Wheat - No Longer Passenger of Volatile Maize Market

ANALYSIS - For 18 months wheat has been a passenger on the movements of the volatile maize market, but this scenario can no longer continue, writes Chris Harris.However, the whole grain market has been marked by a series of global events that has changed the outlook and prospects for the global wheat market.

The wheat market has seen the use of stocks to bolster a market that has seen a deficit on global supply.

Speaking at the Grain Market Outlook Conference in London, Jack Watts, senior analyst with the Home Grown Cereals Authority, part of the Agricultural and Horticultural Development Board, said that wheat production in the current season has been disappointing and has fallen back to the levels of 2010.

Much of the problem has been because of the poor growing conditions in the Black Sea countries - Russia, Ukraine and Kazakhstan.

The heavy drop in production in these countries is expected to lead to some export restrictions particularly in feed wheat and the EU is likely to see a drop in imports of low and medium quality wheat.

However, the deficit that is being produced by poor harvests in the Black Sea region could be filled by a larger crop in the US and also the emergence of India as potentially a leading wheat producer.

It has been predicted that the US will increase its exports from 27.9 million tonnes to 32 million tonnes, increasing its share of the global wheat trade from 19 to 24 per cent.

However Russia, Ukraine and Kazakhstan are expected to see their share of global wheat trade down from 26 per cent to 15 per cent.

"The world is becoming more and more reliant on a global wheat trade and that needs stable relationships," Mr Watts said.

Mr Watts said that Russian exports that were very competitive started to see the availability fall and then they started to price themselves out of the market.

The changes in the market are reflected in the Egyptian GASC wheat purchases that have traditionally been a secure market for Russian wheat. However, since the late summer, Russia has fallen out of that market as France and a new comer Argentina started to fill the demand.

The poor harvests in some of the traditional global suppliers of wheat has meant stocks for export have started to run out and only the US is left with significant stocks for 2012/13.

Mr Watts said that the market is even starting to look at rationing wheat for export and preserving stocks.

Even Australia, which saw plentiful supplies last year, is struggling this year. Plantings are down by four per cent year on year and production is expected to be down to 22.5 million tonnes this year compared to 29.5 million tonnes last year.

With Argentina now featuring on the global market, the prospects this year are for the country to have a reduced area of planting, but good yields and while soya beans still dominate Argentine crops, barley and wheat are growing with wheat becoming a niche crop.

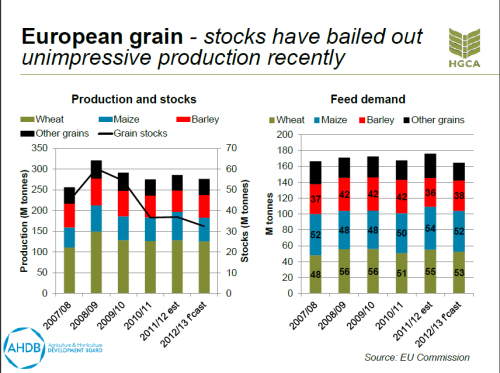

In Europe, grain stocks across the board have been relatively below par and for the wheat sector the market has been drawing on stocks.

However, Mr Watts said: "While Europe is still drawing on stocks it is getting to a stage where it can't and we will be seeing demand rationing."

Between the 2010/11 and the current year European wheat exports are expected to fall from 20.1 million tonnes to 14 million tonnes, with closing stocks falling by 200,000 tonnes.

The situation is reflected in the UK where this year the market has started with low stocks of 1.495 million tonnes and with a predicted poor harvest yield of 6.68 tonnes per hectare compared to previous years of 7.7 tonnes per hectare, imports are likely to rise.

Mr Watts concluded that worldwide wheat is expected to be less abundant this year and the market is likely to turn to the US and countries such as India as exporter stock levels fall.

"Wheat needs to build a premium over the fed grain market to regulate animal fed demand," Mr Watts said.

"The market is not in a 2007/08 scenario, but weather issues in 2013/14 could further sensitise stock levels."