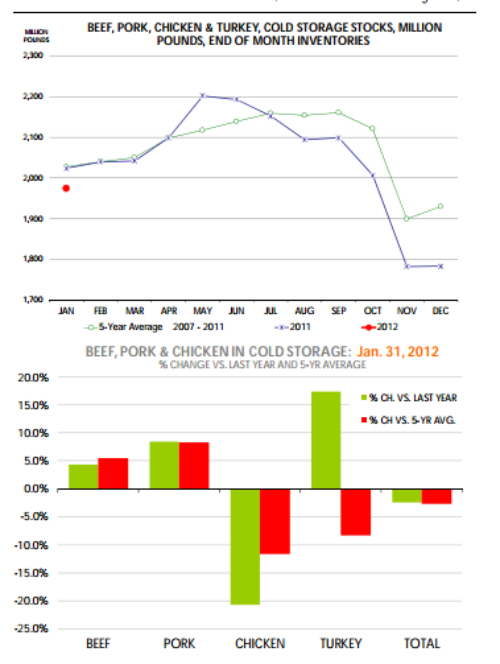

CME: Beef, Pork & Poultry Stocks Down from Last Year

US - The latest USDA cold storage report (released on 2/22) showed that total US beef, pork and poultry stocks remain below year ago levels, write Steve Meyer and Len Steiner.

The

monthly survey pegged total beef, pork and poultry stocks as of

January 31 at 1.974 billion pounds, 2.5% lower than a year ago

and 2.6% lower than the five year average (see chart).

The lower stocks, however, were largely due to the sharp reduction in

the supply of chicken in cold storage. Broiler producers

have been cutting back for more than six months and this appears to have cleaned up the backlog of product that was created

in the first half of 2011. While stocks of broiler leg quarters and

wings have been tight for some time, we are now seeing breast

meat stocks also decline sharply. The latest report pegged the

supply of chicken breast in cold storage at 116.6 million pounds,

21% lower than a year ago and 14% lower than the five year

average. While the USDA data may not capture all the supply

of chicken in freezers across the US, the data does provide an

indication of the year/year trend in cold storage supplies. The

chicken data is important since this is the time when retailers

and foodservice operators are looking at their spring and summer promotions and will try to book product ahead of what appears to be an inflationary grilling season. Chicken breasts

have been seen as the value option so far but prices will likely

not stay down for long given ongoing supply cutbacks and tight

freezer inventories.

While the chicken data painted a generally bullish picture for protein, the pork data was ambiguous. Yes, stocks are

up and that could be seen as bearish but we think a good part of

the increase in stocks may have to do with more product being

put away for export. Those that have a more bearish take on

the report will likely note that it is not a good sign when cold

storage stocks of pork loins, an item that generally finds good

demand in January, rise 25% on year ago levels. Total pork

stocks as of January 31 were pegged at 584.4 million pounds,

8.5% higher than a year ago and 8.3% higher than the five year

average. However, inventories of hams do not appear burdensome at this time, about steady with year ago levels. Pork belly

inventories at 53.7 million pounds were 4.6% higher than a year

ago. Judging from the strong belly pricing, we will likely see

belly stocks climb fast in February and March as end users try

to use freezer hedges ahead of the spring and summer demand

One indicator that some of the increase may be export related is

the big jump in stocks of pork variety meats, up 33% from a year

ago and unclassified pork products, up 29% from a year ago.

Inventories of beef in cold storage were reported at

482.1 million pounds, 4.4% higher than a year ago and 5.6%

higher than the five year average. Beef imports early in the

year were better than the year before and that may have contributed to the modest increase in beef stocks.

Further Reading

| - | You can view the full report by clicking here. |