severe

bird flu, Thailand’s broiler production in 2005 is estimated to recover by 5-6 percent over the

2004 level to 950,000 tons. The growth is mainly attributed to availability of unused

production capacity among poultry processors and a recovery in domestic consumption and

exports. Thailand has banned imports of live poultry and poultry carcasses, cooked or

uncooked, from the United States. FAS/Bangkok, in cooperation with USDA/APHIS, keeps

knocking on the door for Thailand to lift this ban.

Summary

The incidences of Highly Pathogenic Avian Influenza or HPAI, which first hit Thailand

in November 2003 and reoccurred in mid 2004, severely affected the Thai broiler industry in

2004. In addition, there is growing concern among the leading international health

organizations that the HPAI disease virus might mutate to be transmissible from human to

human.

Nevertheless, most Thai broiler entrepreneurs are quite optimistic that, if the disease

does not develop a human-to-human transmission vector, Thailand’s broiler production in

2005 is estimated to recover by 4-5 percent over the 2004 level to 940,000 metric tons.

This growth is attributed to improved management efforts by the relevant disease control

agencies and export-oriented producers to control the HPAI outbreak, availability of unused

production capacity among poultry processors, and a recovery in domestic consumption and,

importantly, exports.

In response to a wide pros-and-cons controversy on the idea to introduce vaccination,

the government set up a national-level committee, the National Veterinary Council (NVC), to

study possible strategies against avian influenza and later announced that vaccination would

remain prohibited. However, it is widely rumored that several poultry growers, especially

layer farmers and fighting cock breeders, have illegally used smuggled vaccines from China

and Hong Kong.

After a sharp drop in domestic consumption in 2004, broiler meat consumption in

2005 is estimated to recover by 11 percent from the 2004 level to 710,000 tons. High stock

levels (especially leg quarters) will continue to depress retail prices and stimulate demand.

In addition, the implementation of improved disease controls should rebuild consumer

confidence in the safety of chicken meat to some extent.

Thai broiler meat exports are estimated to recuperate by 29 percent in 2005 to about

270,000 tons, but this level still falls far short of record exports in 2003 (545,000 tons). A

growth in 2005 is likely to occur with increased production of cooked meat. Trade sources

foresee that these total exports (270,000 tons) should belong to cooked products only

because a likelihood of continued import suspension on uncooked chicken meat by the

governments of importing countries.

On February 12, 2004, Thailand imposed an import suspension on live poultry and

poultry carcasses, cooked or uncooked, from the United States. FAS/Bangkok, in

cooperation with USDA/APHIS, keeps knocking on the door for Thailand to lift this ban.

Production

The incidences of Highly Pathogenic Avian Influenza or HPAI, which first hit Thailand

in November 2003 and reoccurred in mid 2004, severely affected the Thai broiler industry in

2004. The public, both domestically and internationally, questioned the Royal Thai

Government (RTG)’s transparency over the handling of the HPAI outbreak. At the same

time, both exports and domestic consumption of chicken meat in 2004 dropped sharply. As

a result, it is estimated that integrated chicken operations in Thailand may lose about 5.0-6.0

billion baht (US$ 137 million) in 2004.

There is growing concern among the leading international health organizations that

the HPAI disease virus might mutate to be transmissible from human to human. As a result,

the outlook for the Thai broiler industry in 2005 is still volatile. Nevertheless, most Thai

broiler entrepreneurs are quite optimistic that, if the disease outbreak does not develop a

human-to-human transmission vector, Thailand’s broiler production in 2005 should recover

by 4-5 percent over the 2004 level to 940,000 tons. This growth is attributed to improved

management efforts by the relevant disease control agencies and export-oriented producers

to control the HPAI outbreak, availability of unused production capacity among poultry

processors, and a recovery in domestic consumption and, importantly, exports.

Although a reoccurrence of HPAI in mid 2004 hints that the disease may have already

become endemic to Thailand, trade sources believe that the incidences in bird flocks may

decline in 2005 following heavy depopulation measures conducted over several months,

increased efficient biosafety control among integrated poultry processors, and application of

illegal vaccines in the flocks of layer chicken and fighting cocks. Although heavy losses in

2004 made it difficult for several export-oriented processors to meet their cash flow

requirements while paying their debt, debtors of these poultry integrators (especially

bankers) have been flexible in their financing policies to assist these troubled entrepreneurs.

