CME: Beef, Pork, Poultry Estimates Released

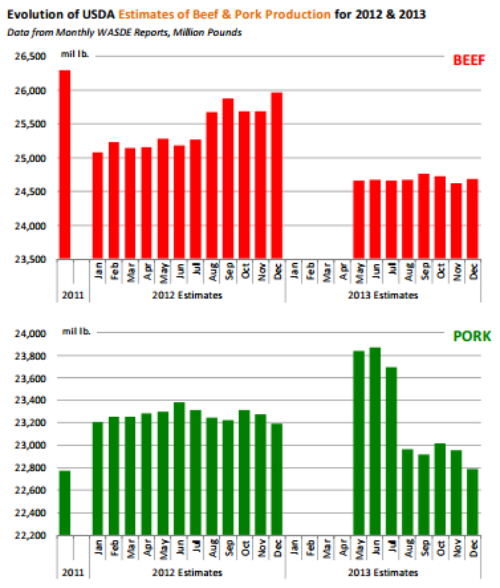

US - USDA released on Thursday its estimates of US beef, pork and poultry production for 2012 as well as an update of forecast for 2013, write Steve Meyer and Len Steiner. The biggest revisions in this latest update concerned estimates of beef output for the current year. USDA now

estimates total US commercial beef production for 2012 at 25.968

billion pounds, about 285 million pounds more than the November

estimate. Current estimated production for 2012 is just 1.2% lower

than what beef output was in 2011. There is an ongoing debate

among market participants about the impact that a smaller herd

and fewer feeders coming to market will have on beef supplies.

After all, we have seen the herd continue to shrink while at the

same time the supply of beef coming to market has been sustained.

Was the big jump in cattle carcass weights something that will be

sustained going forward? Is it possible it will be impacted by calls

to limit the inclusion of ever more effective beta agonists which

have so far underpinned the increase in weights?

One way to look at the impact of the larger weights is to

compare the USDA estimates for beef production earlier in

the year vs. this last December estimate, which includes 10

months of actual data in it. Back in January 2012, USDA was projecting US beef production for 2012 at 25.075 billion pounds, about

1.2 billion pounds or 4.6% less than 2011 production levels. The

latest estimate, however, pegged 2012 beef output at 25.968 billion

pounds, just 324 million pounds, or 1.2% lower than in 2011. Heavier weights explain part of the upward revision in output forecasts.

Consider that steer carcass weights in the first 10 months of the

year have averaged about 856 pounds. During the same period last

year, steer carcass weights averaged about 839 pounds, a 2% year

over year increase in weights. Overall cattle carcass weights for

the first 10 months of this year averaged 777 pounds, compared to

761 pounds last year. Federally inspected carcass weights are running about 2.1% higher than a year ago compare to the trend of the

past 10 years of about 0.5% annual increases. That 1.5% increase

vs. trend translates to about 12 pounds per carcass more this year

vs. the previous year, or about 335 million pounds. Also, more cattle have come to market this year than what USDA and market

analysts expected. The expectation was that with normal moisture,

we would see a notable reduction in the number of cattle coming to

market. The drought this past summer significantly impacted such

forecasts. Going forward, USDA expects a decline in beef output

for 2013. This is likely predicated on a pullback in total cattle

slaughter of almost 5% and carcass weight gains at trend levels of

about 0.5% annual growth. Just as was the case this year, moisture conditions, feed availability and the use of feed additives to

improve performance will be critical drivers that could impact

the forecast.

As for pork supplies, USDA currently pegs total pork

production for 2012 at around 23.195 billion pounds, which is

remarkably close to the 23.209 billion pounds that was forecasted at the beginning of the year. The latest estimates also peg

2013 pork production at 22.792 billion pounds, about 400 million pounds or 1.7% lower than 2012 levels. A smaller pig crop

and lower hog weights in the first half of 2013 should contain

overall pork output levels. As with cattle, feed availability and

the ability to sustain productivity gains in the form of higher

carcass weights remains a key wild card going forward.