CME: Beef, Pork, Poultry Output Down Last Week

US - Total beef, pork, chicken and turkey output last week was 1.603 billion pounds carcass/ready-to-cook weight. That number is 5.24% LOWER than one week earlier and 5.27% LOWER than last year. The year-on-year decline year-to-date total output 2.76% lower than last year at 198.433 million pounds.First, let’s consider some key weekly variables in today’s Production and Price Summary:

The biggest reduction was seen in beef output which fell 6.8%

from the previous week and 6.5% from last year. Sharply lower slaughter (only 582,000 head) was the big driver since average carcass weights, at 787 pounds, continued to be significantly higher (3.6%) than one year ago.

Fed steer prices gained, on average, 0.17/cwt. of 0.1% last

week from one week earlier. The 5-market average of

$122.08/cwt live was 2.5% higher than one year ago.

The Choice grade cutout declined again last week, losing 1.7%

from the previous week to average $177.79/cwt. That value is

5.8% lower than last year in spite of these sizable reductions in

supply — all the result of soft demand and lower trim prices

from the damage to LFTB.

Hog slaughter fell sharply (3.8%) from the prior week as some

plants were dark on Monday in observance of Easter. The

week’s 2.044 million head was 0.77% more than one year ago

and just slightly below (by 18,000) our estimate based on the

March Hogs and Pigs report.

Hog weights were steady with last week and only 1 pound

higher than last year at 209 pounds. Pork production was

3.8% lower than the prior week and 1.4% higher than in ‘11.

National net lean hog prices were steady for the week but remained nearly 9% lower than last year. The cutout fell to

$78.33, 18.3% lower than in the same week in 2011.

Chicken slaughter and production continued to be MUCH

LOWER than last year. Slaughter for the week that ended 4/7

(the latest data available) was 7.5% lower than last year and

1.3% lower than last week. Weights were LOWER than both

the previous week and last year as well, pushing production

down by 8.2%, year-on-year. Egg sets and chick placements

were 4.5% and 4.3% lower than last year, respectively.

Only 3.95 million turkeys were processed the week of 4/7,

12.6% fewer than the previous week (we suspect that was due

to some Good Friday holidays) and 9% lower than last year.

Slightly higher weights left production down 7.9% from 2011.

Whole hen prices remained strong at $107.25, +11% from ‘11.

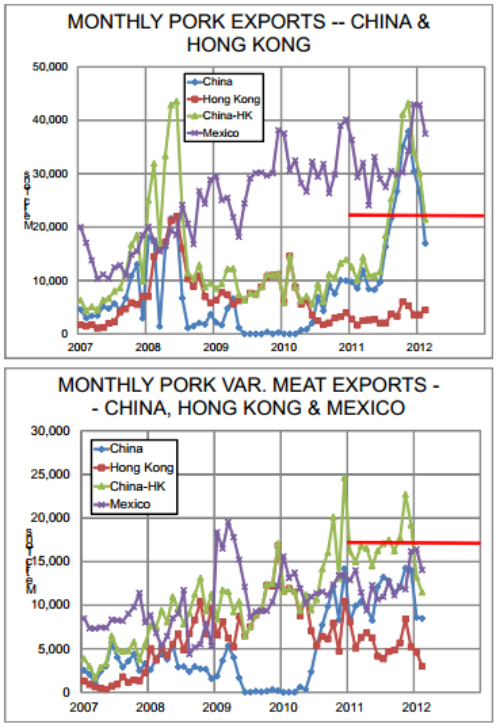

We mentioned on Friday that China-Hong Kong would

be a key market if U.S. pork exports are to perform anywhere

near as well as last year. But just how well must they perform? A

huge question in 2012 is whether purchases by China-HK would fall

as they did in 2009. We don’t think so primarily because shipments

in 2008 were driven mightily by the Olympic games where shipments last year were driven by, we think, more permanent concerns

— death losses among China’s hog herd, rising food prices, a desire to control inflation. All of those are continuing to various degrees in ’12. Turns out that exports to China-HK need to average

almost precisely their February level for ‘12 to match ‘11 for pork

products. That is still a pretty tall order but much less daunting than

thinking we have to hit 40,000 metric tons in a couple of months.

Maybe the more daunting task will be matching last year’s

variety meat shipments. Those need to average 17,180 tons or so

this year and February’s total was just 11,488 tons. For both pork

muscle cuts and variety meats, Mexico appears to be the better bet

for 2012 — if the peso can gain, or at least maintain, value.