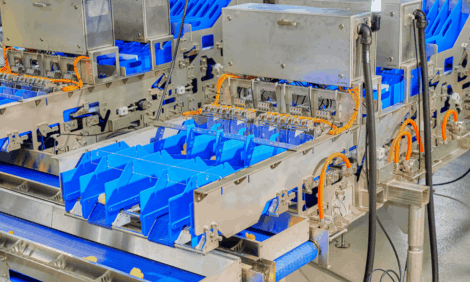

For example, one of the largest broiler processing companies is reportedly successful in

refinancing, which has helped very much to cover its cash flow need. Meanwhile, trade

sources reported that most of the processing plants can access to financial sources to boost

their cash flow and invest in production lines of cooked products for export. As a result,

broiler meat supplies, especially cooked products, will be easily increased when the demand

picks up.

As mentioned in TH4088 Poultry Annual Report, there was a rumor of the

reoccurrence of HPAI in late June and the DLD announced on July 3 its finding of a suspicious

case in a layer farm in Ayudhaya Province. The second outbreak was confirmed. The DLD

recently reported that the cumulative figures of the HPAI outbreak in Thailand from July 23

to September 3, 2004 were 119 cases in 26 provinces. The affected population was mostly

native chickens, ducks, and chicken and quail layers. However, the second outbreak was

apparently less serious than the first one, which spread out to 89 districts in 42 provinces,

with the amount of depopulation reaching about 20 million birds. The official RTG review of

the second HPAI outbreak in Thailand is presented in Appendix A.

The reoccurrence of Highly Pathogenic Avian Influenza (HPAI), H5N1 type, in July

2004 caused poultry farmers to fear that the government’s current stamping-out program

may be insufficient to eradicate the disease. As a result, a group of layer farms and native

chicken raisers (mostly small scale farmers who lack capital to improve farm biosecurity as

recommended by the government) voiced their concerns and pressed the government to

consider vaccination. However, a group of exported-oriented broiler processors strongly

opposed this idea.

The government placated the integrated producers by setting up a national-level

committee, the National Veterinary Council (NVC), in mid July to study possible strategies

against avian influenza and gave it two months to decide on introducing bird-flu vaccination

in critic al areas. The committee was to review: the disease situation, epidemiological factors

especially the transmission mechanism between flocks as well as humans, poultry production

systems, current control measures and the possibility to apply more stringent control

measures such as biosecurity in some sectors, the possibility to control and monitor

outcomes of vaccination, and lastly, the possible impact of vaccination on Thailand.

On September 15, 2004, the NVC submitted a report to the Thai Deputy Prime

Minister, agreeing that: (1) AI vaccination for all kinds of poultry would be prohibited; (2)

The government will accelerate improving farm biosecurity system in the country regarding

disease prevention into and out of farms, farm registration, improving farms to meet

required standards, movement control of birds, control of poultry slaughterhouses, and

proactive surveillance measures; (3) The government would study and research the AI virus

and vaccines to monitor possible viral mutation and to determine the proper measures in the

case that any serious outbreak occurs. However, this research would be conducted in

laboratory and by the government only; and (4) The government would closely consult with

relevant international organization and trading-partner countries before it introduces

vaccination for ornamental birds and fighting cocks.

Although AI vaccination is prohibited, it is widely rumored that several poultry raisers,

especially layer farmers and fighting cock breeders, have illegally used smuggled vaccines

from China and Hong Kong.

In response to questions by the public, mainly from buying countries of Thai chicken

meat, the Ministry of Public Health (MOPH), an agency that directly monitors the use of

animal vaccines, officially banned the use of bird flu vaccine and started a crackdown on any

violation. A regulation was adopted to ban the import, production, sale and use of all avian

influenza vaccine in the country. Public Health Minister Sudarat Keyuraphan said in mid-

August that the government took the action for the sake of public health, and anyone

violating it would face up to 5 years' imprisonment. Meanwhile, the ministry also opened a

hot line and offered a cash reward for those reporting the violators. The Ministry later raided

some suspected poultry farms in Thailand. However, trade sources indicated that the MOPH

found it difficult to arrest violators, mainly because the MOPH lack information on the poultry

farms and proper methods of tracing back illegal use of vaccination in animals. More details

on vaccination in Thailand are reported in FAS/Bangkok’s report (TH4177).

