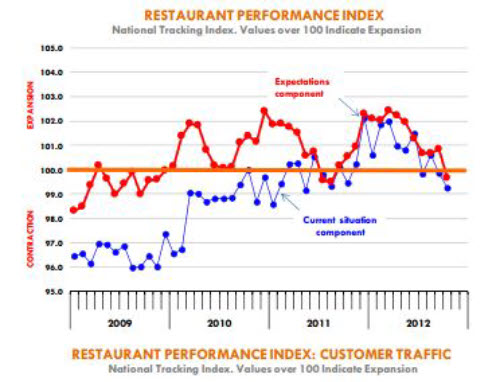

CME: Restaurant Index Drops Below 100 points

Alarm bells should be ringing for beef and pork demand following the latest NRA Restaurant Performance Index, writes the CME Group. The

index has been trending lower for much of this year but the latest

numbers showed a significant decline in both the current conditions

component as well as the outlook for the next few months.

The

overall index for October is now pegged at 99.5 points, down 0.9 per cent

points from the previous months, below the 100 point threshold

that indicates business expansion. This was the first time since

August 2011 that the index has dropped below the 100 point mark.

The index has been pointing to softer business conditions in the

restaurant industry since July when the current component index

dropped below the 100 point mark. What had helped prop up the

overall index in the last four months was the expectation that business was likely to improve.

It usually takes plenty of optimism to

make it in the restaurant business. But after a number of months

of disappointing sales and especially foot traffic, it appears that

operators are now taking a dimmer view of business outlook in

2013.

The index tracking same store sales was running as high as

105.2 last December, the best performance since 2004. However, by

October, the same store sales index was down to about 100.4, still

pointing to expansion but not by much.

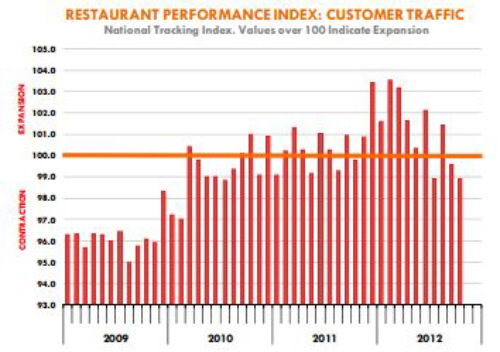

The more troubling indicator in our view is the

steady erosion in foot traffic.

The customer traffic indicator

was about 103.5 as late as February but it has now dropped to

about 98.9, almost 5 per cent point drop in a matter of months. Restaurants are able to post higher same store sales by increasing prices

or extending hours.

At some point, however, you need more people

coming through the doors to sustain revenue growth. The decline

in foot traffic is likely in part due to higher rates of food inflation at

foodservice vs. grocery retail.

The data for October showed that

inflation for food consumed at home was up less than 1 per cent from a

year ago. On the other hand, inflation for food consumed away

from home rose 2.7 per cent vs. October 2011.

Foodservice operators have

been struggling with margins for some time and it does not look

like things will get better in the short term. Prices for center of the

plate items, especially beef, have escalated in recent months.

Cattle prices may be only about 2 per cent higher than a year ago but forward

prices point to all time record highs, with April futures closing on

Friday at 134.575. The offers from packers and distributors for

future business are derivative of these sharply higher future prices.

No wonder restaurant operators feel a little less optimistic about

future business than they did a few months ago.

While recognizing the bearish implications of the

latest NRA report, it is important to recognize that foodservice demand largely reflects the broader trends in the economy.

One factor that correlates very strongly with foodservice business (and the RPI index) is the pace of job growth. More recently, the economy has been adding around 170k jobs a month (vs.

252k last winter).

If this pace of job growth is sustained or

moves back to the 250-300k jobs/month area, we should see the

RPI index back to 101.5-102.0 area and foot traffic back in expansion territory.