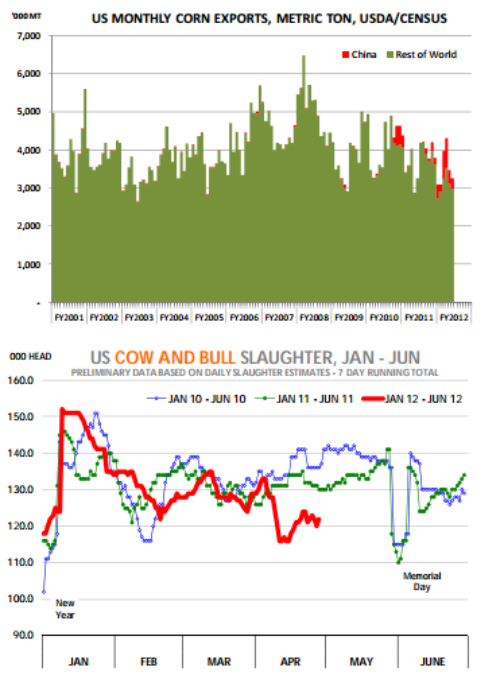

CME: Corn Futures Higher as China Purchases Corn

US - US nearby corn futures were sharply higher on Friday as market participants reacted to news that China purchased 1.472 million metric tons of corn (58 million bushels), write Steve Meyer and Len Steiner.This was one of the biggest one time corn purchases on record to

this market and it reignited speculation that old corn crop stocks

are very tight and may need some rationing until the new crop

starts flowing in. The fact that the new crop has been planted

relatively early in the ECB should provide some notable supplies

before the end of August (official end of marketing year) and yet

grain markets remain concerned about the effect some cooler

weather on corn breaking above ground. But back to the China

story, there has been plenty of speculation in recent months as to

how big a buyer of US corn China will be in the coming years.

Not very long ago, China was a net exporter of corn to a number

of Asian destinations, benefiting both from a freight advantage

and lower costs. However, feed demand in China has been outpacing supply increases. In 2009/10 marketing year, China produced 163.97 MMT (~6.463 bil. Bu) of corn and imported about

1.3 MMT. In marketing year 2011/12, China corn production is

forecast to increase by almost 28 MMT or 17% and yet China is

forecast to import 4 MMT. The increase in Chinese feed demand

has tightened feed availability for a number of Asian markets

that traditionally imported corn from China. And as China now

accounts for 1 out of 5 bushels of corn produced in the world, the

market is now vulnerable to weather events in that part of the

world more so than at any other time on record.

US cow and bull slaughter continues to run well below

year ago levels. While much of the attention recently has been

on packers slowing down slaughter in an effort to prop up prices

ahead of Memorial Day needs, the slowdown in the cow and bull

slaughter is more a reflection of the fundamentals in the beef

market, improving feed conditions compared to a year ago and

strong feeder cattle prices out front have changed the incentives

for cow-calf producers. Indeed, US cow slaughter would be down

even more had it not been for the sharp pullback in milk values,

which are now pushing more dairy cows to market.

The weekly

cow slaughter data, which are published with a two week lag,

showed that for the last four reported weeks (Mar 18 - Apr 14),

total US cow slaughter was 457,400 head, 5.5% lower than a year

ago. During that period, beef cow slaughter was 210,600 head,

17.6% lower than a year ago while dairy cow slaughter was

246,800 head, 7.9% higher than a year ago. Dairy cow slaughter

currently makes up about 54% of the overall US cow slaughter,

the highest such proportion in more than 20 years. It is still

early to proclaim a full rebuilding year as pasture conditions in a

number of key states remain tenuous. A sharp deterioration in

weather conditions could quickly impact beef cow slaughter. As

for the dairy industry, increased productivity, higher cow number

and, even more critically, slowing domestic and export demand,

will likely cause producers to increase the pace of diary herd liquidation, but this time with no government money