Average live broiler production costs in 2005 are forecast to decline to some extent

due mainly to the likelihood of less expensive feed ingredients (especially soybean meal and

corn) and anticipated improvements in overall disease control and surveillance.

Consumption

After a sharp drop in domestic consumption in 2004, broiler meat consumption in

2005 is estimated to recover by 11 percent from the 2004 level to 710,000 tons. High stock

levels (especially leg quarters) will continue to depress retail prices and stimulate demand.

In addition, the implementation of improved disease controls should rebuild consumer

confidence in the safety of chicken meat to some extent.

Domestic prices for live broilers are currently at 29-30 baht/kg (33-35 cents/pound),

as opposed to 26-27 baht/kg (30-32 cents/pound) in January 2004. Retail prices for chicken

boneless breast meat in Bangkok are 53-54 baht/kg (62-63 cents/pound), down from 63-64 baht/kg (73-75 cents/pound) in January 2004. Trade sources reported that prices for leg

quaters reduced sharply from about 45 baht/kg (52 cents/pound) from mid 2004 to currently

25-30 baht/kg (29-35 cents/pound), reflecting the high stocks of these chicken parts.

Trade

Many trade sources believe that Thai broiler meat exports should recover from

210,000 tons in 2004 to about 270,000 tons in 2005, mainly because of the superiority of

Thai cooked products (in terms of quality and pric es) over such other competitors as China

and Brazil and be cause of the ability of Thai producers to increase cooked product supplies

quickly. However, this export level still falls far short of record exports in 2003 (545,000

tons). Trade sources foresee that these total exports (270,000 tons) should belong to

cooked products only because a likelihood of continued import suspension on uncooked

chicken meat by the governments of importing countries. Cooked products should be mostly

exported to the EU, Japan, South Korea, Singapore, and Hong Kong.

The trade disruption with the primary importing countries heavily troubled all

integrated broiler producers in 2004. First, a few large integrated operations have just

recently completed full plant and farming capacity integration and took on debt to pay for the

improvements. Second, most small and medium scale operations had not focused on cooked

products before the crisis. A ban on uncooked products forced these operations to struggle

to diversify their production into cooked products. Third, all producers are forced to compete

fiercely in selling cooked products while overseas demand for cooked products, especially

high valued items, grows slowly. However, all integrated processors are likely to adjust

themselves to this new trade environment much better in 2005.

As Thailand is not exporting uncooked chicken products, there are no export price

quotations on basic uncooked items such as boneless leg (BL) and Skinless Boneless Breast

(SBB) from Thailand. Trade sources reported that C&F price quotations for cooked products

are in a wide range of US$ 2,200-4,000/ton. Prices for fried box-shape-cut boneless leg, one

of the basic cooked products, have dropped from about US$ 3,000/ton in mid 2004 to

currently US$ 2,200-2,400/ton, due to fierce competition among Thai packers. Meanwhile,

prices for high value-added items, such as grilled seasoned boneless breast/leg in stick, are

still profitable at US$ 3,500-4,000/ton. Cooked chicken products are normally

made-to-order meat products that are processed or prepared by heat (such as grilling,

steaming, boiling, etc.). Some of these cooked meat products are puffed or seasoned (with

salt, Japanese sauce, etc.).

Stocks

Trade sources reported that current stocks held by all poultry meat exporters are

about 130-140,000 tons, down from 160-180,000 tons in mid 2004, due mainly to a

production scale-down and heavy sales of leg parts into the domestic market.

Policy

In general, Thailand’s policy for the poultry industry has not changed from the

previous report in 2004. Thailand does not conduct price support and export subsidy

programs. Because of the HPAI outbreak, the Royal Thai Government (RTG) launched

several measures to cope with the disease and to support the poultry industry, from farmers

to integrated poultry processors. These measures include the HPAI Stamping-Out Campaign on poultry farms/areas, a compensation scheme for disease-affected farmers, fee

exemptions for chicken slaughterhouses, and outreach to help unemployed

workers/operators. More details in these programs are available in the TH4088 Report.

In addition to producer support, the RTG, lobbied by a group of integrated broiler

processors, proposed in late 2004 a barter-trade to the Russian government of Thai chicken

meat for Russian fighter aircraft. The idea is to dispose of the huge stocks held by exporters.

