Missouri Bird Flu a Major Concern to US Poultry

US - Two new cases of highly pathogenic avian influenza virus are a cause of "major concern" for the poultry industry, but things aren't critical yet.This is the sentiment of market analysts Dr Steve Meyer of Paragon Economics and Lein Steiner of Steiner consulting, on Tuesday's cases in Missouri.

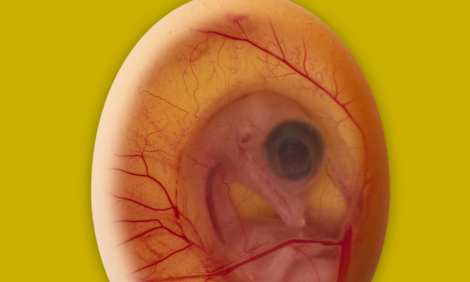

The strain (H5N2) is the same one reported last week in Minnesota and in January in the Pacific Northwest, writes Messrs Steiner and Meyer. This influenza strain poses no threat to human health but is deadly to poultry.

How Might this Impact U.S. Poultry and Meat markets?

First — this is a completely different situation from the one faced by the pork industry in 2013 and 2014 with porcine epidemic diarrhea virus (PEDv). The reason is the stature of the two viruses in the eyes of OIE, the world animal health organization. HPAI is viewed as serious enough that trade bans are allowed where PEDv, for whatever reason, was not. Over 40 countries banned imports of poultry products from Minnesota last week and are expected to fol? low suit with products from Missouri. No countries restricted U.S. pork exports last year though a few did restrict movement of live pigs.

So, where PEDv killed an estimate 6 to 8 million baby pigs and thus restricted U.S. pork supplies, its impact on pork exports came only through its impact on prices. That will not be the case with HPAI. In fact, due to rapid responses of state and federal veterinary agencies, we expect death losses to HPAI to be small relative to total production. Any idea that this virus will kill enough birds to impact supplies and drive prices higher is very likely wrong.

Experience tells us that the demand impacts of import bans greatly overshadow the supply impacts of bird losses. HPAI import bans are almost always limited to the effected state. That mitigates the impact of the bans somewhat in that supply can be pulled from another area to fill foreign orders. But not all plants are the same—some produce only specific products and those may not be completely interchangeable with foreign buyers’ needs.

Second — these most recent cases are cause for very high concern because of their location. While we never want to minimize a disease that damages anyone’s livelihood, HPAI in the Midwest is much more serious than HPAI in Oregon, Washington and Idaho. Minnesota is that nation’s largest turkey producing state. Missouri ranks fourth on this map of 2012 production numbers and was the seventh largest slaughter state in 2014. The Jasper County case in Mis? souri is very close to the Arkansas border and Arkansas ranks number 3 for both turkeys (behind Minnesota and North Carolina) and broilers (behind Georgia and Alabama). Both states are in a major migratory flyway and wild birds are be? lieved to be the vector of introduction for this latest virus.

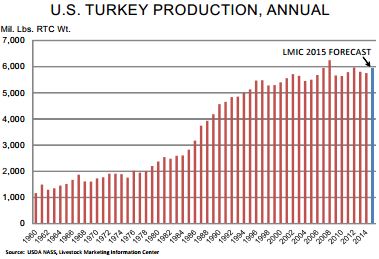

Third — while the threat appears to be for turkeys at present, the big impact on U.S. meat and poultry markets would be a spread to broiler production and subsequent import bans on those products. Again, we don’t mean to minimize the turkey business at all but it simply is much, much smaller than the broiler sector. The Livestock Marketing Information Center has turkey produc? tion forecast to increase 3.5 per cent this year. USDA is expecting a 5.5 per cent increase. But that output figure of around 6 billion pounds ready?to?cook weight pales in comparison to the 37.4 billion pounds of broilers produced in 2014.

What About Turkey Exports?

Further, the turkey sector exported about 14 per cent of its 2014 production while the broiler sector shipped nearly 20 per cent of its output overseas. Any spread of HPAI to major broiler production areas will likely have an even greater impact that these findings in turkey farms and turkey states thus far. Finally — the impacts will be different for different products. U.S. poultry exports are comprised primarily of dark meat product from the back half of the birds. Any export disruption has a disproportionate impact on those values since U.S. consumers generally prefer white meat products.

Top States For Turkey Production

We believe this might be slightly less important in the case of turkey as turkey processors have effectively utilized dark meat in processed items such as turkey ham and lunch meats. But the impact will be far from zero and far greater for turkey dark meat nonetheless.

Bottom Line: The situation is not critical at present but poses some serious threats. The prospect of more turkey on domestic markets is not good.

The prospect of the same thing happening in chicken is far more serious from a market impact point of view. This is yet another piece of negative information for meat and poultry markets that have had a lot of such info so far in 2015!