CME: Corn Market Remains Fluid

US - On Thursday, May 10 (7.30 CST) USDA will release its latest production estimates for US and world agricultural commodities. The situation in the corn market remains particularly fluid, with the market still in a demand rationing mode for old crop corn, write Steve Meyer and Len Steiner. July corn futures in overnight trading

were $6.2725/bu., a premium of $1.02/bu. over December

futures. Old corn crop stocks remain tight and some market

participants are pegging ending stocks for 2011-12 as low as 660

million bu. Strong export sales and higher feed use will likely

continue to pressure old corn crop prices into July and maintain

the premiums to Dec corn. As for the new crop, there is broad

expectation that farmers will likely produce the largest corn crop

on record, enough to bring carryover stocks to more normal levels. USDA will publish its first estimate of US corn supplies for

2012/13, an estimate based on the expectation that planted acres

will be over 96 million bushels per acre and that yields will recover from two dismal years and be close to the 164 bu./acre

trend yield for 1990-2010. This is basically the scenario outlined

by USDA in their February outlook report and there has been

little in recent months that could change this view.

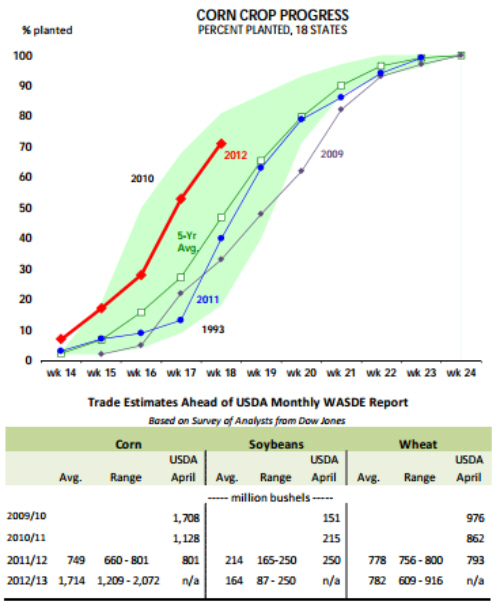

Indeed,

farmers have been able to get the crop in the ground early and so

far planting progress is running well ahead of both year ago and

the five year average pace. The latest USDA crop progress report indicated that as of May 6 US farmers had planted over

71% of the corn crop. For the same week last year farmers

had planted just 40% of the crop and the five year average pace

is at 47%. The Eastern Corn Belt, which was hit particularly

hard last year, appears to be in excellent shape this time around.

Indiana has planted 84% of the crop, compared to just 3% last

year while Illinois has planted 89% of the crop compared to 27%

a year ago. Impressively, about 64% of the Illinois crop and 50%

of the Indiana crop is already emerged. Early emergence does

not guarantee great yields but it lowers the probability that the

crop will be exposed to late July heat during its pollination

phase. Predictably, market participants polled ahead of the

USDA report indicated they expect corn ending stocks to recover.

The chart to the right outlines market expectations for corn,

beans and wheat. On average, corn ending stocks for 2012/13 are

expected to be 1.714 billion bushels, compared to an average of

749 million bushels in 2011/12. The last time total ending stocks

were anywhere close to these levels was in 2009-10, when ending

stocks were 1.708 billion bushels. That year, the average farm price was $3.55 bushel. Keep in mind, however, that corn use for

2012/13 is expected to be larger than in 2009/10 (higher exports

and more ethanol) so it is more important to keep an eye on the

stocks/use (S/U) ratio, which takes into account the growth in

demand. The S/U ratio in 2009/10 was 13.1%. In the following

two years, we have seen the stocks to use ratio decline to 8.6% in

2010-11 and ~6% in 2011-12. We would expect that ending

stocks of about 1.7 billion bushels would correspond to a S/U ratio

of about 12.6%. In 2007-08 we had a similar S/U ratio and farm

prices were $4.20/bushel. Current supply estimates indicate

that corn could trade below $5/bushel next year but futures will

continue to price in summer weather risk, at least until early

August. So far, however, livestock and poultry producers can

look forward to a much improved feed outlook.