CME: Overseas Market to Boost Meat Export Growth

US The latest US meat export data showed tremendous growth in pork exports and sustained increases in beef and poultry shipments, but it also highlights the growing dependence on foreign purchases, particularly from Asian markets, write Steve Meyer and Len Steiner.

The surge in export demand helped pork prices avoid

much of the seasonal price decline in Q4 but the market remains

vulnerable to a possible correction in export shipments, especially if Chinese purchases slow down.

Below is a brief recap of the

latest numbers:

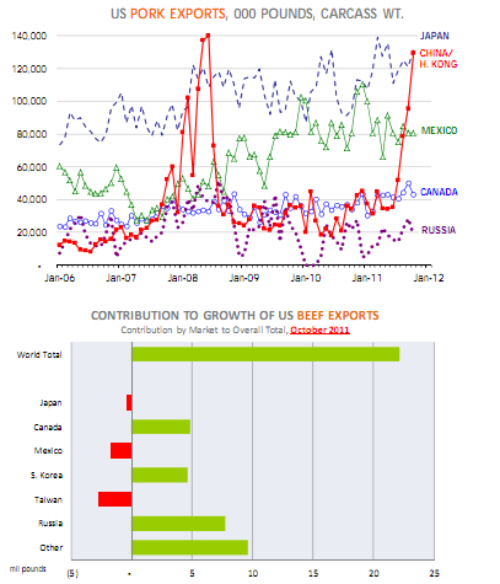

Pork: Total US pork exports in October jumped some 40 million pounds or nine per cent compared to the previous month and were

143 million pounds or 42 per cent larger than a year ago.

The

graphic below shows monthly pork exports to the top five

US pork markets. In October, these markets accounted for 85 per cent

of all US pork shipments.

While most markets have registered

strong growth in the past five years, shipments to China/Hong

Kong remain fickle.

Exports to this market have tripled in just

four months making it once gain the second largest export destination for US pork, after Japan. It is a situation eerily similar

to the summer of 2008 when Chinese buyers ramped up purchases to fill short term needs but then left just as quickly when

domestic supplies recovered.

The outlook for Chinese domestic

pork supplies remains critical for US pork exports and US pork

prices in 2012.

China has the world’s largest sow herd, estimated at 47.5 million head (USDA/FAS) or 61 per cent of the global breeding stock. By comparison the US breeding stock stands at less

than six million head. According to USDA, the Chinese sow numbers were down three per cent at the start of 2011 and are expected to be

slightly lower on 1 January, 2012.

Rampant inflation in feed

costs stunted Chinese pork production in the last 12-18 months.

But, with feed prices drifting lower, not just in the US but globally, it is a matter of time until Chinese producers start expanding again.

Different from the US, where most operations are

large scale and require significant capital investment to expand,

in China the majority of production is in backyard operations.

This makes those operations much more sensitive to changes in

feed prices but also more flexible in expanding production.

Beef: US beef export growth remains positive even as the

growth rate has slowed down. Total shipments in October

were 230 million pounds in October, 10.7 per cent higher than a year ago.

Key markets, such as Japan and Mexico, actually

declined in volume compared to last year. Exports to Russia

have more than doubled and even though that market accounted

for about six per cent of US beef exports, it contributed more than a third

of the growth in beef exports.

Broilers: Broiler exports in October were 689.7 million pounds,

2.5 per cent higher than a year ago and the second largest monthly export volume on record. Exports to Russia are down 70 per cent from a

year ago but other markets have picked up the slack.