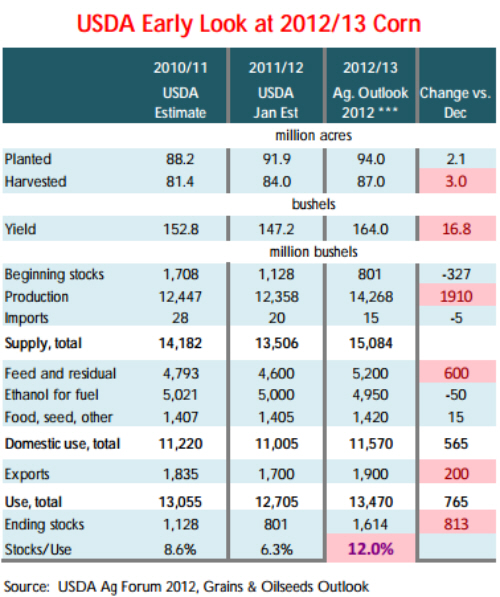

CME: Bearish Corn Outlook for 2012/13

US - USDA presented a decidedly bearish outlook for US corn supplies and prices in 2012/13, writes Steve Meyer and Len Steiner.

The 2012/13 outlook

was expected by market participants, however, considering

much speculation among market participants that farmers will

add some +2 million corn acres this spring. USDA’s early estimates are based on trend yields for the period 1990/91 -

2010/11, leaving out the yield from last year which was seen as

an outlier. The USDA balance table uses a trend yield of 164

bushels per acre, on the high side of private analyst estimates.

The combination of higher yields and higher acres is expected

to generate an almost 2 billion bushel increase in US corn production come fall. The increase in production is large enough to

double expected ending stocks for 2012/13. If this type of increase materializes, it would likely pressure corn prices below

the $5 benchmark by Q4 of this year and in early 2013. December corn futures, however, still are hovering at around $5.60/

bushel.

On the demand side, USDA expects a big increase in

the amount of corn going into livestock and poultry feed. Total

feed and residual (unknown use) for the 2012/13 marketing

year is projected at 5.2 billion bushels, the highest since

2007/08 when corn feed use was 5.858 billion bushels. Much

has changed in US livestock and poultry feeding since then,

however. The primary change has been the inclusion of more

ethanol by-products in livestock and poultry feed (DDGs). By

some estimates, these by-products have displaced more than 1

billion bushels of corn.

The USDA projection for a 600 million

bushel increase in feed use implies increases in both livestock

and poultry numbers. It is a given that the increase will not

come from the cattle industry given a smaller calf crop and the

potential for some heifer retention in 2012/13, which will limit

the number of cattle going into feedlots. Hog slaughter for 2012

is forecast to increase by 2% in 2012 while hog weights are seen

as flat. This kind of increase in pork will be insufficient to absorb the expected 13% jump in feed use. This leaves broiler

industry as a primary candidate for higher corn use. So far

broiler producers show little appetite for expansion, as evidenced by the lower egg sets and chick placements. USDA 2012

forecast is for broiler production to be down 3% from year ago

levels. A good part of this decline will likely happen in the first

half of 2012, however. Still, there is plenty of uncertainty about the outlook for future feed use. Should current feed estimates

fall short, it will further add to the projected ending stocks.

USDA believes that ethanol has hit the blend wall limit and

demand will struggle given lower gasoline consumption in the

US (less gasoline means less ethanol needed to create a 10%

blend). Corn exports are forecast to rise by 200 million bushels

although there is ongoing uncertainty about Chinese corn demand in the upcoming year. In all, a generally bearish view of

US corn supplies, which bodes well for US livestock and poultry

producers. Now if we could only get Mother Nature to read the

report and concur.