CME: Broiler Industry is Now Moving

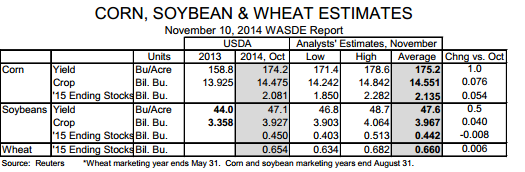

US - As would be expected at this late date in the corn and soybean crop year, analysts expect only minor changes in USDA’s forecasts for grain output and stocks.Analysts do expect these big crops to keep growing somewhat in this month’s report. The corn yield is expected, on average, to increase by one bushels per acres while the bean yield is expected to increase by 0.5 bushels per acre.

The former would ad 76 million bushels to total corn production while the latter will add 40 million bushels of beans to 2014 output. The higher corn output pretty much falls directly to year end stocks which are, according to the surveyed analysts, will exceed 2.1 billion bushels next fall.

Conversely, analysts apparently expect soybean usage to increase more than the crop, pushing projected stocks on 31 August, 2015 marginally lower. That makes sense given the recent big rally in soybean meal prices.

And what about that bean meal? To say it has been a dizzying ride the past few weeks is an understatement but it is primarily a case of logistical challenges that stems all the way back to last year. Recall that USDA’s final estimate for the 2014 soybean carryout was a measly 92 million bushels.

Recall also that Decatur cash soybean meal soared to nearly $600 per ton and some western Cornbelt bid went well over that level back in August. Those two factors indicated just how tight the soybean supply situation was as we approached this harvest which has been slow.

Not extremely slow but this year’s cumulative percentages have lagged the 2009-2012 average (we use that since there were two weeks of missing data last fall due to the government shutdown) by five to 7.5 per cent through two weeks ago.

The last two weeks have seen harvest progress to 76 and 83 per cent of total acres, just four and three per cent behind that four year average. Of course, it has to catch up to the past at some point, right? Those lags would not have been too problematic if not for the fact that late-year soybean supplies had basically emptied the meal pipeline.

Everyone from crushers to feed manufacturers to end users was out of meal and counting on some early beans to refill. When those beans were delayed, supplies tightened and the market put an incentive in place to get beans crushed.

The climb ran out of steam last Thursday but the December contract gained over $16 yesterday. We think this year’s crop will come to bear on this market but the rally has put some short term stress on end users. As you have read here before, the biggest users or meal are poultry producers followed by pork producers.

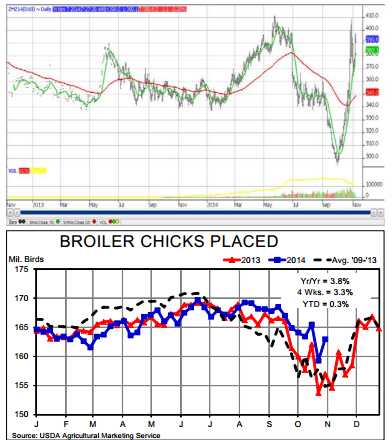

And the broiler industry is now moving. Broiler chick placements last week showed their largest year on year gain so far in 2014 at +3.8 per cent. They have been steadily growing on last year’s pace since early August.

Egg sets have moved closer to last year’s levels the past two weeks so we expect the yr/yr placement growth to slow a bit in the next three weeks but remain very positive as the sector finally responds to lower costs and strong profits.

The broiler breeder flock has grown by over two per cent, yr/yr, the past three months and average broiler weights have gained 0.26 lbs. (about five per cent) since late June. That is about double the normal seasonal rise.