US Poultry Outlook Report - December 2005

By U.S.D.A., Economic Research Service - This article is an extract from the December 2005: Livestock, Dairy and Poultry Outlook Report, highlighting Global Poultry Industry data.

Poultry

An uncertain export market situation, rising stocks, and an increase in production in October has placed downward pressure on most broiler prices. Cold storage holdings for the end of the third quarter were revised upward by 18 million pounds, and broiler meat production was 5 percent higher in October. Prices for breast meat products and leg quarters in November were down 18 and 2 percent from last year. Turkey supplies and prices are the exact opposite, with tight supplies from little growth in production and a strong export market, pushing most turkey prices higher.

Eggs

Wholesale table egg prices (NY grade A large) in the third quarter of 2005 averaged 66.6 cents a dozen, compared with 55.9 cents a dozen, or 19 percent higher than the second quarter. For all of 2005, wholesale table egg prices (NY grade A large) are expected to average 64.6 cents per dozen, substantially less than last year’s close of 82.2 cents per dozen. For 2006, wholesale egg prices are expected to average between 63 and 68 cents per dozen.

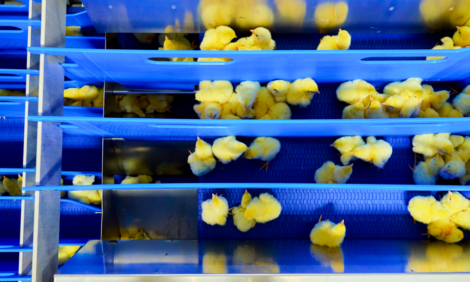

Broiler Meat Production Up 5 Percent in October

Broiler meat production totaled 3.04 billion pounds in October, up 4.7 percent from

October 2004. Over the first ten months of 2005 broiler production has totaled 29.5

billion pounds, 3.7 percent higher than the previous year. The increased meat

production in October was the result of both an increase in the number of birds

slaughtered, up 1.9 percent, and an increase in the average live weight of birds at

slaughter, up 2 percent to 5.5 pounds. So far in 2005, the average weight at

slaughter for broilers has been 5.35 pounds, which is 1.7 percent higher than in the

same period in 2004. The growth in live weight at slaughter combined with gains in

the number of chicks being placed for growout, points towards continued increases

in broiler meat production through December and into 2006. Over the last five

weeks (October 29 to November 26, 2005), the number of chicks being placed for

growout has averaged 167 million per week, an increase of 2 percent over the same

period the previous year.

Cold storage holding of broiler products at the end of the third quarter was revised

upward to 753 million pounds. This is a 9.6 percent from the end of the second

quarter, but still 21 million pounds less that at the end of the third quarter 2004.

Stocks of most broiler products have risen over the last quarter, but stocks of breast

meat and leg quarters have accounted for most of the increase. Stocks continued to

grow in October with breast meat totaling 145 million pounds, up 7 percent from

the previous year. Stocks of leg quarters had reached as low as 54 million pounds

earlier in the year, but by the end of October had grown to 113 million pounds,

however this is still 3 percent lower than at the same time in 2004.

Larger production and growing stocks have put downward pressure on most broiler

prices. The two most dramatic declines have been for boneless/skinless breast meat

and leg quarters. Boneless/skinless breast meat prices in the Northeast market

averaged $1.03 per pound in November, down 18 percent from last year and down

from a high of $1.53 per pound in February. Leg quarter prices in the Northeast

market averaged 29 cents per pound in November, only 2 percent lower that last

year, but through most of 2005 leg quarter prices had been very strong, averaging

over 40 cents per pound from June to October. Prices for leg quarters have fallen

chiefly due to uncertainties in export markets. The price of whole broilers was also

lower in November at 67 cents a pound, down 2 percent from the previous year and

2 cents lower than the October price.

In the weekly AMS Broiler Market News Report, there is a breakout of the total

number of broilers being slaughtered into three different size classes. Since the end

of September the number of broilers with a live weight of over 5.25 pounds (the

heaviest size class) has averaged a double digit growth rate compared with the same

period in the previous year. This growth in the percentage of all broilers being

slaughtered that fall into the biggest size class has driven up the average live weight

at slaughter and since most broilers of this size are cut up for parts, it has placed

more parts meat on the market placing downward pressure on prices.

October Turkey Meat Production Up 4 Percent

Turkey meat production in October was reported at 483 million pounds, up 3.6

percent. A 3.6-percent increase in the number of birds being slaughter accounted

for the increase as the average live weight of birds at slaughter was 26.9 pounds,

down slightly from last year. Even with the increase in October, turkey meat

production so far in 2005 is up less than 1 percent from the same period in 2004.

Although a higher number of birds were slaughtered in October, this is the opposite

of what was happening in the turkey industry at the beginning of 2005. In the first

quarter of 2005, the number of birds being slaughtered was down 6 percent from the

previous year, but total meat production was up 1 percent because the average live

weight of turkeys at slaughter was 29.3 pounds, 6.5 percent higher that the previous

year. For most of 2005 the average live weight of turkeys at slaughter has gradually

been declining. As supplies have tighten in 2005, turkeys are being slaughtered at

slightly lighter weights to keep supplies moving to consumers.

With little overall growth in turkey meat production and a strong export market,

stocks of turkey products have gradually fallen and prices for almost all turkey

products have increased. Cold storage levels for turkey products at the end of the

third quarter were revised downward to 478 million pounds, down 9.4 percent from

the same period in 2004. The decline was due to a mixture of lower stocks of whole

turkeys and turkey products.

