CME: US/Mexico Anti-Dumping Saga Continues

US - Another week and another turn in the saga of US chicken exports to Mexico, write Steve Meyer and Len Steiner. It appears that news wires (and us reading

them) jumped the gun when, quoting Mexico’s Foreign Trade Commission (COCEX), reported that Mexico would not impose antidumping duties on imports of US leg quarters and leg/thigh meat.

The resolution published by the Mexico Ministry of Economy in the

“Diario Oficial De La Federacion” noted that anti-dumping duties

will indeed be imposed on imports of US chicken leg quarters. The

only caveat, and which may have led to the erroneous report last

week, was that the duties will not be imposed right away given that

the Mexican broiler industry is struggling with the after effects of

avian flu. The exact date when the duties will come into effect will

be announced in the Diario Oficial (similar to the US Federal Register) at a later date.

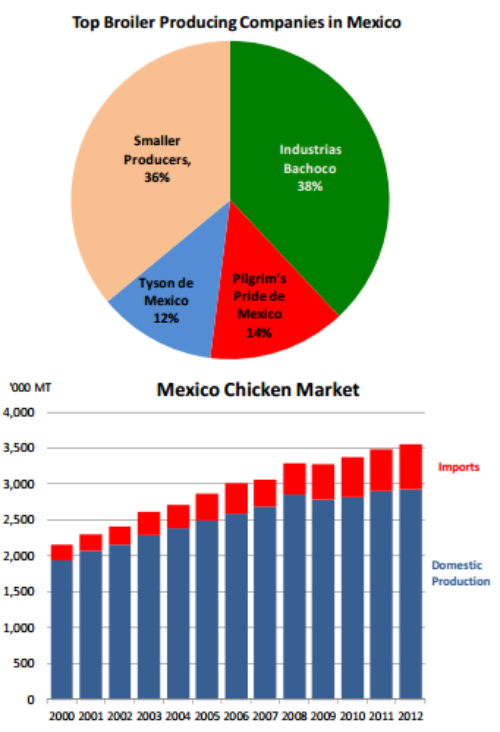

The decision to impose anti-dumping duties on Mexican

imports of leg quarters and leg/thigh meat is final. It is a victory

for Industrias Bachoco, one of the applicants that brought the case

before the Mexico commission and the largest poultry producer in

Mexico. The US can appeal the decision before binding arbitration

at WTO but that is a long process and it is ambiguous as to whether the US would win. The final resolution imposes two tariffs on

imports of leg quarters and leg/thigh meat. Imports from some US

companies, Simmons, Tyson, Sanderson and Pilgrim’s Pride will be

assessed an anti-dumping duty of 25.7%. Imports from all other

US companies will be assessed a duty of 127.5%. The reason for

the two-tiered tariff is given in the lengthy final report (see link at

bottom of article). The report finds that based on WTO rules and

methodology, a tariff of 25.7% would be sufficient to remove injury

to the domestic industry. The report noted that the price differential between domestic and imported prices in 2010 was 25.7%.

Therefore, even though the initial calculations indicate a much

higher anti-dumping margin may be warranted, it is appropriate to

impose a lower anti-dumping duty given the prevailing market

prices at the time when the case was brought by applicants. Mexican officials also noted that based on WTO rules those companies

that did not cooperate during the investigation may obtain a less

favorable ruling. Per the resolution, the more favorable tariff will

apply “to exporters who appeared and provided sufficient information (Simmons, Sanderson, Tyson Foods and Pilgrim's Pride

Corporation), in the case of all other exporters an antidumping duty equal to the greater of the dumping margins found, which is

127.5%, will apply (our translation).” Also important to note is that

the tariff will apply not just to leg quarters but to “ legs, thighs or

legs attached to the thigh.” Based on USDA data, Mexico will

import some 630,000 MT of broiler meat in 2012. As discussed in

other reports, some 250,000 MT of US product may be impacted

by the tariff although given the two-tier system, it is unknown to

us what the real tariff impact will be. The real long term impact

is from the flawed logic of imposing anti-dumping duties using

the “constructed value” method. It opens the door for such tariffs

in other markets where US exporters compete.