CME: Broiler Supplies to Remain Tight

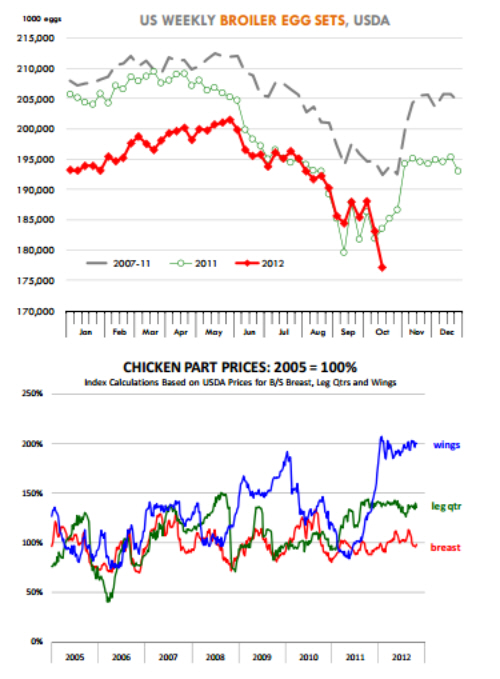

US - Broiler supplies are expected to remain tight at least through the first half of 2013 as high feed costs depress producer margins, write Steve Meyer and Len Steiner.The latest USDA ‘Broiler Hatchery’ report, a

weekly survey of commercial hatcheries in 19 states, showed a dramatic reduction in egg sets for the week ending October 20. One

week does not make a trend and we will need to see more data before jumping to any conclusions. Still, the report showed that for

the week ending October 20 hatcheries placed about 177.1 million

eggs in incubators, 3.5% less than last year’s already low numbers.

This is the smallest number of broiler egg sets since March 12,

1994. One thing to keep in mind is that this data is preliminary

and USDA could revised it, either up or down, in the next two

weeks as survey data is further analyzed. Still, the broader point is

that broiler producers, as expected, remain in a contraction mode.

While some probably expected a more rapid response to the record

feed costs, it is not unusual to see some type of lag in production

cutbacks depending on feed supplies that have already been priced,

contractual obligations and other such factors. How deep producers

cut production will depend in part on feed costs but also on the

price of cuts. Corn and soybean meal prices have pulled back some

in recent weeks but cash prices remain in the $7.8/bu. range for

corn and around $480/ton for soybean meal. These feed prices are

up 21% and 57%, respectively, compared to last year. Futures are

indicating corn prices in the $7.50 range through next summer and

meal above $4.30 ton. Keep an eye on soybean meal prices. While

corn prices tend to get much of the attention with regard to feed

costs, soybean meal accounts for as much as 24% of a broiler diet.

Soybean prices have been particularly strong and are closely tracking the planting and production prospects in South America at this

time. If there were to be a bullish surprise regarding the South

American crop, meal prices could be disproportionately impacted.

This is because in the last two years soybean meal has carried a

larger portion of the soybean value. Soybean oil, which once commanded significant premiums, has lost ground to palm oil. Biodiesel remains a very niche product that has lost ground. Record

high corn prices and the risk of further escalating in the price of

meal will likely keep broiler producers on the defensive.

Input costs are only part of the equation. Producers have

struggled to push up prices for parts. They have been successful for

some but not others. Clearly one of the most problematic areas has

been the price of broiler breast meat. The chart to the right shows

the progress in the price of three main broiler parts using 2005

prices as a base. Since 2005, the price of wings has about doubled.

The last USDA numbers had wings priced at around $1.89/lb

while boneless/kinless chicken breasts were quoted at around

$1.30/lb. The problem is that you get double the amount of b/s

breast meat than you get wings from a broiler. Leg quarter prices are about 36% higher than in 2005 but they have been stagnant in last 12 months. Bottom line: Output price gains have

not kept up with the increase in input costs, hence the continued

production declines until producers bring a margin back in the

business.