CME: Poultry Slaughter Recovering After February Disruption

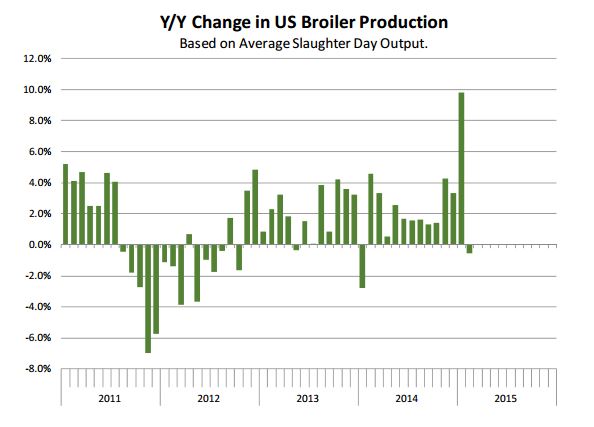

US - Transportation disruptions due to weather caused a significant decline in February broiler and turkey slaughter, but slaughter rates have now started to recover, write Steve Meyer and Len Steiner.Total broiler slaughter in February was 652.5 million head, 1.8 per cent lower than a year ago. The number of slaughter days was the same as a year ago so there was no need to adjust for calendar differences.

In January, however, the difference in slaughter days was significant.

Based on monthly slaughter numbers, January broiler slaughter was up 2.9 per cent. But when adjusted for the difference in slaughter days, slaughter was up 7.8 per cent.

Weekly broiler slaughter has started to recover and currently is running about 3 per cent above 2014 levels.

Chick placements in the last four weeks have averaged about 3.7 per cent above year ago levels, implying that the three per cent increase in broiler slaughter will likely be sustained into April and early May.

But slaughter is only part of the picture in broiler production. Broiler weights have increased substantially and in February they averaged 6.09 pounds per bird (live weight), an increase of 1.3 per cent compared to a year ago.

In the last four months, average broiler weights were up 1.5 per cent compared to a year ago. Higher slaughter and heavier birds have set the stage for a notable increase in broiler production.

Total broiler production in February was 2.993 billion pounds (ready to cook), 0.5 per cent lower than a year ago.

In the last four months, broiler production (adjusted for differences in slaughter days) has increased 4.2 per cent compared to the same period a year ago.

Broiler production in March is expected to also be about 4.5 per cent higher than a year ago, adding to the total supply of meat protein coming to market.

Prospective Plantings Review

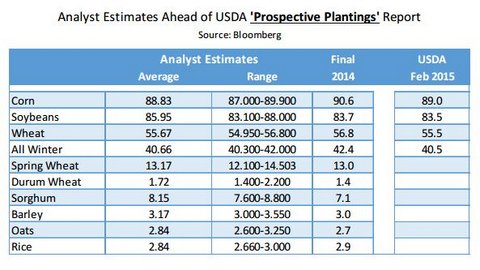

The USDA will soon publish the results of its annual survey prior to the start of the planting season.

This is a key report used by analysts and market participants to form ideas about the size of the grain crop in the fall and it is critically important for US livestock and poultry producers.

The table summarises analyst estimates based on a poll conducted by Bloomberg. On average, analysts expect US farmers to plant about 88.8 million acres with corn this spring, down 1.8 million acres from a year ago and in line with the USDA projections outlined in the February outlook meetings.

US farmers are expected to start the next marketing year with about 1.8 billion bushels of corn in storage and the reduction in acres reflects these ample stocks and the decline in profitability from prior years.

Some analysts think that the reduction in corn acres may be even larger but one needs to consider the shifts that took place in US farming following the surge in ethanol demand.

Pulling back on planted acres, given investments in equipment and land, will likely be a slow process. Acres enrolled in the Conservation Reserve Program have declined sharply and this also will impact the plantings numbers we see this spring.

For reference, corn plantings in 2012 were 97.3 million acres. Once the planting number is published this Friday, market participants will start to focus on the relative pace of plantings and what that may imply for corn yields.

As always there is plenty of speculation as to the corn yields we will see this year, always a favourite pastime coming into spring.

The USDA Outlook Forum presentation used a trend yield of 166.8 bushels per acre of corn and a total production number of 13.595 billion bushels. Some analysts point out that corn yields tend to decline below trend following a record year and it will be interesting to see if this year follows that same path.

Overall, however, if plantings approach the 89 million acre level for corn and corn yields remain near the 165-166 bushel/acre area, corn prices are likely to remain in the $4.00 to $4.50 area.