CME: USDA Reinstates Its Cancelled Reports

US - Less than two months after announcing it was discontinuing a number of programmes, USDA reversed course and announced on Friday that most, but not all, of the proposed cancellations will be reinstated, write Steve Meyer and Len Steiner. Below is a

list of reports of interest to livestock market participants

and implications:

July Cattle Inventory Report: Reinstated.

The midyear cattle inventory survey provide, among other things,

an accounting of the number of cattle outside feedyards, a

measure of the supply picture in Q3 and Q4.

The survey

also is closely watched to benchmark estimates of herd

expansion/contraction and forecasts for beef supplies two

years forward. Market analysts, both at USDA and in the

private sector, rely on the cattle inventory data to project

forward cattle prices.

The data also is a key benchmark

used by participants in futures markets to assess forward

pricing. Removing the mid-year benchmark would have further

increased uncertainty in cattle markets and reduced the reliability of forward estimates provided in official government reports.

Needless to say, this was a welcome turn of events and good

news for cattle markets

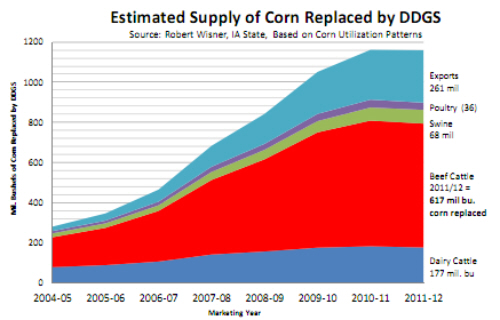

Distiller Co-Products for Feed Survey: Discontinued

This

report was discontinued even before it started. This was supposed to be an annual survey of US livestock and poultry users

regarding their consumption of ethanol by products which go

into the animal feed supply. So far, analysts have relied on

broad ethanol production and feed consumption data to extrapolate the overall consumption of these by-products.

The chart

below is based on data calculated by Professor Wisner at Iowa

State. Based on his projections, ethanol by-products have displaced about 1.2 billion bushels of corn from the national feed

supply and export markets. The proposed USDA survey was

supposed to provide much more rigorous and nuanced data as to

the channels using such products.

This would have allowed analysts to improve their projections of corn feed use in forward

quarters and likely reduced the volatility in livestock and poultry prices relating to changes in the price of corn, still the primary input in US meat protein production. The survey was also

supposed to provide details on the “decision to use the feed, including nutrient values, product consistency, product form, product testing, inclusion rates, economics, shelf life, storage and

transportation (ethanolproducer.com).”

All that will have to

wait and industry will continue to rely on projections and estimates. It remains to be seen if this will be covered in the 2012

Ag Census, which will be conducted in late 2012 and 2013.