CME: Broiler Cutout Price Jumped Last Week

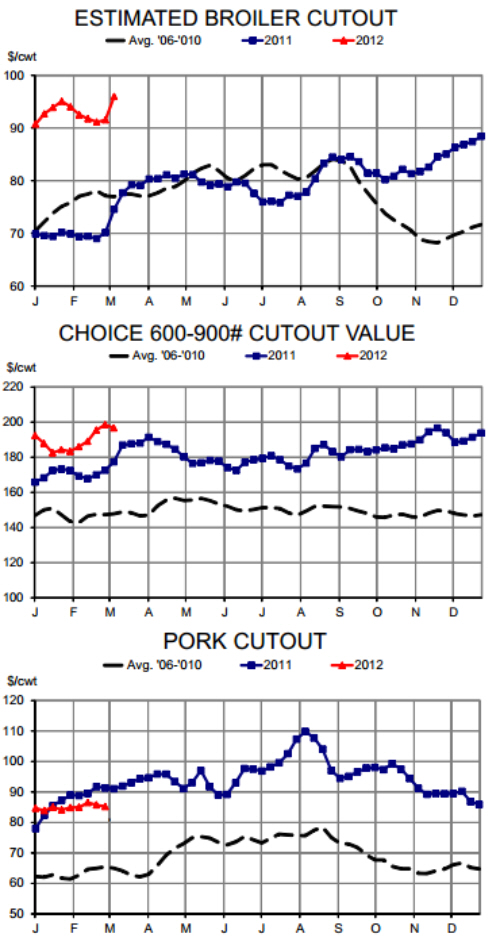

US - Has the broiler cutout — and especially boneless, skinless chicken breast meat — FINALLY shaken off the doldrums of the past two years? write Steve Meyer and Len Steiner.Has the broiler cutout — and especially boneless, skinless chicken breast meat — FINALLY shaken off the doldrums of

the past two years? Like a doctor celebrating progress by a seriously

injured or ill patient, we aren’t ready to declare the malady over just yet

but last week’s nice gains for both of these key prices suggest that the

broiler sector may finally be returning to some semblance of health.

As can be seen below, our computed broiler cutout value jumped

sharply last week, gaining $4.43/cwt. to reach $95.97. The increase

was supported by all chicken cuts but the big contributors were Bnls/

Sknls breasts at +$6.24/cwt., tenders at +$9.05/cwt. and wings at

+$3.57/cwt. from the week before. Breasts are still only 1% higher

than one year ago but tenders are up 15.9% and wings are more than

double the prices of mid-March 2011.

The $95.97 estimated cutout value (which, for our newer

readers, is the weighted average price of all of the parts of a chicken)

is at its highest level since 2004 when chicken prices went to all-time

highs and the cutout topped out at $109 and change. It also marks the

second week this year in which the cutout value has exceeded the

2010 high which marked the largest price response to output cuts

which were driven by the corn and soybean meal price surge of 2007-

2008. Many — including us — are saying “Well it’s about time!” to this

increase in chicken values after a 7% output reduction in Q4-2011 and

YTD production that is 6.1% below year-ago levels. Let’s just hope it

continues and that chicken companies don’t get too bullish and begin

another breeder flock expansion. Our sources indicate that higher

output is already on the way in the form of more and more heavy birds

destined for boning. Several chicken companies are looking for new

barns to accommodate the longer growing periods these birds require.

Meanwhile, the Choice-grade beef cutout reversed

course in its assault on the magical $200/cwt. level last week,

falling nearly $2 to $196.65. That reduction, of course, was from a

new weekly record high or $198.51 the week of March 2. The Choice

cutout normally continues to rise through April and into May as slaughter numbers fall. The average increase over the period 2006-2010

was about $10/cwt. The rally last year was closer to $20. A repeat of

that would put the Choice cutout well above our expectations of $215

to $217 for the seasonal peak.

The Select grade cutout has rallied at an even faster clip to

push the Choice-Select spread to its lowest level in almost a year. No

surprise there as the spread usually bottoms in late-February or earlyMarch as the portion of cattle that grade Choice increases. Over 65%

of the cattle that were graded in each of the past three weeks achieved

the Choice grade. Those weeks mark the first time that level has been

surpassed since — the week of March 12 last year. We expect the

percentages to begin to fall soon but they may be a bit sticky since

slower chain speeds have backed some cattle up in feedyards, giving

them a few more days to marble and meet Choice specifications.

Finally, amid all of this positive, the pork cutout value

continues to muddle along in a sideways pattern—that is PERFECTLY NORMAL FOR THIS TIME OF YEAR. Easter ham demand

is pretty much over and no other cut has any seasonal strength until

hog numbers fall and grills fire up demand for ribs and chops. So don’t

expect much for this value soon — but summer is coming!