However, Russia finally did not agree to these negotiations mainly because Russia normally

buys a limited amount of imported frozen chicken meat, and has implemented strict health

requirements on imported meat products.

On January 25, 2005, the Cabinet approved an additional budget of 4.7 billion baht

(approx. US$ 120 million) for a three-year bird flu eradication plan and contingency

measures to cope with the possible outbreak of human-to-human infection. It was reported

that about 741 million baht (about US$ 19 million) would be set aside for contingency

measures such as establishment of new human vaccine labs, education program, and

procurement of equipment and anti-viral medicine.

Thailand is a protected poultry market through the government’s use of nontransparent

controls of the import permit requirement (potential importers are unable to get

them issued), high WTO bound rates of import tariff (currently 30 percent for chilled or

frozen uncooked meat and 40 percent for cooked chicken meat), and a discriminatory import

permit fee on uncooked products (approx. US$ 250/ton).

As a result of import control practices, the U.S. can only supply commodities that do

not compete with domestic production, including broiler genetics and turkey meat, to

Thailand. However, Thailand has taken other steps that disrupt the trade flow by reacting

stringently to the findings of Avian Influenza cases in the United States. On February 12,

2004, the Department of Livestock Development (DLD) imposed an import suspension on

live poultry and poultry carcasses, cooked or uncooked, from the United States.

FAS/Bangkok, in cooperation with APHIS, has repeatedly requested the Thai

government to lift the ban or accept a regionalization concept to allow U.S. live poultry and

poultry products for entry into Thailand. The Thai authorities disagreed with the proposed

regionalization idea by claming that they also receive the same reactions from their buying

countries with regard to the emergence of the HPAI outbreak in Thailand. Although the Thai

authorities recently agreed in principle to accept U.S. cooked products for entry,

USDA/Washington and FAS/Bangkok are negotiating with Thai authorities to waive some

additional unnecessary health requirements imposed by Department of Livestock

Development (DLD) on U.S. poultry imports. In addition, FAS/Bangkok also put forth

USDA/APHIS’s request to the Thai DLD to remo ve the ban on all live poultry and poultry

products (uncooked and cooked products) as the United States eradicated the HPAI disease

in the country. The DLD has not yet responded to this request.

Marketing and U.S. Opportunities

Thailand is a potential market for U.S. chicken parts (especially leg-quarters),

mechanically deboned meat (MDM), and value-added chicken meat. Thai local consumers,

like those in other Asian countries, prefer dark meat to white meat. Recent official data

indicated that prices for bone-in legs in the Thai market are only 9-10 percent cheaper than

breast meat, compared to approximately a 30 percent differential in the U.S. market. In

preliminary price analysis, FAS/Bangkok found that the hypothetical costs of U.S. legquarters

imported to Thailand should be 10-20 percent cheaper than domestic wholesale

prices for leg-quarters sold in Bangkok. This is also the case for MDM. Potential buyers for

chicken parts and MDM should be food processors (sausage processors in the case of MDM)

and supermarkets. Value-added chicken meat can be introduced to modern retail markets

and HRI industry. Thailand may import bone-in-leg meat for processing in Thailand and reexport

it to such markets as Japan and non-EU countries. The current existence of HPAI

outbreak in Thailand should offer opportunity for Thai processors to source raw material from

the U.S. and add flavorings, treatments, and cook for re-export.

Thailand has been a promising market for U.S. turkey meat. Although the offic ial

imports of turkey meat (reported by the Thai Customs Department) were only USD 24,000 in

value in the first 11 months (Jan-Nov) 2004 compared to about USD 100,000 in 2003 (Jan-

Dec), trade sources indicated that the actual figures highly exceeded this number due to the

prevalent smuggling activities in Thailand. Because of a ban on U.S. poultry, the U.S. market

share in 2004 dropped from the normal 90-100 percent of total imports to 44 percent. Fine

hotels/restaurants and modern trade supermarkets in large cities use nearly all of import

turkey meat.

Further Information

To read the full report please click here

List of Articles in this series

To view our complete list of 2005 Semi-Annual Poultry and Products Semi-Annual reports, please click hereSource: USDA Foreign Agricultural Service - February 2005