CME: Domestic Meat Demand a Mixed Bag

US - What is worse — high feed prices or poor pasture conditions? We will get a partial answer to that question Friday afternoon when USDA releases its monthly Cattle On Feed report, write Steve Meyer and Len Steiner. The results

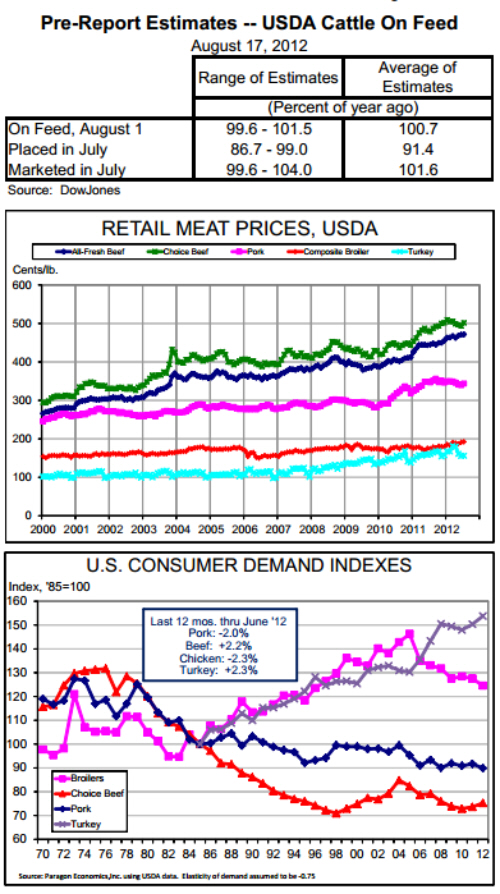

of Dow Jones’ pre-report survey of market analysts appear at right.

The ten respondents expect the August 1 inventory of cattle in feedlots

with capacities of 1000 head and more to be slightly higher than last

year in spite of lower placements and higher marketings during July.

Readers should note that Dow Jones throws out the highest and lowest of the individual estimates when it computes the average value.

One factor to keep in mind is the discrepancy that has developed this year between the data for these monthly-surveyed larger lots

and all lots which are surveyed and estimated only twice per year.

Growth of some feedlots that were near the 1000-head capacity

threshold and the exit of some smaller feedlots from the cattle feeding

sector has driven up the survey universe for the monthly report while

reducing the number of “non-monthly” feedlots. The result is higher

monthly numbers simply because of the survey sample. USDA estimates that this has caused the monthly numbers to be 1.5 to 2% higher, year-on-year, than they would have been had the industry’s structure remained constant. July reports illustrated the point with the Cattle On Feed report showing inventories in the big lots 2.7% higher than

last year while the Cattle report showed inventories in all lots up only

0.8%.

According to data gathered by the Bureau of Labor Statistics and published by USDA’ Economic Research Service, the

average price of all fresh beef and broilers set new record in July.

And neither of those records can be attributed to this year’s feed cost

increases. Those are still to come as U.S. producers of all meats and

poultry reduce supplies in response to higher costs and widespread,

often deep losses. The average retail price for all fresh beef reached

$4.715/lb, up 0.2% from June and 6% from July 2011. The broiler

supply reductions that began early last summer finally began to get

some price traction in March and have now driven the composite retail

broiler price to $1.921/lb., 0.6% higher than in June and 10.4% higher

than last year. Choice beef prices were not record high in July but

were up sharply, gaining 1.6% for the month and 4.9% versus year

ago. Pork prices were still over 11 cents/lb. below their record level

set last September but did increase 1.1% in June to reach $3.434/lb.

And we repeat: NONE of these price increases are being

driven by THIS YEAR’S costs. The beef increases are actually still

responses to the 2007-2008 cost increases, exacerbated, of course,

by the 2010 corn price run-up and last yaar’s drought. The broiler

increases were driven by higher costs since the fall of 2010.

Domestic meat and poultry demand was a decidedly

mixed bag through June, the last month for which indexes can be

computed since they depend on export data. We don’t recall a

time of such stark and almost perfectly offsetting figures for the four

major species. The chart at right shows annual indexes for 1970

through 2011 and data for the 12 months ending in June 2012 versus

the prior 12 month period. Beef and turkey have enjoyed demand

gains over the past year while pork and chicken have seen challenges

on the demand side.