CME: Corn Feed Prices

US - USDA’s December World Agricultural Supply and Demand Estimates, released yesterday, contained few surprises and no large changes from the November report, write Steve Meyer and Len Steiner.It is common for USDA to leave production figures steady but tweak some usage numbers in the December report before the year’s final estimates are published in January.

Some highlights of this report are:

US corn production and the primary demand areas were left unchanged. "Other industrial" usage (primarily high fructose corn syrup) was increase by 10 million bushels. That increase resulted in projected year?end stocks dropping by 10 million bushels to 1.998 billion.

The average trade guess was for an increase in carryout stocks to 2.027 billion so this was a bit of a surprise that should have been bullish. Corn futures, though, were one to two cents lower in yesterday’s pit sessions and are up fractionally in the overnight trade. USDA left its forecast range for the weighted average US farm price steady at $3.20-$3.80 per bushel. Current corn prices are at the high end of our expected range for the year.

World corn numbers were left largely unchanged. Argentina’s estimated production was lowered by 10 million tonnes while no changes were made for Brazil. World ending stocks were raised from 191.5 MMT to 192.2MMT. The trade had expected a decline to 191.4. This factor is likely the best explanation for yesterday’s lower prices.

USDA increased its estimate of 2014?15 US soybean exports by 40 million bushels. That likely reflects the aggressive pace of soybean shipments and bookings since 1 September. But will those survive the South American harvest?

USDA’s year end stocks forecast was dropped from 450 to 410 million bushels, slightly more than the trade’s 427 million estimate had anticipated. It seems that about any number here is a relief after the ridiculous low (zero for all practical purposes!) level of year end stocks this past fall.

USDA left their soybean price forecasts alone but lowered oil prices and raised meal prices. The market did not buy the two bullish numbers in this report, though, as 2014 crop beans fell by 13 to 17 cents/bushels. Meal futures for the 2014 crop were $5.10 to $6.40 per ton lower.

World soybean supply numbers were virtually unchanged with a production increase of 0.3 MMT in Paraguay being the only change among the major exporters or importers. US bean exports were increased by 1.1 MMT while those of Argentina and Brazil were decreased by 0.9 MMT. Projected world ending stocks were dropped from 90.3 MMT to 89.9 MMT. The average trade estimates was 89.7 MMT.

As with the others, there were not many changes for either US or world wheat numbers. US ending stocks were lowered by 10 million bushels, right in line with average trade guesses. The reduction was caused by a 10 million increase in exports.

Forecast world ending stocks were increased by two MMT to 194.9 with 1.5 MMT of the increase being in the EU. The new year end stocks estimate was larger than the average trade guess of 191.8 pushing wheat futures lower across the board.

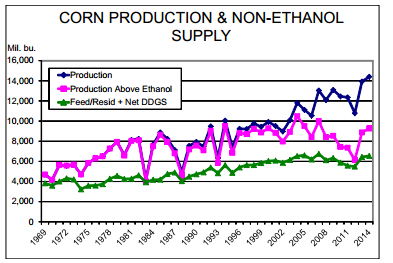

Where does all of this leave US meat and poultry producers? The easy answer is “A darned sight better off that any time in recent memory!” The chart below underlies our contention that the US corn sector has finally “caught up” to the demand that was created — and perhaps a better word is “hastened” — by the energy acts of 2005 and 2007.

As can be seen, the amount of corn available above the level used for ethanol has finally gotten back above the levels of 2008 and 2009 when the full force of the 2007 energy act first began to be felt. “Non-ethanol” corn supplies are still 1.227 billion bushels smaller this year than they were in 2004-2005, however.

To be fair, we must add in domestically available DDGS supplies and that puts the total supply of corn based feed ingredients slightly higher than it was in 2004. Not all of those DDGS are used to replace corn, of course, but their availability for whatever purpose in formulating feed rations is very important and must be recognised.

Though corn based feed usage will be about the same this year as it was 10 years ago, total meat and poultry output will be sharply higher. Yesterday’s report raised 2015 beef output slightly but left the other species unchanged from November.

Total four species production in 2015 is now forecast to be 92.505 billion pounds carcass/ready to cook weight. That figure is 9.9 per cent HIGHER than in 2004 but species shares have changed dramatically. The largest change is for beef output which will be 3.3 per cent lower in 2015 than in 2004.

While biofuels policy and higher corn prices played a role in that decline, it is far more atiributable to droughts and the ongoing aggressive rebuilding of the cow herd. 2015 pork, broiler and turkey supplies are expected to be +15.2 per cent , +16.3 per cent and +10.1 per cent , respectively, from their 2004 levels.