How Will Increase in Broiler Production Affect Meat Prices?

US - Looking at the weekly statistcs for the main species, one item stands out—the sharp increase in broiler production and the implications this has for meat prices in 2015, writes Steve Meyer & Len Steiner.There was plenty of talk in early 2014 about the potential for higher chicken production given the decline in corn prices (remember corn went as high as $8 per bu. in the fall of 2012 to around $4.5/bu in the fall of 2013).

That production growth failed to materialize, largely because of the normal lag in rebuilding the hatching flock, productivity issues tied to bird genetics, a rally in corn and producer reluctance to increase production after such a price shock in 2012.

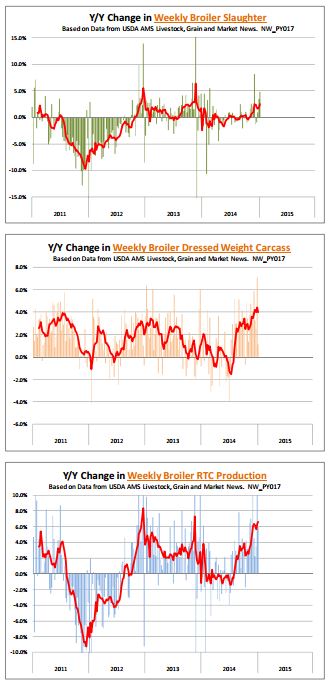

During the first half of 2014 chicken production was about steady compared to a year ago. Both components of supply growth, slaughter and weights, failed to generate growth and this helped sustain not just chicken prices but also contributed to the generally bullish outlook for red meat prices.

Since last fall, chicken supplies have been on the increase. Broiler slaughter for the week ending January 3 (a holiday shortened week) was 133.2 million head, 3.5 per cent higher than the previous year.

For last week, USDA reported a preliminary slaughter estimate of 163.8 million head, which, if correct, would imply a 4.8 per cent increase in slaughter. For the last six reported weeks, broiler slaughter is up about 2.5 per cent compared to a year ago.

This number appears to be in line with chick placements in late November and early December. Chick placements continued to increase in December and for the week ending January 3 they were up 3.6 per cent compared to the previous year.

The hatching flock as of December 1 was 2.1 per cent higher than the previous year and improvements in hatchability (a major issue in the first half of last year) imply that chick placements in the next three months could increase 3.5 per cent or maybe more compared to a year ago.

In addition to bringing more birds to market, broiler producers are also getting those birds to heavier weights.

USDA quoted average broiler live weights at 6.20 pounds, 7.1 per cent higher than the previous year. We would not make too much of this since last year weights for the corresponding week were lower than normal. Rather, the important number to keep in mind is that average bird weights for the last six weeks have been about 4.4 per cent higher than the previous year.

This kind of increases surpasses any of the growth we have seen in the past four years. The significant increase in bird weights and the larger slaughter numbers have bolstered chicken supplies available in the domestic market.

The latest USDA report shows RTC broiler production for week ending January 3 at 627.4 million pounds, 10.8 per cent higher than the previous year while the six week average was 6.3 per cent above year ago levels.

Production should be even higher for week ending January 10. Based on our estimated, broiler RTC production should be a little over 755 million pounds, 6 per cent higher than a year ago and an all time record.

Broiler numbers are slated to grow in Q1 at a time when chicken exports, similar to beef and pork, are struggling to expand. This implies more meat protein available in the domestic markets - and consequently lower prices.