CME: Drop in Domestic Meat Consumption Expected

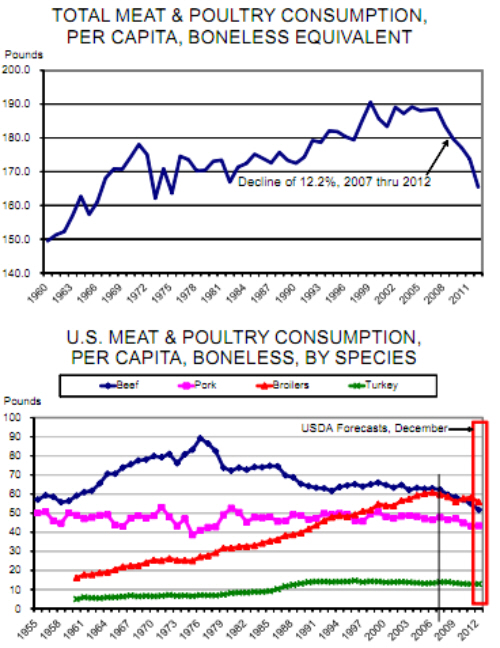

US - USDA's December forecasts indicate another sharp drop in US domestic meat and poultry consumption is coming in 2012, write Steve Meyer and Len Steiner.That should come as no surprise to industry observers but the cumulative reductions of the past few years are rather shocking in historical context. The top chart at right shows total US meat and poultry per capita consumption on a boneless equivalent (BE) basis from 1960 through 2011 with the 2012 observation representing the boneless equivalent of USDA’s December WASDE forecasts of retail weight consumption.

We use boneless equivalent here because it best represents the amount actually consumed by people after allowing for pet food usage (a major contributor to the difference between carcase and retail weight) and wastage such as bones and skin, the latter being an important factor for chicken.

These data indicate that the average American will consume 12.2 per cent less meat and poultry in 2012 that they did in 2007. Note that the high for BE consumption was in 1999 at just over 190 pounds per person. After a seven pound decline through 2001 due to reductions in domestic consumption of all three major species — primarily driven by growing exports –- total consumption stabilised from 2002 through 2007 at very near 189 pounds. Then came 2008 and the beginning of this precipitous drop.

The bottom chart shows the same data for each of the four major species with the vertical black line marking 2007. Note that that year marks the beginning of downtrends for all species, including chicken whose steady growth, before that point, had been practically bullet-proof. Even pork consumption, which had been quite steady since the early 1980s began to fall in 2008 and the downtrend for beef consumption accelerated. There are a number of reasons for the change. Among them are:

Growing exports. This is especially true for pork which saw exports jump by more then 40 per cent in 2008 and will set another record this year. Beef exports also grew as they recovered from the 2003 BSE discovery. Larger exports meant lower domestic “availability” and thus lower consumption. This began to be a real factor when production increases were limited by the next factor.

Higher costs. It is no coincidence that the rapid growth of cornbased ethanol production coincides with the downtrend in U.S. meat and poultry consumption. The first major diversions of corn to ethanol drove feed costs higher and producers of all species saw floods of red ink. Some reduced output. Others were forced out of business thus further reducing market supplies. Domestic availability was reduced in order to push prices high enough to cover the new level of costs. It was a classic economic response to a heretofore outside shock. Exploding oil prices added fuel to the fire (pun fully intended) by making ethanol, and thus corn as a fuel feedstock, even more valuable.

The fruition of 30-40 years of government policy. This doesn’t get a lot of talk but, to us, it is the elephant in the room. If the federal government and its agencies decide to wage war on a product and continue that war for long enough, it will eventually have an impact. And the feds have indeed waged war on meat protein consumption for many years. Add in the efforts of a large number of non-governmental agencies that oppose meat consumption for reasons ranging from the environment to animal rights to social justice and one could conclude that it was amazing that consumption held up as long as it did.

Will meat and poultry consumption turn around? We concur with USDA that they will not, at least in the short run. The drop to 165.5 pounds in 2012 will be driven by lower beef and chicken supplies. The latter of those may level off in 2013 but beef output will almost certainly decline again with the total very likely falling below the 162.9 of 1973 and quite possibly reaching the 161 of ‘66