CME: Chicken Prices Finally Rose in January

US - There's Hope! Or at least we think there is hope given last week's retail meat price data from the Bureau of Labor Statistics via USDA's Economic Research Service, write Steve Meyer and Len Steiner.As you can see in the charts below - if you look REAL hard - retail chicken prices finally showed

signs of life in January, rising 6.2 cents/lb. (3.4%) from December to

reach $1.855 per pound (+5.5%, yr/yr). The January price is just 0.2

cents lower than the record composite chicken price set in May 2009.

Some of you may think we have gone completely off our

rockers to make so much of such a small increase in prices but it is the

first indication that broiler companies’ hugr reductions in output are

having an impact at retail.

Broiler production was 7.6% lower than

one year earlier in the fourth quarter of 2011 and is down 6.1% so far

in 2012. Broiler egg sets and chick placements remain sharply lower

than last year at -5.2% and -3.8%, respectively, but those numbers

indicate that the year-on-year declines may be slowing.

There are time lags to consider, no doubt, but we would wonder if the reductions are large enough yet to drive lasting improvements in margins. Our main concern remains breast meat, which,

when one considers boneless/skinless, tenders and bone-in breasts,

accounts for 38-40% of the cutout value. Wholesale boneless/skinless

breasts fell to just over $1.22/pound two weeks ago, their lowest level

since November. This price has not been above $1.37 per pound

since October 2010 about the time the last round of "post-high-feedcost" expansion hit the market. The "post" part of that qualifier, of

course, did not last long and broiler producing companies have, until

just recently, seen a steady stream of red ink. We hope this marks

the beginning of a trend - for those companies, their growers and

employees and beef, pork and turkey producers as well.

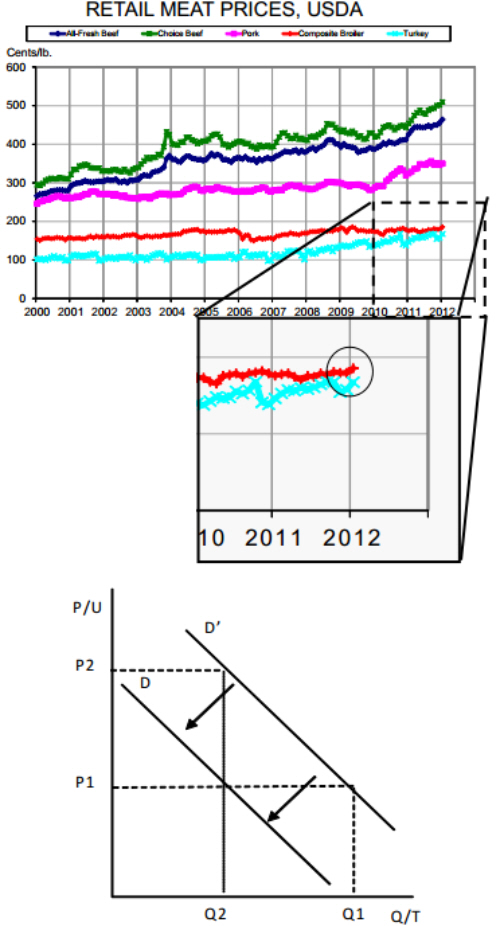

By the way, Choice beef and All-fresh beef set new records in January as well. Choice beef averaged $5.093/lb., 12.1%

higher than last year. The average price of all fresh beef was $4.640,

up 8.7 cents from last month and 9% higher than one year ago. Pork

and turkey prices increased in January, too. Both fell short of setting

new records but turkey only missed by 0.5 cents/pound so, given the

normal rise of turkey prices during the year, new records are almost

guaranteed. Ditto for pork.

So are these high prices causing "demand destruction"?

Absolutely NOT. There is a reason for high prices - LOWER SUPPLIES. And there is a reason for lower supplies - HIGHER COSTS.

Higher retail prices are the manifestation of higher costs and resulting

losses and lower output/availability/consumption. Consumption is less

because less product is available to consumers. That's the same reason prices are higher. Exports play a role as well but the big driver is

the huge increase in costs since 2006. Do fewer people want to eat

meat? Perhaps. But it is certain that a) fewer people want to eat meat

and b) more people want to eat less meat when it is priced at recordhigh levels — especially when personal incomes have struggled.

Those that believe we are better off eating less meat have found a

sure-fire way to make that happen: Price it beyond the ability to pay.

Always remember that price is part of demand and demand is

not consumption or quantity. Moving from P1 to P2 in response to a

decrease in quantity from Q1 to Q2 is not demand destruction; that

would be going from D' to D due to lower incomes, higher taxes, etc.

Further Reading

| - | You can view the full report by clicking here. |