Prices for turkeys and most turkey products were moving in the opposite direction

from broiler products. Prices for whole hens in the Eastern market averaged 87.8

cents per pound in November, up 9.5 percent from the previous year. Throughout

2005, prices for whole birds have been at or above the previous year. Prices for

turkey parts have also been strong, with prices for breast meat averaging $1.18 per

pound in October, up 21 percent from a year earlier. Prices for drumsticks and

fresh mechanically separated meat were also higher, 7 and 16 percent above the

previous year.

Over the first 10 months of 2005, the number of turkey poults being hatched for

growout has averaged 23 million per month, down slightly from the same period in

2004. This indicates that turkey meat supplies are expected to remain tight through

the remainder of 2005 and through at least the first quarter of 2006.

Broiler Exports Down From Previous Year but Recover From September

Broiler exports at 520 million pounds for October are down 9 percent from October

of last year. Lower shipments to Commonwealth of Independent States countries

(-38 percent), Eastern Europe (-38 percent), the Baltic States (-61 percent), and the

Caribbean (-41 percent), accounted for most of the decline. Lower exports to these

and other smaller markets may have been due to high leg quarter prices. Leg quarter

prices were as high as $0.46 per pound in October before declining in November to

$0.29 per pound (Northeast Market Prices). Lower export demand may also reflect

importer concerns about consumers’ reactions to recent Avian Influenza discoveries

in Asia and Europe.

Exports in October were almost balanced by very large exports to Russia.

Shipments to Russia totaled 216 million pounds, the largest monthly export of U.S.

broiler meat in 3 years. Shipments to Russia increased by 193 percent from

September’s 74 million pounds, likely due to recovery of exports following Gulf

Port disruptions.

October Turkey Exports Continue Strong

Total U.S. turkey exports in the first 10 months of 2005 were 470 million pounds,

33 percent higher than the same period last year. Exports this year are clearly being

driven by Mexican demand for imported turkey meat. So far this year, Mexico has

accounted for about 63 percent of U.S. turkey exports. A favorable exchange rate--

the peso has appreciated more than 6 percent against the U.S. dollar in the last 12

months--continued strong macro economic growth in Mexico supported by oil

prices, in addition to population increases are likely contributing factors to strong

demand for U.S. turkey products.

In addition to the factors mentioned above, Mexico’s consumption growth of U.S.

turkey may have come at the expense of higher U.S. pork prices and slower

increases in pork imports from the United.States. The average monthly shipment of

pork to Mexico in 2005 was 42,831 million pounds, 4 percent (44,651) less than

2004 shipments. A similar story could be told for beef and veal given the tight U.S.

supplies and high prices of both commodities.

U.S. Egg Prices Rebound in the Third Quarter

Wholesale table egg prices (NY grade A large) in the third quarter of 2005 averaged

66.6 cents a dozen, 19 percent higher than the 55.9 cents a dozen reported in the

second quarter. For all of 2005, wholesale table egg prices (NY grade A large) are

expected to average 64.6 cents per dozen, substantially less than last year’s close of

82.2 cents per dozen. For 2006, wholesale egg prices are expected to average

between 63 and 68 cents per dozen.

Retail egg prices averaged $1.20 cents per dozen in the third quarter, 3.4 percent

higher than the second quarter. But for all of 2005, retail egg prices are expected to

average in the low $1.20s per dozen, a price much lower than the 2004 record high

of $1.34 per dozen. Retail egg prices in 2006 are forecast to be about unchanged

from 2005.

During the third quarter of 2005, the total number of U.S. table egg layers declined

by a total of 1.2 million birds, compared with the second quarter. However, the

monthly average eggs produced per 100 layers rose from 2,231 to 2,267 over the

same period. Consequently, U.S. table egg production increased from 1,580 million

dozen in the second quarter to 1,603 million dozen in the third quarter.

Total U.S. egg production in 2005, table and hatching, is expected to rise to 7.5

billion dozen, less than 1 percent over 2004. Table eggs are expected to account for

about 85 percent of total production in 2005, and likely will stay at this same

percentage in 2006. Hatching egg production in 2005 is expected to rise by a little

over 1 percent, reflecting higher egg and broiler production.

U.S. Eggs and Egg Products Strongly Up

During the first 10 months of 2005, U.S. eggs and egg product exports (in-shell egg

equivalent), rose substantially from 133 to 173 million dozen, 30 percent higher

than the same 10-month period in 2004. Exports of processed egg products were

the front runner, showing a substantial increase of 67 percent in volume terms,

followed by table eggs at 22 percent higher than the same period a year ago.

U.S. table egg export shares reversed direction during the first 10-months of 2005.

U.S. export share to East Asia (Japan, China, and Hong Kong) more than doubled

from 24.5 to over 50 percent, while the share to Mexico and Canada declined from

67 to 41 percent. Hong Kong and China were the largest export markets for U.S.

table eggs, receiving 19.5 million dozen, compared with only 10.7 million dozen

during the same period last year.

For all of 2005, total U.S. exports of eggs and egg products are expected to reach

200 million dozen, up 19 percent from last year. This increase in U.S. exports of

egg and egg products is mainly due to the lifting of all restrictions imposed by many

countries following outbreaks of low pathogenic Avian Influenza in early 2004.

For 2006, U.S. exports are estimated to be unchanged at about 200 million dozen.

Links

For more information view the full Livestock, Dairy and Poultry Outlook - December 2005 (pdf)Source: Livestock, Dairy and Poultry Outlook - U.S. Department of Agriculture, Economic Research Service - December 2005