CME: Slaughter Days Affect Poultry Supplies

US - Poultry supplies in October were higher than a year ago but this was largely due to a significant difference in the number of slaughter days available in the month, writes Steve Meyer and Len SteinerLast October there were 21 weekdays and 5 Saturdays while in

October 2012 there were 23 weekdays and 4 Saturdays. Keep this

in mind when looking at the monthly slaughter and production

data.

The latest government statistics show that total US broiler

slaughter in October was 745.9 million head, 6.3% larger than a

year ago.

However, when you convert the monthly number on a

per slaughter day basis, broiler slaughter in October 2012

was down 2.9% from the previous year.

October 2012 broiler

production on a Ready-to-Cook (RTC) basis was estimated at 3.335

billion pounds, 7.7% larger than a year ago.

Converted on a weekday basis, data shows this October we had a daily production of

145.0 million pounds compared to a daily production of 147.5 million pounds last year, a decline of 1.7%. One item that does not get

affected by the difference in available slaughter days in a given

months are broiler weights.

The data shows that producers continue to bring heavier birds to market. In October 2012, the average live weight of broilers coming to market was 5.95 pounds per

bird. On a RTC basis, the weight was 4.47 pounds per bird.

These

bird weights are up 1.1% from the previous year and represent all

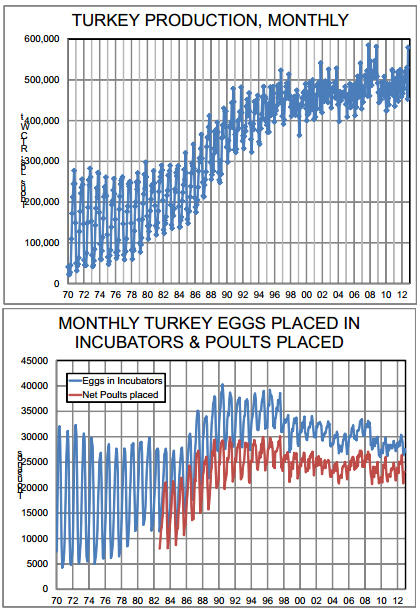

time record highs. Turkey production (RTC basis) in October was

579.7 million pounds, 10.5% higher than a year ago. Daily weekday turkey production at 25.2 million pounds was 0.9% higher

than a year ago.

Daily production was higher despite fewer turkeys coming to market than a year ago. Daily turkey slaughter of

about 1.085 million birds per day was down 2% from last year but

sharply higher bird weights more than offset the decline in actual

slaughter. Live weights for turkeys in October were 29.01 pounds,

up 2.4% from last year.

Behind the monthly statistics there is a point which we

think is important. Often the data that gets a lot of press is the

number of eggs set in incubators or poults placed on feed, numbers

that are seen as proxy of future production levels.

And to a certain

extent that is true. However, the broiler industry has been able

for at least the last 20 years to manage an almost straight linear

growth in the weight of birds coming to market (see chart).

If anything, that growth has accelerated in the last few months as feed

costs have increased. Even as the industry has reduced the capacity in terms of birds that are raised in a given month, it has been

able to make up for some of the lost tonnage by increasing efficiencies via the size of the birds coming to market. While month to

month there is significant variation as to the supply of poultry

coming to market the 12-month moving average of broiler production currently is close to the levels we saw before the financial crisis (and resulting industry contraction).

This production

has recovered even as overall slaughter remains well below the

record highs of 2007-08. While producers will likely contain

egg sets and placements in the coming months, it is likely

weight increases are here to stay, and will help offset some of

the reduction in slaughter levels.