CME: Avian Influenza Limited Impact on Prices

US - Avian influenza continues to march through the upper Midwest with USDA reporting confirmed cases in six more flocks in Iowa, North Dakota, Wisconsin and Minnesota, write Steve Meyer and Len Steiner.In addition, a Bloomberg report quoted Iowa Secretary of Agriculture as saying there were four more probable cases in Iowa. The reported cited Northey as saying HPAI has now infected 9.5 million laying hens in Iowa.

There are a few things to keep in mind about HPAI and its impact:

-

H2N5 HPAI has not been indicated in any human infections. We believe this is critical since any hint of human infection with this virus would be damaging to demand. Whether it would impact demand for eggs or turkey or anything remotely considered poultry would depend on how the coverage plays out. Recall the damage that H1N1 influenza did in 2009 when it was called “swine flu” but did not come from pigs and wasn’t spread by pork products! We are concerned about one development today: Workers in the infected operations have been urged by the CDC to take Tamiflu to reduce the possibility of infection since influenza viruses are so adept at mutating. This strikes us as a reasonable precaution but we fear how it might be covered in a mainstream press that seems to relish scaring people at any opportunity.

-

The virus has not impacted broilers in any major way. There are some broiler operations in Minnesota but, though it ranked #1 for turkey slaughter and production in 2014, it ranked 23rd for broiler slaughter and 21st for broiler production. There has still been only one case in a major broiler state (Arkansas) and Mexico has already relaxed its ban on products from that state to a ban to allow products that will undergo thermal processing/heat treatment in Mexico. Leg quarter prices have fallen sharply but this is not a demand or supply disaster of any sorts for broilers.

-

HPAI has reduced turkey export demand and has now impacted enough flocks to have a significant impact on turkey supply as well. The first of these was NEGATIVE for turkey prices and demands for competitor products. The latter will clearly be positive for both, much the same way PEDv impacted hogs and other species last year.

-

Any impact on eggs will likely be confined to that industry. Iowa was the top egg producing state in 2014 so the spread of HPAI will impact supplies. But we have never seen a meat/poultry demand model that included eggs so we do not expect cross-price impacts. Higher egg prices might impact the demand for compliments like bacon but the empirical relationship must be pretty tenuous. FYI: In 2014, US egg exports were 269.8 million dozen, 0.27 per cent of the 99.8 billion dozen produced.

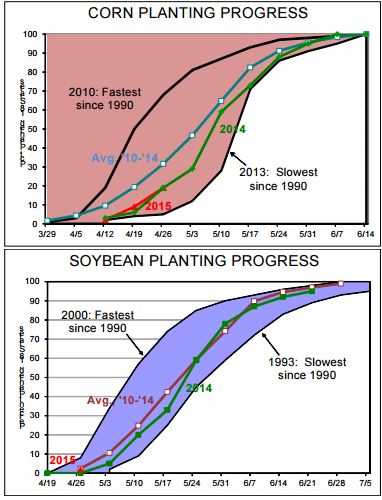

The US Department of Agriculture’s weekly Crop Progress report indicated more or less normal gains in corn planting for the past week and said that soybean planting is off to a pretty normal sort of start as well.

Data for the 18 key states are represented by the charts. Note that the averages shown here are actual averages of the data for same weeks one year prior.

Our data will not match USDA’s 5 year average data which involves some sort of extrapolations, we think, to account for slightly different dates.

Corn planting has been completed on 19 per cent of acres as of Sunday. That is well below the 25 per cent average from 2010 through 2014 but is actually a bit ahead of last year’s 17 per cent as of the last Sunday in April.

As we recall, last year’s crop turned out pretty well after a lot of hand-wringing over plantings that trailed the average pace all spring.

Southern states are lagging badly at this point and most observers believe we are at a point that some acres will switch to beans. Kentucky producers have planted only 7 per cent of their corn versus a “normal” pace of 45 per cent. For Tennessee, those figures are 17 per cent and 60 per cent.

South Dakota and Minnesota are the only states that are significantly ahead of their normal pace but conditions in both states are very dry at the moment. We see nothing to be alarmed about at this point,especially since planting date is a VERY poor predictor of eventual crop yield or size.

Soybean planting is just beginning with only 2 per cent of acres planted as of Sunday. That compares to 3 per cent last year and 4 per cent, on average, from 2010 to 2014.

The key point here is that enough acres have been planted to begin the 2015 line in the week ended April 26.